Walgreens Boots (WBA) Q3 Earnings Top Estimates, Margins Dip

Walgreens Boots Alliance, Inc. WBA reported adjusted earnings per share (EPS) of $1.47 for third-quarter fiscal 2019, down 3.9% year over year (down 2.4% at constant exchange rate or CER). However, the figure exceeded the Zacks Consensus Estimate by 3.5%.

On a reported basis, net earnings came in at $1 billion, reflecting a 23.6% decline from the prior-year quarter. Reported EPS came in at $1.13, down 16.2% on a year-over-year basis.

Sluggishness in Retail Pharmacy International and margin contractions put pressure on the bottom line during the quarter.

Total Sales

Walgreens Boots recorded total sales of $34.59 billion in the fiscal third quarter, up 0.7% year over year and 2.9% at constant exchange rate or CER. The top line edged pastthe Zacks Consensus Estimate of $34.53 billion. Year-over-year growth was led by improvements within the Retail Pharmacy USA and Pharmaceutical Wholesale divisions, partially offset by a dull performance within Retail Pharmacy International.

Segments in Detail

Walgreens Boots reports through three segments: Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale.

Retail Pharmacy USA

The segment’s sales came in at $26.5 billion in the third quarter, highlighting an improvement of 2.3% year over year. Excluding the impact of store optimization following the acquisition of Rite Aid stores, organic sales growth was 2.9% year over year.

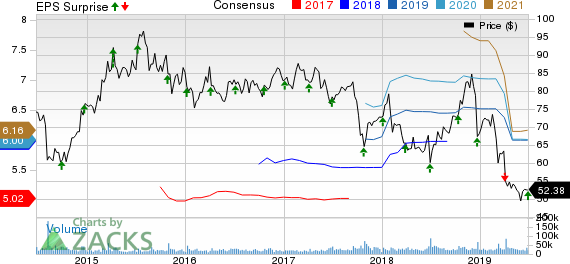

Walgreens Boots Alliance, Inc. Price, Consensus and EPS Surprise

Walgreens Boots Alliance, Inc. price-consensus-eps-surprise-chart | Walgreens Boots Alliance, Inc. Quote

Pharmacy sales, accounting for 73.9% of the Retail Pharmacy USA division’s sales in the quarter, increased 4.3% from the year-ago quarter on higher brand inflation, prescription volume and growth in central specialty. Pharmacy sales at comparable stores improved 6% while prescriptions filled in comparable stores rose 4.7% year over year in the quarter. The impact of store optimization following the acquisition of Rite Aid stores caused a 2.9% dip in retail sales. Comparable retail sales slid 1.1% year over year.

Retail Pharmacy International

Revenues at the Retail Pharmacy International division decreased 7.3% on a year-over-year basis to $2.8 billion in the fiscal third quarter. Sales were down 1.6% at CER considering a 1% slip in Boots UK.

In the United Kingdom, comparable pharmacy sales inched up 0.8% and comparable retail sales declined 2.6% in the reported quarter.

Pharmaceutical Wholesale

The Pharmaceutical Wholesale division’s quarterly sales were $5.9 billion, down 1.7% year over year (up 8.3% at CER, banking on growth in the emerging markets).

Margins

Gross profit in the reported quarter fell 4.2% year over year to $7.45 billion. However, gross margin contracted 111 basis points (bps) to 21.5%.

Selling, general and administrative (SG&A) expenses remained relatively flat year over year at $6.24 billion. Adjusted operating income deteriorated 21.2% to $1.21 billion. Overall, operating margin shrank 98 bps to 3.5%.

Financial Condition

Walgreens Boots exited the fiscal third quarter with cash and cash equivalents of $839 million compared with $818 million at the end of second-quarter fiscal 2019. Long-term debt was $12.13 billion compared with $12.69 billion at the end of the fiscal second quarter. Year to date, the company generated operating cash flow of $3.22 billion compared with $5.45 billion in the year-ago period.

Guidance Intact

Walgreens Boots maintained its earlier-provided adjusted EPS guidance for fiscal 2019, flat with the year-ago period’s figure at CER.The Zacks Consensus Estimate for this metric is pegged at $5.99.

Our Take

Walgreens Boots’ fiscal third quarter adjusted earnings as well as revenues outpaced the respective Zacks Consensus Estimate.

Overall, the Retail Pharmacy USA division witnessed comparable prescription growth and also benefited from a strong retail prescription market. Within this segment, Walgreens Boots has been making a good progress on account of expanding prescription volumes. Meanwhile, tough market conditions, particularly in retail, have been inducing sluggishness in the Retail Pharmacy International division. However, the company is taking steps to accelerate the digitalization and transformation initiatives of its business. Margin pressure persists as a major overhang on the stock.

Zacks Rank & Key Picks

Walgreens currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are Cerner Corporation CERN, Penumbra PEN and The Cooper Companies COO, each with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cerner’s long-term earnings growth rate is expected to be 13.5%.

Penumbra’s long-term earnings growth rate is projected at 21.5%.

Cooper Companies’ long-term earnings growth rate is estimated at 10.8%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cerner Corporation (CERN) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research