VIX ETFs Rise After S&P 500 Clears 1,500

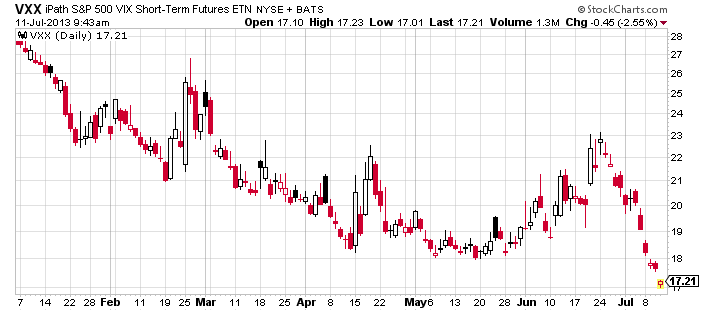

Volatility-linked exchange traded products such as iPath S&P 500 VIX Short Term Futures ETN (VXX) bounced a little on Thursday after grinding down to fresh all-time lows to start the year. Some equity investors appeared to be hedging in the options Thursday market after the S&P 500 briefly rose above the key 1,500 mark.

The CBOE Volatility Index, or VIX, is hovering near a five year-low. However, one option trader believes that the VIX and related exchange traded funds are not really that low.

Adam Warner, an options trader and contributor to Schaeffer’s Investment Research, points out that the current VIX reading is “not as silly low as meets the eye” when you compare it to the 10-day realized volatility in the S&P 500. [New Lows for Volatility ETFs as VIX Drops to 2007 Levels]

“Options certainly are cheap at these levels,” Warner wrote, referring to contracts on the CBOE index. “It’s just not some magical, fade-able moment here.”

On Tuesday, the so-called realized volatility for the SPDR S&P 500 ETF (SPY) dropped to 5.09, the lowest since August, reports David Wilson for Bloomberg.

The VIX is known as Wall Street’s fear gauge and rises when investors are seeking protection in S&P 500 options. Specifically, the VIX reflects volatility expectations for the next month.

The iPath S&P 500 VIX Short Term Futures ETN was up 5% in afternoon trading as the S&P 500 erased its earlier gains. The volatility ETN has been hitting new all-time lows over the past two weeks.

Other volatility ETFs include VelocityShares VIX Short-Term ETN (VIIX) , VelocityShares Daily 2x VIX Short-Term ETN (TVIX) , ProShares Ultra VIX Short-Term Futures (UVXY) and ProShares VIX Short-Term Futures ETF (VIXY) . [VIX ETFs Still Flopping as Small-Caps Hit Fresh High]

The products, which fell sharply in 2012, are designed to track VIX futures contracts rather than the spot price.

On the other hand, inverse funds like the VelocityShares Daily Inverse VIX Short-Term ETN (XIV) are performing well on the heightened complacency in the markets.

iPath S&P 500 VIX Short Term Futures ETN

For more information on CBOE Volatility Index related funds, visit our VIX category.

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.