Is Vanguard Information Technology ETF a Buy?

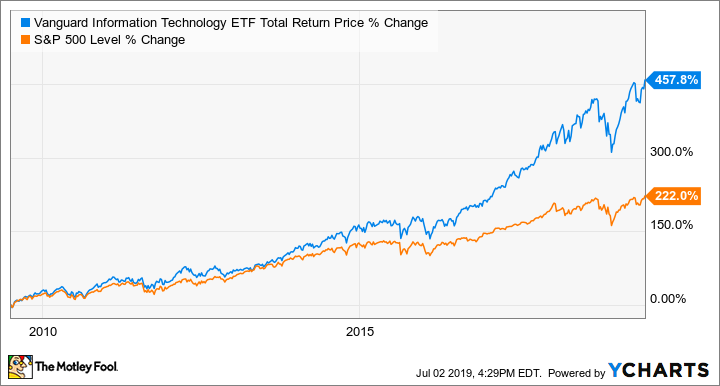

Big technology, love it or hate it, is transforming the world we live in. And as a result, technology stocks have been delivering market-beating returns for quite some time. Enter the Vanguard Information Technology ETF (NYSEMKT: VGT). Over the last decade, this sector-specific index fund has more than doubled the return of the S&P 500. No matter what surprises have been thrown at it over the last 10 years, VGT has continued to shine.

Data by YCharts.

It looks like technology will continue to lead the economy forward for the foreseeable future. That means VGT might make a good core holding for portfolios of all kinds.

What exactly is the Vanguard Information Technology ETF?

Vanguard is a leader in passive exchange-traded funds, shares of which can be bought and sold just like individual stocks. VGT passively follows the information technology sector, and its underlying holdings are weighted by market cap -- the bigger the company, the bigger its allocation in the fund. The names span software companies, chipmakers, electronic payment processors, and other tech-forward services.

The 10 largest holdings in the ETF are:

Company | % Allocation of Vanguard Information Technology ETF |

|---|---|

Microsoft (NASDAQ: MSFT) | 15.6% |

Apple (NASDAQ: AAPL) | 14.3% |

Visa (NYSE: V) | 4.5% |

Mastercard (NYSE: MA) | 4% |

Cisco Systems (NASDAQ: CSCO) | 4% |

Intel (NASDAQ: INTC) | 3.4% |

Adobe (NASDAQ: ADBE) | 2.3% |

Oracle (NYSE: ORCL) | 2.2% |

PayPal Holdings (NASDAQ: PYPL) | 2.1% |

salesforce.com (NYSE: CRM) | 2% |

Holdings as of May 31, 2019. Data source: Vanguard.

The fund thus offers investors exposure to some of the biggest technology powerhouses -- although companies like Amazon (NASDAQ: AMZN), Google parent Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), and Facebook (NASDAQ: FB) are excluded. Amazon is often categorized as a retailer instead of a tech company, and Alphabet and Facebook were reclassified as communications services companies in 2018. (For a fund that includes those heavyweights, check out VGT's closely related peer, the Vanguard Growth ETF (NYSEMKT: VUG).) But for a tech pure-play that heavily weights the cream of the crop, but also includes plenty of smaller companies that could end up being tomorrow's leaders (the fund has 335 holdings total), VGT is the way to go.

Image source: Getty Images.

The why and the how

Even though it has missed out on the gains of a few big technology icons, VGT hasn't been hurting. Not only has the fund smashed the overall market, it is also handily outpacing the other funds that follow the IT sector. Even the iShares U.S. Technology ETF (NYSEMKT: IYW) (which includes Google and Facebook) and the First Trust Dow Jones Internet ETF (NYSEMKT: FDN) (which includes Amazon, Google, and Facebook) haven't matched its results over the long term.

Fund | Annual Expense Ratio | Trailing 10-Year Total Return |

|---|---|---|

Vanguard Information Technology ETF (NYSEMKT: VGT) | 0.10% | 178% |

Fidelity MSCI Information Technology ETF (NYSEMKT: FTEC) | 0.08% | 166% |

Technology SPDR ETF (NYSEMKT: XLK) | 0.13% | 163% |

iShares U.S. Technology ETF (NYSEMKT: IYW) | 0.43% | 162% |

First Trust Dow Jones Internet ETF (NYSEMKT: FDN) | 0.52% | 167% |

Returns as of July 1, 2019. Data source: Vanguard, State Street Global Advisors, First Trust, iShares, Fidelity, and YCharts.

The near non-existent cost of ownership (not including brokerage fees to buy and sell shares) is the primary reason Vanguard's take on the IT index has outperformed. Granted, the Fidelity fund is now on par as far as expenses go, and is nearly identical in its underlying holdings, so either fund should be a good choice going forward.

As to specifics of ownership, I typically recommend my clients have a minimum of 10 to 20 individual stocks. If that isn't possible because your account is too small, then VGT is a great way to get in on a lot of fast-growing tech companies without needing to fret about diversification. Thus, for investors who are just getting started, or who are looking to quickly increase their IT exposure, VGT is a good solution.

Retirees living off of their investments may wish to keep their exposure small. That's because VGT can be volatile. It's a growth fund, and its laser-focus on technology makes it even more prone to up-and-down swings. However, Vanguard lists the blended price-to-trailing-12-month-earnings ratio of the fund at 21.0, lower than the 22.8 for the S&P 500 index. That makes the IT index a relative value considering its higher expected long-term growth. Thus, for retirement portfolios in need of some potential stock growth, one could do worse than VGT.

Whether it's for someone who is just beginning to build their investment portfolio, or for someone who wants to get a little extra pep without hand-picking stocks, the Vanguard Information Technology ETF is a solid buy. It offers diversification, high-quality businesses, and plenty of growth potential with extremely low fees. For those looking to stay in IT for the long haul, this ETF should be a top pick.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Nicholas Rossolillo and his clients own shares of Alphabet (C shares), Apple, Facebook, Intel, Mastercard, Microsoft, Salesforce.com, Vanguard Growth ETF, and Vanguard Information Technology ETF. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Apple, Facebook, Mastercard, Microsoft, PayPal Holdings, Salesforce.com, and Visa. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool recommends Adobe Systems. The Motley Fool has a disclosure policy.