Vertex (VRTX) to Report Q4 Earnings: What's in the Cards?

Vertex Pharmaceuticals Incorporated VRTX will report fourth-quarter 2022 results on Feb 7, after the market closes. In the last reported quarter, VRTX delivered a positive earnings surprise of 8.67%.

This large-cap biotech’s performance has been pretty impressive, with its earnings beating estimates in three of the trailing four quarters but missing the mark in one. VRTX has a trailing four-quarter earnings surprise of 3.16%, on average.

Vertex Pharmaceuticals Incorporated Price and EPS Surprise

Vertex Pharmaceuticals Incorporated price-eps-surprise |

Vertex Pharmaceuticals Incorporated Quote

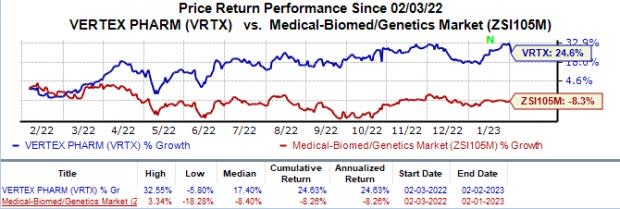

In the past year, shares of Vertex have risen 24.6% against the industry’s 8.3% decline.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for the quarter to be reported.

Factors to Consider

Vertex’s revenue growth in fourth-quarter 2022 is likely to have been driven by a rapid uptake of its blockbuster cystic fibrosis (CF) medicine Trikafta/Kaftrio (Trikafta’s brand name in Europe). The Zacks Consensus Estimate and our model estimates for Trikafta sales are pegged at $2.04 billion and $1.99 billion, respectively.

Sales for Trikafta in the to-be-reported quarter are likely to have been driven bystrong uptakes in international markets and increased drug adoption in the United States among pediatric patients (6-11 years of age). Higher sales of Trikafta are likely to have caused sales erosion of Vertex’s other CF drugs and existing combinations, namely Kalydeco, Orkambi and Symdeko/Symkevi.

Investors will also expect an update on Vertex’s non-CF pipeline during the fourth-quarter conference call.

As part of its collaboration with CRISPR Therapeutics CRSP, Vertex developed exa-cel (formerly CTX001), an investigational ex-vivo CRISPR gene-edited therapy for two indications, namely sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT).Vertex expects exa-cel to be its next commercial launch.

During fourth-quarter 2022, Vertex and partner CRISPR Therapeutics initiated a rolling biologics license application (BLA) submission with the FDA for exa-cel in both SCD and TDT indications. Both CRISPR Therapeutics and Vertex intend to complete this rolling submission in first-quarter 2023.

This October, the FDA accepted the company’s investigational new drug (IND) application seeking to initiate a clinical study on a new candidate, VX-634, targeting alpha-1 antitrypsin deficiency (AATD). A clinical study will start later this year.

Last December, the FDA also accepted another one of the company’s IND applicationsseeking to start clinical studies on VX-522, an investigational mRNA-based therapy for cystic fibrosis (CF) indication. With this therapy, management intends to target a patient populationwho still cannot benefit from its four marketed CF medicines. The therapy is being developed in collaboration with Moderna. This study is expected to begin in early-2023.

Apart from the above therapies, Vertex is rapidly advancing its mid- to late-stage pipeline candidates in additional diseases like acute pain, APOL1-mediated kidney diseases (AMKD) and cell therapy for type I diabetes. The company signed a collaboration deal with Entrada Therapeutics in December 2022 to discover and develop intracellular Endosomal Escape Vehicle (EEV) therapeutics for myotonic dystrophy type 1 (DM1).

Earnings Whispers

Our proven model does not predict an earnings beat for Vertex this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Vertex has an Earnings ESP of -3.00% as the Most Accurate Estimate of $3.42 per share is lower than the Zacks Consensus Estimate of $3.53.

Zacks Rank: Vertex has a Zacks Rank #3, currently.

Stocks to Consider

Here are a few stocks worth considering from the overall healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Arcus Biosciences RCUS has an Earnings ESP of +29.01% and a Zacks Rank #1. You can the complete list of today’s Zacks #1 Rank stocks here.

Arcus Biosciences’ stock has declined 27.7% in the past year. Arcus Biosciences beat earnings estimates in three of the last four quarters while missing the mark on one occasion. Arcus Biosciences has delivered an earnings surprise of 56.74%, on average.

Syndax Pharmaceuticals SNDX has an Earnings ESP of +10.66% and a Zacks Rank #1.

Syndax Pharmaceuticals’ stock has surged 87.7% in the past year. Syndax Pharmaceuticals beat estimates in three of the last four quarters while meeting the mark on one occasion. Syndax Pharmaceuticals has delivered an earnings surprise of 95.39%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Arcus Biosciences, Inc. (RCUS) : Free Stock Analysis Report