V.F. Corp (VFC) Q1 Earnings Miss Estimates, Sales Improve Y/Y

V.F. Corporation VFC reported mixed first-quarter fiscal 2023 results, with the bottom line missing the Zacks Consensus Estimate and the top line surpassing the same. Earnings declined year over year while sales increased in the quarter.

The company delivered solid top-line growth, courtesy of robust consumer engagement with its outdoor, streetwear and active brands. Yet, softness in the consumer environment coupled with inflationary pressures were headwinds.

V.F. Corporation Price, Consensus and EPS Surprise

V.F. Corporation price-consensus-eps-surprise-chart | V.F. Corporation Quote

Q1 Highlights

V.F. Corp’s adjusted earnings per share of 9 cents declined 68% year over year and missed the Zacks Consensus Estimate of 13 cents per share. On a constant-currency (cc) basis, adjusted earnings per share were down 59%.

Net revenues of $2,261.6 million rose 3% year over year and beat the Zacks Consensus Estimate of $2,222.6 million. At cc, revenues were up 7%. The top line gained from growth in the EMEA and Americas regions, partly offset by sluggishness in the APAC region stemming from COVID lockdowns across China. Revenues of the company’s big four brands were up 2% (up 6% at cc), while the rest of the portfolio increased 9% (up 16% at cc).

Revenues in the Americas were up 6% year over year on a reported basis and 7% at cc. In the EMEA region, revenues rose 10% (up 24% at cc). APAC revenues decreased 20% on a reported basis (down 15% at cc), whereas the same in Greater China fell 33% (down 30% at cc). The company’s international revenues inched down 1% year over year on a reported basis (up 9% at cc).

Channel-wise, wholesale revenues were up 13% (up 18% at cc) year over year. In the direct-to-consumer channel revenues declined 7% (down 3% at cc). The digital channel witnessed a revenue decline of 18% and 14% on a reported and cc basis, respectively

Gross margin contracted 260 basis points (bps) to 53.9%, mainly due to the mix and increased freight costs. These factors were somewhat offset by price increases.

Adjusted operating income decreased 48% year over year to $77.5 million on a reported basis and 40% at cc. The adjusted operating margin contracted 340 bps to 3.4%.

Segmental Details

Revenues in the Outdoor segment rose 24% to $768.6 million (up 31% at cc). The Active segment reported revenues of $1,253.9 million, down 4% (unchanged at cc) year over year. Revenues in the Work segment fell 13% year over year (down 11% at cc) to $238.9 million.

Financial Details

V.F. Corp ended the fiscal first quarter with cash and cash equivalents of $528 million, long-term debt of $4,468.4 million and shareholders’ equity of $3,352.5 million. Inventories were up 92% year over year, amounting to $2,341.4 million.

For the three months ended June 2022, the company used an operating cash flow of $358.3 million. It returned $194 million to shareholders through dividend payouts in the fiscal first quarter. The company declared a quarterly cash dividend of 50 cents per share, payable Sep 20, 2022, to shareholders of record as of Sep 12.

Going ahead, adjusted cash flow from operations is likely to be roughly $1.2 billion for fiscal 2023. Capital expenditures are expected to be approximately $250 million.

Image Source: Zacks Investment Research

Other Updates

V.F. Corp continues to adjust its business operations per the government guidelines associated with COVID-19. Most of the company’s supply chain is operational at present. Although its raw material suppliers across China are currently operational, it saw an eight-week lockdown in China during the first quarter of fiscal 2023. This led to logistics-related issues causing ongoing product delays. Management highlighted that majority of its final product manufacturing and assembly suppliers are now operating at normal levels across the region. The company is working with its suppliers to minimize disruptions. Its distribution centers are operating in accordance with government guidelines to maintain safety and health protocols.

All stores in North America and EMEA regions remained open during the reported quarter. In the APAC region, including Mainland China, 12% stores (including partners) were shut at the start of the fiscal first quarter, with an average of 14% of stores closed during the quarter. That said, all stores are operational in the region at present.

Outlook

For fiscal 2023, the company still anticipates revenue growth of at least 7% at cc. V.F. Corp is maintaining its currency-adjusted fiscal 2023 view. However, considering the ongoing adverse impacts from foreign currency fluctuations, management is updating its reported earnings view for fiscal 2023. The company now expects adjusted earnings per share (EPS) of $3.05-$3.15, projecting 4-7% year-over-year growth at cc.

Adjusted gross margin is predicted to expand slightly above the previous view of a 50 bps expansion. The adjusted operating margin is likely to be 13.2%, down from the earlier view of 13.6%.

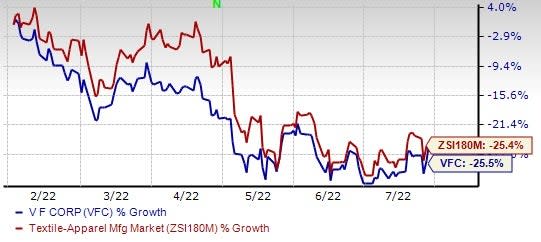

The Zacks Rank #4 (Sell) stock has lost 25.5% in the past six months compared with the industry’s decline of 25.4%.

3 Consumer Discretionary Stocks Worth Noting

GIII Apparel GIII, which designs, sources and markets women's and men's apparel, sports a Zacks Rank #1 (Strong Buy). GIII Apparel has a trailing four-quarter earnings surprise of 97.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GIII’s current financial year sales and EPS suggests growth of 13.8% and 8.2%, respectively, from the corresponding year-ago reported figures.

Rocky Brands RCKY, a key designer and marketer of premium quality footwear and apparel, currently sports a Zacks Rank #1. RCKY delivered an earnings surprise of 17% in the last reported quarter.

The Zacks Consensus Estimate for Rocky Brands’ 2022 sales and EPS suggests growth of 24% and 25.3%, respectively, from the year-ago corresponding figures.

lululemon athletica LULU, which designs, distributes and retails athletic apparel and accessories, carries a Zacks Rank #2 (Buy). lululemon has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for LULU’s current financial year sales and EPS suggests growth of 22.9% and 21.2%, respectively, from the corresponding year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

V.F. Corporation (VFC) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Rocky Brands, Inc. (RCKY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research