Vera Bradley Jumps on Earnings Beat

- By Sydnee Gatewood

Fashion handbag designer Vera Bradley Inc. (VRA) reported its fiscal second-quarter 2018 results before the opening bell on Aug. 30.

The Indiana-based retailer posted earnings per share of 13 cents, beating the estimates of 10 cents. Quarterly revenue of $112.4 million beat estimates of $112 million but fell from $119.2 million in the comparable quarter of 2017.

Warning! GuruFocus has detected 3 Warning Sign with VRA. Click here to check it out.

The intrinsic value of VRA

Comparable sales declined 4.3% during the quarter due to year-over-year declines in store and e-commerce traffic. CEO Robert Wallstrom commented on the company's performance amid pressure in the retail industry.

"Although comparable sales trends improved over those in the first quarter, challenges in the retail environment continued into the second quarter," he said. "Total revenues were in line with our expectations."

After the announcement, shares rose in premarket trading to open at $10.76. It closed at $10.07 on Tuesday.

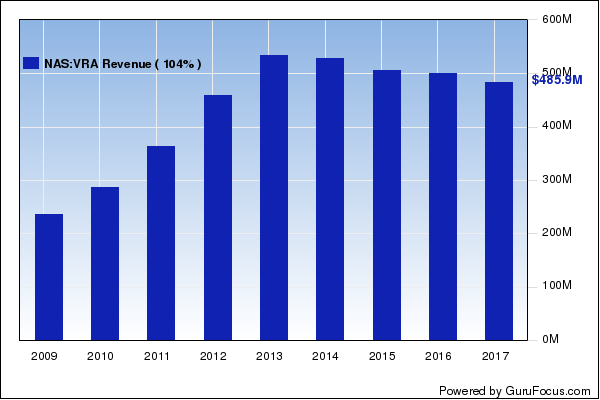

The graph below illustrates the company's revenue growth since 2009.

Despite efforts Vera Bradley has taken over the last several years to "strengthen and modernize" its brand, Wallstrom said the company has not progressed at the pace it had hoped due to the state of the retail environment.

As a result, over the next three years the company will take a more aggressive approach to "restore brand and company health" by focusing on product and pricing and reducing its selling, general and administrative expenses. The company is calling the initiative Vision 20/20.

Wallstrom highlighted the three key initiatives in regard to product and pricing, which include reducing the amount of available clearance items, eliminating unprofitable products and "developing strong assortment standards around introducing new categories, prices and patterns."

With most of these initiatives being implemented in fiscal 2019, the company is expecting annual revenues to be negatively affected. The SG&A expenses, though, are expected to reduce spending by up to $30 million.

"By executing Vision 20/20, we believe we are on the right course for the future, restoring our brand health, improving operating performance and enhancing shareholder value," Wallstrom said.

For the third quarter, Vera Bradley expects revenue between $112 million and $117 million, down from $126.7 million in the year-ago quarter and diluted EPS of 13 cents to 15 cents.

Daruma Capital's Mariko Gordon (Trades, Portfolio) is the company's largest guru shareholder with 8.23% of outstanding shares. She and Jim Simons (Trades, Portfolio) reduced their Vera Bradley positions during the quarter. Steven Cohen (Trades, Portfolio) established a stake and Chuck Royce (Trades, Portfolio) added to his holding. Barrow, Hanley, Mewhinney & Strauss is also a shareholder.

Disclosure: I do not own any stocks mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with VRA. Click here to check it out.

The intrinsic value of VRA