Value-Adding Materials Dividend Stocks To Buy Now

The materials industry is deeply cyclical with producers benefiting highly during an economic boom and many players going bankrupt in a bust. Hence an eye toward macroeconomic factors, such as demand for commodities, is necessary when investing in the materials sector. Another key driver of a materials company’s profit is the commodity prices which in turn steers the level of dividend payouts and yield. As a long term investor, I favour these materials stocks with great dividend payments that continues to add value to my portfolio.

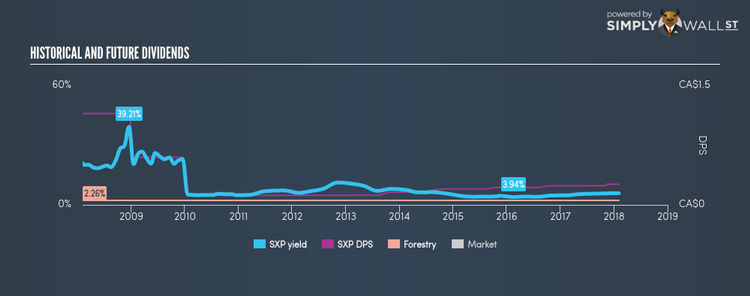

Supremex Inc. (TSX:SXP)

SXP has a large dividend yield of 5.86% and pays out 46.39% of its profit as dividends . Although shareholders haven’t seen an increase in DPS in 10 years, the company has been reliable and hasn’t missed a payment, which is what you want from a dividend payer. When we compare Supremex’s PE ratio with its industry, the company appears favorable. The CA Forestry industry’s average ratio of 14.6 is above that of Supremex’s (8.6). Dig deeper into Supremex here.

Airboss of America Corp. (TSX:BOS)

BOS has a decent dividend yield of 2.72% and their current payout ratio is 47.93% . The company’s DPS have increased from $0.05 to $0.28 over the last 10 years. Much to the delight of shareholders, the company has not missed a payment during this time. Airboss of America’s future earnings growth looks strong, with analysts expecting 79.04% EPS growth in the next three years. Continue research on Airboss of America here.

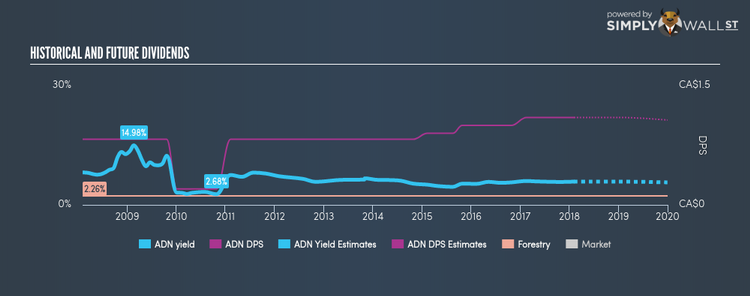

Acadian Timber Corp. (TSX:ADN)

ADN has an appealing dividend yield of 5.85% and the company has a payout ratio of 83.30% , with the expected payout in three years hitting 126.81%. Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from $0.825 to $1.1. Comparing Acadian Timber’s PE ratio against the CA Forestry industry draws favorable results, with the company’s PE of 14.6 being below that of its industry (14.6). Continue research on Acadian Timber here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.