Verso (VRS) Q4 Revenues and Earnings Beat Estimates, Up Y/Y

Verso Corporation VRS reported fourth-quarter 2021 adjusted earnings per share of 73 cents per share, which beat the Zacks Consensus Estimate of 67 cents. It marked a turnaround from a loss of $1.84 per share in the prior-year quarter driven by improved sales and operations.

The company generated revenues of $328 million in the quarter under review, reflecting year-over-year growth of 4.5%. This was aided by favorable price/mix of $57 million, partially offset by $43 million in decreased sales, primarily attributable to the sale of Duluth and idled Wisconsin Rapids mills. Volume was 341 thousand tons during the quarter, down from 392 thousand tons in the last-year quarter, chiefly due to the sale of Duluth and idled Wisconsin Rapids mills. The top line figure outpaced the Zacks Consensus Estimate of $298 million.

Cost of sales was $252 million, down 23% year over year. Gross profit was $76 million in the quarter against a loss of $13 million in the prior-year quarter.

Verso Corporation Price, Consensus and EPS Surprise

Verso Corporation price-consensus-eps-surprise-chart | Verso Corporation Quote

Selling, general and administrative expenditure surged 47% year on year to $22 million. Adjusted EBITDA was $74 million in the reported quarter, which skyrocketed 722% from the prior-year quarter. Adjusted EBITDA margin was 22.6% compared with 2.9% in the year-ago quarter. Favorable price/mix, lower net operating expenses due to lower closed/idled mill spend as well as cost reduction initiatives across the mill system aided margins in the quarter. However, lower sales volume, inflationary costs due to purchased pulp, latex, energy and freight as well as higher selling, general and administrative costs negated some of these gains.

Financial Position

Verso’s cash and cash equivalents were $172 million at the end of 2021 compared with $137 million at the end of 2020. Operating cash flow was $180 million in 2021, marking a significant improvement from the outflow of $62 million in the prior year. The company’s long-term debt was $3 million as of Dec 31, 2021, down from $4 million as of Dec 31, 2020.

On Dec 19, 2021, Verso entered into a definitive merger agreement with BillerudKorsnäs AB. Per the deal, BillerudKorsnäs AB has agreed to acquire all of the outstanding shares of Verso for a purchase price of $27.00 per share in cash.

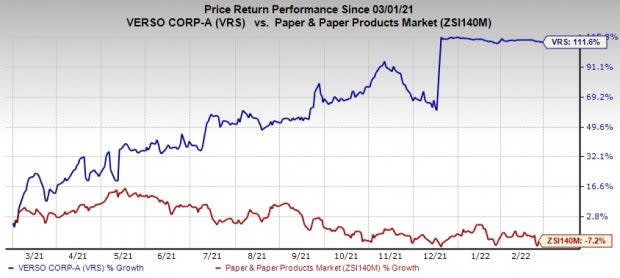

Share Price Performance

Image Source: Zacks Investment Research

Over the past year, Verso’s share price has soared 111.6% against the industry’s decline of 7.2%.

Zacks Rank & Stocks to Consider

Verso currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include Teck Resources TECK, Nutrien NTR and Allegheny Technologies Incorporated ATI. All of these stocks carry a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Teck Resources has a projected earnings growth rate of 21.5% for the current fiscal year. The Zacks Consensus Estimate for TECK's current fiscal year earnings has been revised upward by 28% in the past 60 days.

Teck Resources beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed once, the average surprise being 13%. TECK’s shares have surged around 71% in a year.

Nutrien has a projected earnings growth rate of 70% for the current year. The Zacks Consensus Estimate for NTR's current-year earnings has been revised 17% upward in the past 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters and missed once, the average surprise being 60.3%. NTR has rallied around 54% in a year.

Allegheny has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI's current-year earnings has been revised upward by 46% in the past 60 days.

Allegheny beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average surprise being 127.2%. ATI has rallied around 24% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

Verso Corporation (VRS) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research