Value Investing with ETFs Back in Favor

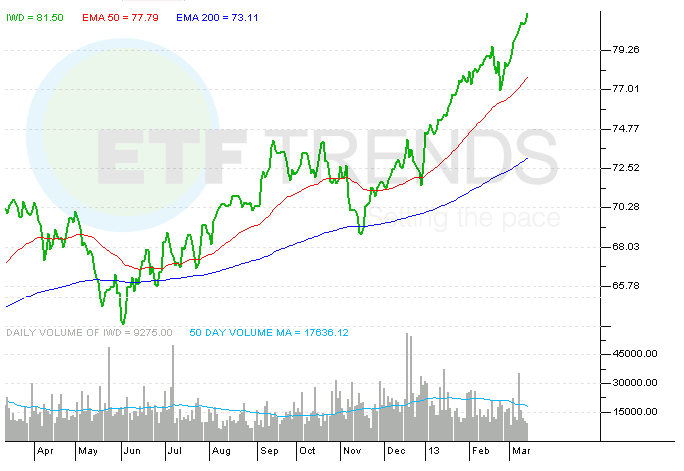

Value focused stocks and exchange traded funds are making a comeback due to recent outperformance. iShares Russell 1000 Value Index Fund (IWD) has charged ahead of the growth strategy over the past six months.

“Value investing is a rigorous approach that requires discipline to pay off. Value stocks often represent companies with relatively high business risk and poor prospects for growth and that may remain out-of-favor for years. In fact, value strategies have underperformed since 2007, partially because of their disproportionate weight in the financial industry,” Alex Bryan wrote for Morningstar. [Focus on Value with Large-Cap ETFs]

The value focused ETF IWD is a great way to take on the so-called value premium in the U.S. stock market. The large-cap focus will give investors a smaller premium compared to small-cap strategies but the risk adjusted returns are far greater. And over time, value-stocks are known to yield better risk-adjusted returns as investors tend to underrate them, reports Bryan. [ETF Spotlight: IWD]

Daniel Putnam for InvestorPlace reports that since September 19, 2012, the iShares Russell 1000 Growth Index Fund (IWF) has been outpaced by IWD, the value ETF, by over 6 percentage points. It appears that those investors who were patient and kept their faith in value stocks and strategies have been rewarded. [Investing in Corporate America with ETFs]

Reasons value may be outperforming now:

Value strategies tend to have a higher weighting in the financial sector. IWD has a 27.9% allocation to financials while IWF has 7.3%. And the financial sector has been making huge moves up since November 2012 lows.

Apple (AAPL) is about 8% of the growth portfolio, and the company is still the largest weighting. So just as APPL helped the growth strategy take off in 2012, it has anchored the related ETF down in the current year.

Value is just where it’s at right now. S&P data shows that value stocks in the S&P 500 are estimated to report EPS growth of 17.3% in 2013, compared with 12.1% for growth stocks. The only asset class this is higher now is in small-caps. The 2.1% yield for IWD is a plus.

iShares Russell 1000 Value Index Fund

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.