ViacomCBS (VIAC) Q4 Earnings Miss Estimates, Revenues Rise Y/Y

ViacomCBS VIAC delivered adjusted earnings of 26 cents per share in fourth-quarter 2021, declining 75% year over year.

The Zacks Consensus Estimate for earnings was pegged at 38 cents per share

Revenues of $8 billion beat the Zacks Consensus Estimate by 6.6% and increased 16% year over year.

Adjusted OIBDA declined 53% from the year-ago quarter’s level to $557 million.

Selling, general and administrative expenses increased 31.3% year over year to $1.99 billion.

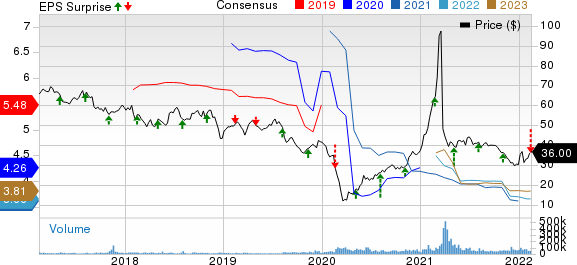

ViacomCBS Inc. Price, Consensus and EPS Surprise

ViacomCBS Inc. price-consensus-eps-surprise-chart | ViacomCBS Inc. Quote

Revenues by Type

Advertising revenues of $2.63 billion inched up 1.3% year over year, driven by an improved advertising market.

Affiliate revenues of $2.1 billion climbed 2.1% year over year, reflecting expanded distribution and higher reverse compensation.

Global streaming & digital video revenues surged 48.1% year over year to $1.32 billion, driven by 84% growth in streaming subscription revenues and 25.5% streaming advertising revenue growth.

Global streaming subscribers touched 56 million, adding 9.4 million subscribers in the reported quarter.

Theatrical revenues logged $39 million in the reported quarter compared with the year-ago quarter’s $4 million. Content-licensing revenues of $1.9 billion increased 44.6% year over year.

Segment Details

ViacomCBS’ TV Entertainment revenues increased 18.5% year over year to $3.69 billion, driven by higher licensing, streaming and affiliate revenues.

TV Entertainment’s adjusted OIBDA declined 73.2% from the year-ago quarter’s figure to $147 million due to increased investment in Paramount+ streaming services.

Cable Networks revenues increased 16.6% year over year to $4 billion, driven by higher streaming, advertising, affiliate and licensing revenues.

Cable Networks’ adjusted OIBDA declined 33.6% from the year-ago quarter’s reading to $532 million, driven by a robust top line.

Filmed Entertainment revenues increased 61% year over year to $826 million, driven by higher theatrical and licensing revenues.

Licensing and other revenues in the filmed entertainment segment increased 54% year over year, driven by a higher volume of licensing that includes company-owned streaming services and from the comparison against the impact in 2020 from Covid-related production shutdowns.

Adjusted OIBDA was $54 million, up 200% year over year.

Balance Sheet

As of Dec 31, 2021, ViacomCBS had cash and cash equivalents of $6.3 billion compared with $4.8 billion as of Sep 30, 2021.

ViacomCBS committed $3.5 billion revolving credit facility remains undrawn.

Total debt as of Dec 31, 2021, was $17.71 billion in line with the total debt as of Sep 30, 2021.

Zacks Rank & Stocks to Consider

ViacomCBS currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are Cedar Fair FUN and Crocs CROX, both sporting a Zacks Rank #1 (Strong Buy), and Gildan Activewear GIL, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cedar Fair is set to announce fourth-quarter 2021 results on Feb 16.

FUN is up 41.3% in the past year against the Zacks Leisure and Recreation Services industry’s decline of 4.2% and the Consumer Discretionary sector’s fall of 23.1%.

Crocs is set to announce fourth-quarter fiscal 2021 results on Feb 16.

CROX is up 24.6% in the past year against the Zacks Textile – Apparel industry’s decline of 10.7% and the Consumer Discretionary sector’s fall of 23.1% in the past year.

Gildan Activewear is set to announce fourth-quarter 2021 results on Feb 23.

GIL is up 42.7% in the past year against the Zacks Textile – Apparel industry’s decline of 10.7% and the Consumer Discretionary sector’s fall of 23.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Cedar Fair, L.P. (FUN) : Free Stock Analysis Report

ViacomCBS Inc. (VIAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research