ViacomCBS (VIAC) Q1 Earnings Top Estimates, Revenues Rise Y/Y

ViacomCBS’ VIAC first-quarter 2021 adjusted earnings of $1.52 per share beat the Zacks Consensus Estimate by 24.5%. The bottom line increased 36% year over year.

Revenues of $7.4 billion missed the Zacks Consensus Estimate by 0.65% but increased 14% year over year.

Adjusted OIBDA increased 31% from the year-ago quarter to $1.6 billion.

Selling, general and administrative expenses increased 9.6% year over year to $1.4 billion.

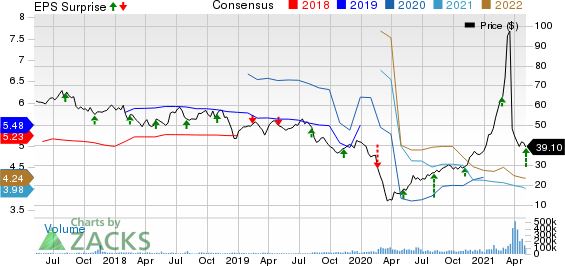

ViacomCBS Inc. Price, Consensus and EPS Surprise

ViacomCBS Inc. price-consensus-eps-surprise-chart | ViacomCBS Inc. Quote

Revenues by Type

Advertising revenues of $2.7 billion increased 21% year over year, driven by CBS’ broadcasts of Super Bowl LV and NCAA Tournament games.

Affiliate revenues of $2.07 billion climbed 5% year over year driven by higher reverse compensation and retransmission fees, as well as expanded distribution.

Global streaming & digital video revenues increased 65% year over year to $816 million, driven by 69% growth in streaming subscription revenues and 62% streaming advertising revenue growth.

Global streaming subscribers totaled 36 million, up 63.2% year over year. Subscriber additions in the quarter were led by the launch of Paramount+ streaming services in the United States.

SHOWTIME OTT delivered its best quarter ever in sign-ups, streams and hours watched, driven by originals, including Your Honor and Shameless, as well as theatricals.

Pluto TV’s total global MAUs reached 49.5 million. Pluto TV international expansion continued, with its launch in France in first-quarter 2021.

Meanwhile, content-licensing revenues of $1.8 billion increased 11% year over year. Theatrical revenues of this Zacks Rank #4 (Sell) company declined 99% year over year to $1 million in the reported quarter due to the closure or reduction in capacity of movie theaters in response to coronavirus.

Segment Details

ViacomCBS’ TV Entertainment revenues increased 19% year over year to $3.5 billion, which benefited from strong affiliate revenue growth, offset by lower content licensing revenues. Moreover, CBS’ broadcasts of tentpole sporting events and subscriber growth at Paramount+ aided growth.

TV Entertainment’s adjusted OIBDA decreased 22% from the year-ago quarter to $449 million due to increased investment in Paramount+ streaming services.

Cable Networks revenues of ViacomCBS increased 14% year over year to $3.3 billion driven by growth in licensing, as well as higher streaming advertising and streaming subscription revenues.

In the first quarter, ViacomCBS owned most of the top 30 cable networks popular among viewers in the 18-49 years age group. Showtime also had two of the top four scripted shows on premium cable in the quarter.

Cable Networks’ adjusted OIBDA moved up 49% from the year-ago quarter to $1.18 billion, as a result of the increase in revenues.

Meanwhile, Filmed Entertainment revenues increased 23% year over year to $997 million, reflecting growth in licensing revenues, partially offset by a decline in theatrical revenues.

Licensing revenues increased 55% year over year to $996 million attributed to higher revenues from the licensing of programming to Paramount+ and third parties, as well as revenues from the licensing of Miramax titles.

Adjusted OIBDA was $204 million, which increased $177 million year over year primarily due to higher licensing revenues.

Balance Sheet

As of Mar 31, 2021, ViacomCBS had cash and cash equivalents of $5.49 billion compared with $2.98 billion as of Dec 31, 2020. ViacomCBS had committed $3.5 billion revolving credit facility that remains undrawn.

In March, ViacomCBS completed the early redemption of senior notes maturing in 2022 and 2023 for a total of $2 billion.

Total debt as of Mar 31, 2021 was $17.7 billion compared with $19.73 billion as of Dec 31, 2020.

Cash flow provided by operating activities was $1.6 billion compared with $399 million used in the previous quarter and $357 million provided in the year-ago quarter.

Free cash flow was $1.5 billion against negative free cash flow $453 million in the previous quarter and free cash flow of $306 million in the year-ago quarter.

Key Q1 Developments

On Jan 14, 2021 ViacomCBS announced that the company delivered the first-ever addressable impressions within a live national broadcast via MVPD set-top box. This was in in partnership with DISH Network DISH owned DISH Media.

Moreover, the company entered into a new multi-year deal with Sinclair Broadcast Group SBGI to add 13 CBS network affiliations for Sinclair stations.

Further, ViacomCBS entered into a new distribution agreement that adds more content from ViacomCBS’ leading portfolio of news, entertainment and sports networks to Disney DIS owned Hulu’s live TV subscription streaming service, Hulu + Live TV.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DISH Network Corporation (DISH) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Sinclair Broadcast Group, Inc. (SBGI) : Free Stock Analysis Report

ViacomCBS Inc. (VIAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.