Volatility 101: Should InnSuites Hospitality Trust (NYSEMKT:IHT) Shares Have Dropped 27%?

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term InnSuites Hospitality Trust (NYSEMKT:IHT) shareholders, since the share price is down 27% in the last three years, falling well short of the market return of around 50%. Unfortunately the share price momentum is still quite negative, with prices down 9.4% in thirty days.

View our latest analysis for InnSuites Hospitality Trust

InnSuites Hospitality Trust isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

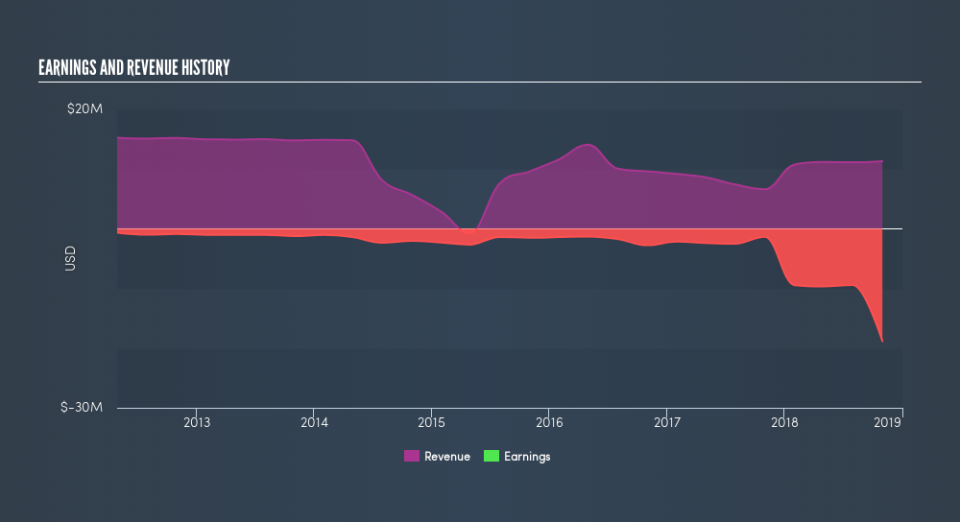

In the last three years InnSuites Hospitality Trust saw its revenue shrink by 2.0% per year. That is not a good result. The annual decline of 9.8% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, InnSuites Hospitality Trust's TSR for the last 3 years was -24%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that InnSuites Hospitality Trust shareholders have received a total shareholder return of 13% over one year. And that does include the dividend. That certainly beats the loss of about 2.4% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. You could get a better understanding of InnSuites Hospitality Trust's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.