Walgreens Boots (WBA) Q4 Earnings Top Estimates, Margins Up

Walgreens Boots Alliance, Inc. WBA reported adjusted earnings per share (“EPS”) from continuing operations of $1.17 for fourth-quarter fiscal 2021, increasing 29.5% from the year-ago comparable figure (up 28.5% at constant exchange rate or CER). The figure also surpassed the Zacks Consensus Estimate by 13.6%.

GAAP EPS from continuing operations for fourth-quarter fiscal 2021 was 41 cents, up 6.4% year over year.

Full-year adjusted EPS from continuing operations was $4.91, rising 14.6% from the year-ago comparable figure (up 13.7% at CER). The figure also outpaced the Zacks Consensus Estimate by 2.9%.

Total Sales

Walgreens Boots recorded total sales of $34.26 billion for the fiscal fourth quarter, up 12.8% year over year and 11.8% at CER. The top line also surpassed the Zacks Consensus Estimate by 2.9%.

The company stated that the top line reflects strong growth in core business. With the easing of COVID-19 restrictions in the quarter, comparable U.S. pharmacy and retail sales both registered robust growth, and the U.K. business saw a strong recovery.

Fiscal 2021 sales from continuing operations were $132.5 billion, up 8.6% from the year-ago period and 7.5% at CER. The metric edged past the Zacks Consensus Estimate by 0.3%.

Quarterly Details

Following Walgreens Boots’ announcement regarding the sale of the majority of its Alliance Healthcare businesses and a portion of the Retail Pharmacy International segment's businesses in Europe to AmerisourceBergen, the company reorganized the remaining businesses into two reportable operating segments — United States and International.

United States

The segment’s sales totaled $28.76 billion for the fiscal fourth quarter, highlighting an improvement of 6.6% year over year.

Comparable sales for the quarter increased 8.1% from the year-ago quarter, reflecting an 8.9% uptick in comparable pharmacy sales and a 6.2% rise in comparable retail sales.

Total prescriptions (adjusted to 30-day equivalents) filled in the fiscal fourth quarter rose 8.6% year over year. In comparable stores, prescriptions filled increased 8.8% from the year-ago quarter.

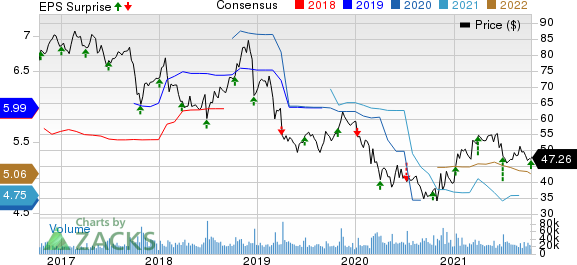

Walgreens Boots Alliance, Inc. Price, Consensus and EPS Surprise

Walgreens Boots Alliance, Inc. price-consensus-eps-surprise-chart | Walgreens Boots Alliance, Inc. Quote

Pharmacy sales were up 6.7% from the year-ago quarter.

Retail sales increased 6.5% and comparable retail sales grew 6.2% year on year. Comparable retail sales (excluding tobacco and e-cigarettes) also increased 7.2% from the prior-year quarter.

Health and wellness sales increased 14% backed by cough cold flu, at-home COVID-19 tests and vitamins.

International

Revenues at the International division surged 61.8% on a year-over-year basis to $5.51 billion for the fiscal fourth quarter. Sales were up 52.6% at CER, driven by the company's new joint venture (“JV”) in Germany. Excluding incremental sales from the JV, the International segment’s sales increased 9.3% year over year at CER, reflecting the ongoing recovery in the U.K. market, wherein COVID-induced restrictions were eased on Jul 19.

Boots UK’s comparable retail sales increased 11.4% driven by robust demand for pharmacy services, particularly COVID-19 tests.

Margins

Gross profit for the reported quarter increased 18.6% year over year to $7.5 billion. Gross margin expanded 107 basis points (bps) to 21.9%.

Selling, general and administrative expenses were up 15.2% year over year to $6.65 billion.

Adjusted operating profit for the quarter was $854 million, reflecting a 54.7% surge from the year-ago period. Operation margin was 2.5% for the reported quarter, reflecting a 55-bps expansion year over year.

Financial Condition

Walgreens Boots exited fiscal 2021 with cash and cash equivalents of $1.19 billion compared with $1.35 billion recorded at fiscal third quarter-end. Total debt was $8.98 billion at fiscal fourth quarter-end, down from $15.70 billion at third quarter fiscal 2021-end.

Cumulative net cash provided by operating activities at fiscal 2021-end was $5.55 billion, up from the year-ago period’s $5.48 billion.

Fiscal 2021 Guidance

Walgreens Boots noted that management will discuss strategic priorities for the future and reveal its fiscal 2022 guidance at the Virtual Investor Conference later today.

Our Take

Walgreens Boots exited fourth-quarter fiscal 2021 with better-than-expected earnings and revenues. Impressive performance by both the operating segments buoys optimism. Robust sales of Boots.com instill investor confidence. Strong growth in the International segment, aided by the formation of the company's joint venture in Germany during the fiscal year, and solid growth in the United States segment are encouraging.

To date, Walgreens has administered more than 40 million COVID-19 vaccinations and 16 million COVID-19 tests. Continued acceleration of Walgreens omnichannel offerings and a rise in MyWalgreens membership are notable upsides during the quarter.

Zacks Rank and Key Picks

Walgreens Boots currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space with strong earnings and revenues estimates for the September-end quarter include STAAR Surgical Company STAA, Omnicell, Inc. OMCL and West Pharmaceutical Services, Inc. WST.

STAAR Surgical is expected to report third-quarter 2021 adjusted EPS of 16 cents, implying year-over-year growth of 14.3%. The Zacks Consensus Estimate for revenues is pegged at $57.1 million, implying a 22.6% year-over-year increase. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Omnicell is expected to report third-quarter 2021 adjusted EPS of 91 cents, implying year-over-year growth of 51.7%. The Zacks Consensus Estimate for revenues is pegged at $283.8 million, implying a 32.8% year-over-year improvement. The stock carries a Zacks Rank #2 (Buy).

West Pharmaceutical is expected to report third-quarter 2021 adjusted EPS of $1.82, implying year-over-year growth of 58.3%. The Zacks Consensus Estimate for revenues is pegged at $684.7 million, implying 24.9% year-over-year growth. The stock carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

STAAR Surgical Company (STAA) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research