Value-Adding Growth Stocks To Buy Now

Looking to enhance your portfolio with high-growth, financially-robust stocks, but not sure where you should even begin? Stocks such as Centennial Resource Development and Ideal Power are deemed to be superior in terms of how much they’re expected to earn and return to shareholders, according to analysts. Whether it be a well-known tech stock or a risky small-cap, I believe diversification towards growth can add value to your current holdings. Below I’ve compiled a list of stocks with a bright future ahead.

Centennial Resource Development, Inc. (NASDAQ:CDEV)

Centennial Resource Development, Inc., together with its subsidiary, Centennial Resource Production, LLC, operates as an independent oil and natural gas company in the United States. Formed in 2015, and currently headed by CEO Mark Papa, the company size now stands at 119 people and with the company’s market cap sitting at USD $5.16B, it falls under the mid-cap stocks category.

CDEV is expected to deliver a buoyant earnings growth over the next couple of years of 31.10%, bolstered by an equally impressive revenue growth. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 9.21%. CDEV’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Thinking of investing in CDEV? Other fundamental factors you should also consider can be found here.

Ideal Power Inc. (NASDAQ:IPWR)

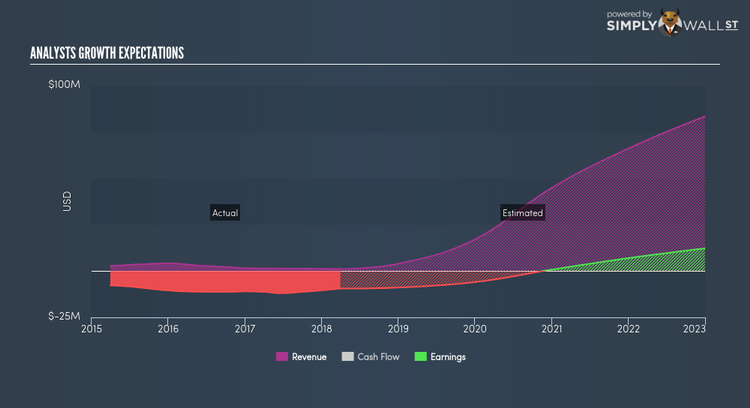

Ideal Power Inc. develops power conversion solutions with a focus on solar and storage, microgrid, and stand-alone energy storage applications. Started in 2007, and now led by CEO Lon Bell, the company size now stands at 19 people and with the market cap of USD $16.94M, it falls under the small-cap group.

An outstanding 67.22% earnings growth is forecasted for IPWR, driven by strong underlying sales growth over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. IPWR ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Want to know more about IPWR? I recommend researching its fundamentals here.

The Estée Lauder Companies Inc. (NYSE:EL)

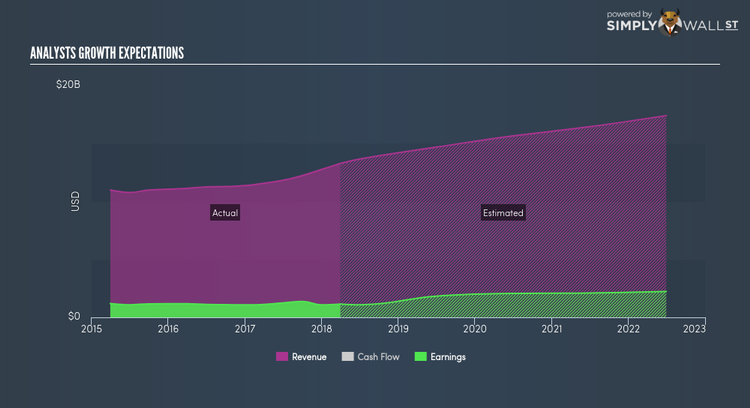

The Estée Lauder Companies Inc. manufactures and markets skin care, makeup, fragrance, and hair care products worldwide. Founded in 1946, and run by CEO Fabrizio Freda, the company currently employs 46,000 people and has a market cap of USD $51.62B, putting it in the large-cap stocks category.

EL is expected to deliver an extremely high earnings growth over the next couple of years of 21.11%, driven by a positive double-digit revenue growth of 16.08% and cost-cutting initiatives. It appears that EL’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 49.11%. EL’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.