Verisk's AIR Worldwide Partners Capsicum Re for Cyber Models

Verisk Analytics, Inc. VRSK owned Catastrophe modeling firm AIR Worldwide (AIR) yesterday announced a partnership with full-service global reinsurance broker Capsicum Re.

As part of this partnership, the duo engages in development of models that will enable assessment and quantification of silent cyber risks. The models are anticipated to be available with the upcoming ARC versions via Capsicum Re's broking service. Also, the reinsurance broker has adopted ARC, AIR's cyber risk modeling and analytics platform, which comprises a wide range of cyber scenarios and models, delivering sophisticated insights into its insurance portfolios.

Prashant Pai, vice president of cyber offerings at Verisk stated, "Silent cyber exposure could exist in some insurance policies when cyber-related risks are not specifically included or excluded in the policy wording." "As a result, it's possible the insurance industry could face higher-than-expected loss ratios when cyber incidents occur if certain cyber-related exposures are not necessarily accounted for during the underwriting process," he added

Shares of Verisk have rallied 25.5% year to date, outperforming the 18.4% increase of the industry it belongs to.

Partnership to Prop Up Verisk’s Insurance Segment

The collaboration is expected to boost Verisk’s insurance segment that provides analytics in the areas of fraud detection, catastrophe modeling, loss estimation and underwriting.

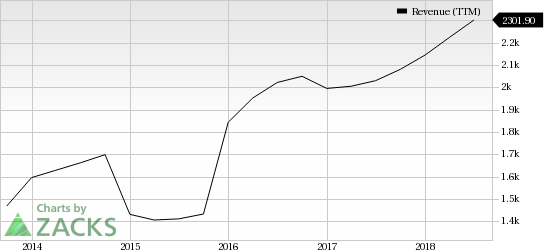

Verisk Analytics, Inc. Revenue (TTM)

Verisk Analytics, Inc. Revenue (TTM) | Verisk Analytics, Inc. Quote

In the second quarter of 2018, revenues from this segment were $429.4 million, up 12.3% year over year on a reported basis and 8.4% at organic constant currency basis. Within the segment, underwriting and rating revenues of $288.9 million rose 10.3% on a reported basis and 6.2% at organic constant currency basis, primarily driven by strength in the company’s catastrophe modeling services as well as underwriting solutions.

Zacks Rank & Stocks to Consider

Currently, Verisk carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Business Services sector are Heidrick & Struggles International HSII, BG Staffing BGSF and Genpact G. While Heidrick & Struggles International sports a Zacks Rank #1, BG Staffing and Genpact carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The expected long-term EPS (three to five years) growth rate for Heidrick & Struggles International, BG Staffing and Genpact is 13.5%, 20% and 10%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Heidrick & Struggles International, Inc. (HSII) : Free Stock Analysis Report

BG Staffing Inc (BGSF) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research