Vanguard Health Care Fund Adds 3 Stocks to Portfolio

The Vanguard Health Care Fund (Trades, Portfolio) released its portfolio for the second quarter earlier this week, listing three new positions.

Managed by Jean Hynes, the fund invests in a variety of health care-related stocks from around the world in order to achieve long-term capital appreciation. She picks stocks of companies that have high-quality balance sheets, strong management teams and the potential for new products that will generate consistently above-average revenue and earnings growth.

Based on these criteria, the fund established holdings in Stryker Corp. (NYSE:SYK), Royalty Pharma PLC (NASDAQ:RPRX) and WuXi Biologics (Cayman) Inc. (HKSE:02269) during the quarter.

Stryker

Having previously sold out of Stryker in the second quarter of 2018, Vanguard opened a new 1.07 million-share stake, allocating 0.42% of the equity portfolio to the holding. The stock traded for an average price of $184.16 per share during the quarter.

The Kalamazoo, Michigan-based company, which manufactures medical devices and equipment, has a $71.93 billion market cap; its shares were trading around $191.67 on Friday with a price-earnings ratio of 35.18, a price-book ratio of 5.73 and a price-sales ratio of 5.09.

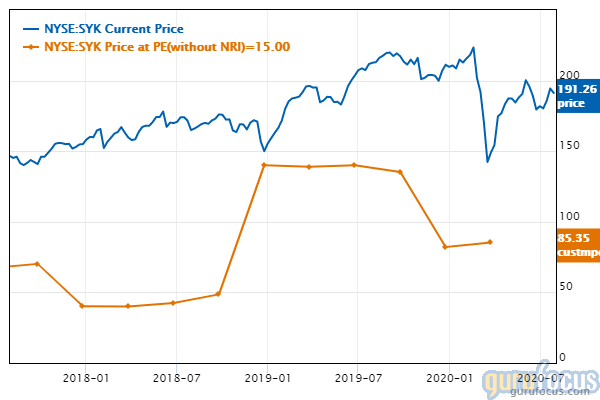

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced. The GuruFocus valuation rank of 3 out of 10 also supports this assessment.

GuruFocus rated Stryker's financial strength 5 out of 10. Although the company has issued approximately $3.2 billion in new long-term debt over the past three years, it is still at a manageable level. The high Altman Z-Score of 4.41 also indicates the company is in good standing even though its assets are building up at a faster rate than revenue is growing.

The company's profitability fared even better, scoring an 8 out of 10 rating despite having a declining operating margin. Stryker is supported by strong returns that outperform a majority of competitors, a moderate Piotroski F-Score of 4, which implies business conditions are stable, and consistent earnings and revenue growth. It also has a predictability rank of four out of five stars. According to GuruFocus, companies with this rank typically return an average of 9.8% per annum over a 10-year period.

Of the gurus invested in Stryker, Ken Fisher (Trades, Portfolio) has the largest stake with 0.35% of outstanding shares. Other top guru shareholders include PRIMECAP Management (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Ken Heebner (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Yacktman Asset Management (Trades, Portfolio), Ray Dalio (Trades, Portfolio) and Steven Cohen (Trades, Portfolio).

Royalty Pharma

The fund invested in 3.05 million shares of Royalty Pharma, dedicating 0.32% of the equity portfolio to the stake. During the quarter, shares traded for an average price of $49.50 each.

The biopharmaceutical company, which went public in June, purchases economic interests in marketed and late-stage products from life sciences organizations. Headquartered in New York, the company has a market cap of $25.79 billion; its shares were trading around $42.44 on Friday with a price-earnings ratio of 38.3, a price-book ratio of 4.94 and a price-sales ratio of 16.41.

According to the Peter Lynch chart, the stock is overvalued.

Royalty Pharma's financial strength was rated 4 out of 10 by GuruFocus. While the company has sufficient interest coverage, the debt ratios are significantly underperforming in comparison to the rest of the industry.

The company's profitability scored a 5 out of 10 rating, driven by strong margins and returns that outperform a majority of industry peers.

The Health Care Fund holds 0.50% of Royalty Pharma's outstanding shares.

WuXi Biologics

After exiting a position in WuXi Biologics in the first quarter of 2018, Vanguard entered a new stake of 6.34 million shares. The trade had an impact of 0.25% on the equity portfolio. The stock traded for an average per-share price of 125.63 Hong Kong dollars ($16.21) during the quarter.

The Chinese company, which provides open-access, integrated technology platforms for biologics drug development, has a HK$210.21 billion market cap; its shares were trading at HK$160.6 on Friday with a price-earnings ratio of 194.02, a price-book ratio of 15.49 and a price-sales ratio of 49.32.

Based on the Peter Lynch chart, the stock appears to be overvalued.

WuXi Biologics' financial strength and profitability were both rated 8 out of 10 by GuruFocus. Although the company has issued approximately 850.22 million yuan ($121.88 million) in new long-term debt over the past three years, it is at a manageable level due to comfortable interest coverage. The robust Altman Z-Score of 19.09 also indicates the company is in good standing even though its assets are building up at a faster rate than revenue is growing.

The company also benefits from an expanding operating margin, strong returns that outperform a majority of competitors and a moderate Piotroski F-Score of 4.

With 0.47% of outstanding shares, Vanguard is the company's largest guru shareholder. The Matthews Pacific Tiger Fund (Trades, Portfolio) and the Matthews China Fund (Trades, Portfolio) also own the stock.

Additional trades and portfolio performance

Other top trades for the quarter included additions to the Regeneron Pharmaceuticals Inc. (NASDAQ:REGN), Edwards Lifesciences Corp. (NYSE:EW) and Danaher Corp. (NYSE:DHR) positions, as well as reductions of its Eli Lilly and Co. (NYSE:LLY) and Vertex Pharmaceuticals Inc. (NASDAQ:VRTX) holdings.

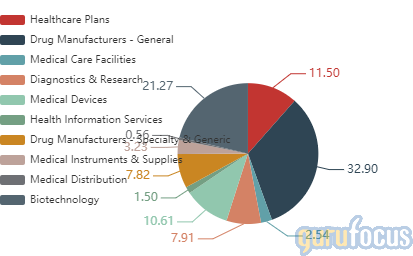

The Health Care Fund's $46.68 billion equity portfolio is composed of 89 stocks. By industry, drug manufacturers make up the largest percentage of its holdings at 32.9%, followed by biotechnology at 21.27% and health care plans at 11.5%.

According to its website, the fund posted a 22.93% return for 2019, slightly outperforming its benchmark, the Spliced Health Care Index. The index posted a return of 22.67% for the year.

Disclosure: No positions.

Read more here:

Comcast Posts Earnings Beat on the Back of Strong Subscriber Growth

Andreas Halvorsen Takes an Interest in GoHealth Following Its IPO

Seth Klarman Strengthens Viasat Connection

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.