Value-Adding Energy Dividend Stocks To Buy Now

The energy industry is highly dependent on commodity prices, making its profits and cash flows sensitive to the economic cycle. However, after the 50% plunge in oil prices in 2014, energy companies are now benefiting from the recovery through higher cash flows. Consequently, dividend payment expectations have risen along with these companies’ profitability. I’ve identify the following energy stocks paying high income, which may increase the value of your portfolio.

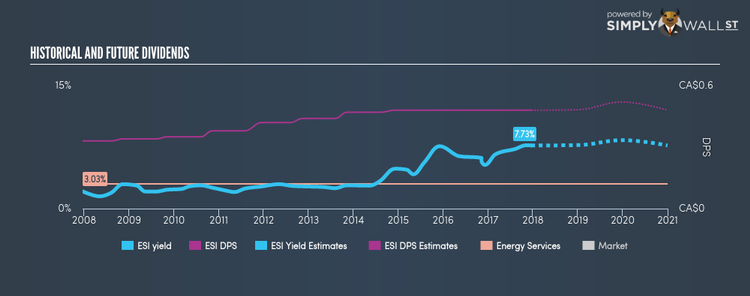

Ensign Energy Services Inc. (TSX:ESI)

ESI has an appealing dividend yield of 7.70% and a reasonably sustainable dividend payout ratio . ESI’s dividends have seen an increase over the past 10 years, with payments increasing from $0.33 to $0.48 in that time. They have been dependable too, not missing a single payment in this time. The company also looks promising for it’s future growth, with analysts expecting an earnings per share increase of 80.36% over the next three years.

Pason Systems Inc. (TSX:PSI)

PSI has a good-sized dividend yield of 3.88% with a large payout ratio . PSI’s DPS have risen to $0.68 from $0.16 over a 10 year period. They have been dependable too, not missing a single payment in this time. Pason Systems could be a good investment for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next 12 months

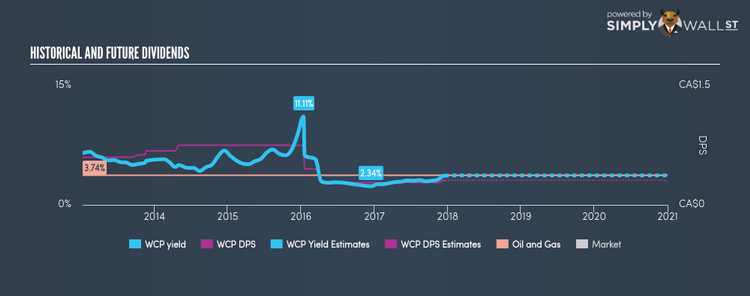

Whitecap Resources Inc. (TSX:WCP)

WCP has a nice dividend yield of 3.69% and pays 34.20% of it’s earnings as dividends , with analysts expecting the payout in three years to be 81.64%. WCP’s dividend is not only above the low risk savings rate, but also amongst the top dividend payers in the market. Whitecap Resources is also reasonably priced, with a PE ratio of 10.3 that compares favorably with the CA Oil and Gas average of 14.4.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.