Vale (VALE) Reports Loss in Q2, Revenues Hit by Dam Disaster

Vale S.A. VALE reported a loss of $133 million or 3 cents per share in second-quarter 2019 against the Zacks Consensus Estimate of earnings of 58 cents. This can primarily be attributed to provisions related to the Brumadinho dam rupture, and the decommissioning of Germano dam and the Renova Foundation. Notably, the company had reported a profit of $86 million or 1 cent in the prior-year quarter.

The second quarter marks consecutive quarterly loss for Vale as a result of the Brumadinho dam disaster. On Jan 25, a tailings dam at the Corrego do Feijao iron ore mine, 5.6 miles east of Brumadinho, Minas Gerais, Brazil, operated by Vale collapsed and killed around 300 people in Brazil's deadliest mining disaster ever. Vale remains focused on reparation of damages caused to the families, infrastructure, communities and environment.

In the second quarter, Vale recorded a total provision of $1.374 billion which includes environmental measures and related agreements ($1.190 billion), the decommissioning or de-characterization of other structures not considered in the first quarter of 2019 ($98 million) and revision of the provision related to the Framework Agreements, including the compensation for collective moral damages ($86 million). In addition, the company also recorded $158 million of ongoing reparation expenses related to the Brumadinho dam rupture.

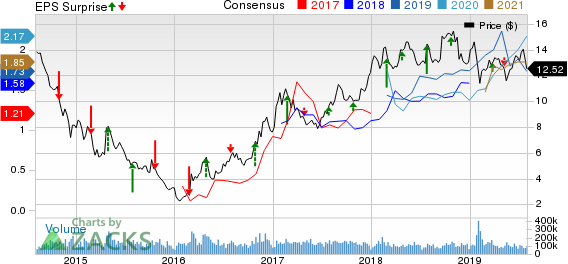

VALE S.A. Price, Consensus and EPS Surprise

VALE S.A. price-consensus-eps-surprise-chart | VALE S.A. Quote

Revenues

Net operating revenues grew 7% year over year to $9,186 million. However, the figure missed the Zacks Consensus Estimate of $9,311 million.

Of the total net operating revenues, sales of ferrous minerals accounted for 79.6%, coal contributed 2.8%, base metals comprised 16.7%, and the remaining 0.8% was sourced miscellaneously.

Geographically, 61.8% of revenues generated from Asia, 15.1% from Europe, 11.8% from South America, 5.8% from North America, 2.7% from the Middle East, and 2.8% from Rest of the World.

Operating Performance

In the second quarter, cost of goods sold totaled $5,173 million, down 4% year over year. Gross profit rose 24% year over year to $4,013 million. Gross margin came in at 43.7%, expanding 600 bps year over year.

Selling, general and administrative expenditure decreased 10% to $110 million, while research and development expenses declined 2% to $90 million, both on a year-over-year basis.

Adjusted operating income was $2,132 million in the reported quarter against the prior-year quarter’s operating profit of $3,014 million. Adjusted EBITDA was $3,098 million in the reported quarter compared with $3,875 million in the prior-year quarter. Excluding the provisions and ongoing reparation expenses from the Brumadinho dam rupture, EBITDA in the quarter stood at $4.6 billion in the quarter.

Balance Sheet & Cash Flow

Vale exited the second quarter of 2019 with cash and cash equivalents of $6,048 million compared with $6,369 million at the prior-year quarter end. Net debt at second-quarter 2019 end stood at $9,026 million, down from $11,519 million at the year-ago quarter.

In the second quarter of 2019, net cash generated from operating activities totaled $2,955 million compared with $3,544 million recorded in the prior-year quarter. Capital spending summed $730 million in the reported quarter compared with $705 million in the second quarter of 2018.

Other Updates

Vale announced that with the resumption of Brucutu operations in June, it has made substantial progress in the second quarter of 2019 toward the 93 Metric tons per year (Mtpy) of iron ore production, which was halted in the first quarter following the dam disaster. The Brucutu mine has led to a recovery of 30 Mtpy of production capacity, and the partial resumption of dry processing at the Vargem Grande complex will add about 12Mtpy (5 Mt in 2019).

Regarding the approximate 50 Mtpy currently curbed, it is expected that about 20 Mtpy of dry processing production will be gradually resumed starting by the end of this year while the remaining 30 Mtpy is estimated to return in about two to three years.

Price Performance

In a year’s time, shares of Vale have fallen 11.8%, in line with the industry.

Zacks Rank & Other Stocks to Consider

Vale currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are SSR Mining Inc. SSRM, Kinross Gold Corporation KGC and Arconic Inc. ARNC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SSR Mining has an expected earnings growth rate of a whopping 134.8% for 2019. The company’s shares have surged 58.1% over the past year.

Kinross has a projected earnings growth rate of 107.5% for the current year. The company’s shares have gained 30.3% in a year’s time.

Arconic has an estimated earnings growth rate of 38.2% for the ongoing year. Its shares have moved up 14.8% in the past year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Arconic Inc. (ARNC) : Free Stock Analysis Report

Silver Standard Resources Inc. (SSRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research