Versum Materials (VSM) Q2 Earnings & Sales Beat Estimates

Versum Materials, Inc. VSM recorded net income of $61.6 million or 56 cents per share in second-quarter fiscal 2018 (ended Mar 31, 2018), up from $44.9 million or 41 cents per share a year ago.

Barring one-time items, adjusted earnings came in at 59 cents per share, which beat the Zacks Consensus Estimate of 52 cents.

Sales jumped around 26% year over year to $340.7 million, mainly driven by strong growth in its Advanced Materials product lines and Delivery Systems & Services (DS&S) segment. The figure also topped the Zacks Consensus Estimate of $305 million.

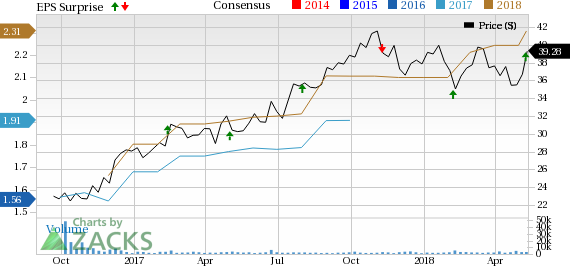

Versum Materials Inc. Price, Consensus and EPS Surprise

Versum Materials Inc. Price, Consensus and EPS Surprise | Versum Materials Inc. Quote

Segment Highlights

Revenues from Materials segment climbed 10% year over year to $218.9 million in the reported quarter, mainly driven by double-digit growth in volume, partly offset by unfavorable price and mix.

Sales from the DS&S unit jumped 69% to $121.1 million in the quarter on the back of continued strong growth in equipment and installation project due to strong demand across all markets, especially China and Korea.

Financials

Versum Materials ended the quarter with cash and cash equivalents of $254.4 million, up around 44.7% year over year. Long-term debt was $976.1 million, down from $978.9 million a year ago.

Outlook

Expectations of improved industry capital spending and continued strength in the semiconductor market along with the company’s position with key customers enabled Versum Materials to provide a favorable outlook for fiscal 2018.

For the year, the company expects total sales in the range of $1,320-$1,360 million (up from prior guidance of $1,250-$1,300 million), adjusted EBITDA of between $425 million and $445 million (up from previous guidance of $415-$435 million), excluding one-time costs related to the implementation of its enterprise resource planning system.

Price Performance

Shares of Versum Materials have moved up 9.9% in the past three months, outperforming the industry’s 4.2% gain.

Zacks Rank & Other Stocks to Consider

Versum Materials currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks worth considering in the basic materials space are The Chemours Company CC, Steel Dynamics, Inc. STLD and Huntsman Corporation HUN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term earnings growth rate of 15.50%. Its shares have jumped 21.4% over a year.

Steel Dynamics has an expected long-term earnings growth rate of 12%. Its shares have rallied 40% over a year.

Huntsman has an expected long-term earnings growth rate of 8.3%. Its shares have moved up 22% over a year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntsman Corporation (HUN) : Free Stock Analysis Report

Chemours Company (The) (CC) : Free Stock Analysis Report

Versum Materials Inc. (VSM) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.