Value-Adding Growth Stocks To Buy Now

Most investors find it challenging to find companies with prospective double-digit growth rates that are also financially robust. These hidden gems also add meaningful upside to a portfolio, should the companies meet expectations. Investment in growth companies can benefit your current holdings, whether it be in established tech giants or undiscovered micro-caps. Here, I’ve put together a few companies the market is particularly optimistic towards.

First Financial Bancorp. (NASDAQ:FFBC)

First Financial Bancorp. operates as the bank holding company for First Financial Bank that provides commercial banking and other banking, and banking-related services to individuals and businesses in Ohio, Indiana, and Kentucky. Formed in 1863, and now run by Archie Brown, the company employs 1,366 people and with the company’s market capitalisation at USD $3.10B, we can put it in the mid-cap stocks category.

Want to know more about FFBC? Other fundamental factors you should also consider can be found here.

Align Technology, Inc. (NASDAQ:ALGN)

Align Technology, Inc. designs, manufactures, and markets a system of clear aligner therapy, intraoral scanners, and computer-aided design and computer-aided manufacturing (CAD/CAM) digital services. Formed in 1997, and currently run by Joseph Hogan, the company now has 8,715 employees and has a market cap of USD $23.88B, putting it in the large-cap category.

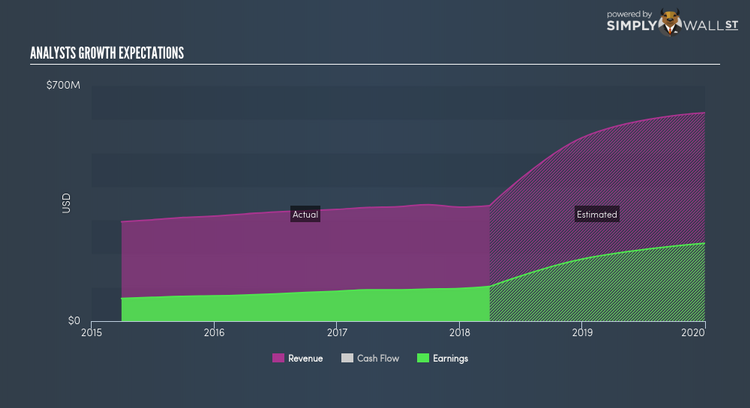

ALGN’s projected future profit growth is a robust 21.44%, with an underlying 55.51% growth from its revenues expected over the upcoming years. It appears that ALGN’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 29.18%. ALGN ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Thinking of investing in ALGN? Have a browse through its key fundamentals here.

Sensus Healthcare, Inc. (NASDAQ:SRTS)

Sensus Healthcare, Inc. manufactures and markets superficial radiation therapy devices to healthcare providers worldwide. Started in 2010, and currently run by Joseph Sardano, the company provides employment to 45 people and with the stock’s market cap sitting at USD $92.26M, it comes under the small-cap group.

SRTS is expected to deliver a triple-digit high earnings growth over the next couple of years, bolstered by an equally impressive revenue growth of 65.92%. It appears that SRTS’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. SRTS ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.