The Wall Street guide to making money on hurricane season

Some hurricanes will harmlessly dissipate over the ocean. Others will cause billions of dollars in damage after hitting land.

Much of those damage costs are covered by insurance companies, which pay for those claims with the premiums they collect and invest. When those costs reach catastrophic levels, insurance companies will turn to their own insurers: the reinsurance companies.

It’s worth noting that insurance and reinsurance are for-profit businesses. They’re businesses that made a billionaire out of Warren Buffett (BRK-A, BRK-B).

As the Atlantic hurricane season comes to its peak, Barclays’ Jay Gelb believes traders can make some money trading the insurers.

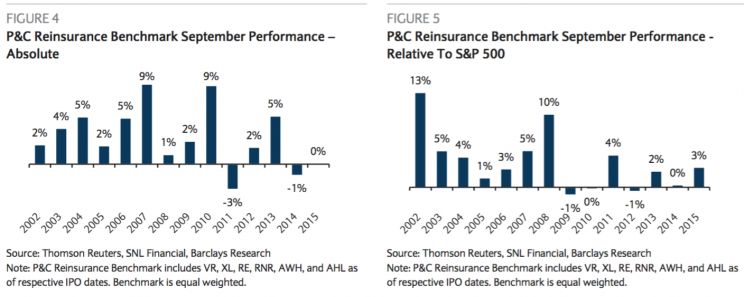

“We recommend a short-term buying opportunity for reinsurance stocks in the month of September as the typical peak of hurricane season approaches, based on our analysis of the historical performance of a benchmark of catastrophe-exposed property-casualty reinsurance stocks,” Gelb wrote on Thursday. “On average over the last 14 years, this benchmark of catastrophe- exposed P&C stocks has outperformed the S&P 500 in September by 352bps.”

The benchmark of reinsurance Gelb is referring to include Validus Holding (VR), XL Group (XL), Everest Re Group (RE), RenaissanceRe Holding (RNR), Allied World Assurance (AWH), and Aspen Insurance Holdings (AHL).

The reinsurance business broadly has not been doing very well.

“I think the business of the reinsurance companies generally is less attractive for the next ten years than it has been for the last ten years,” Buffett said during his annual shareholder meeting. “In part, that’s because what’s happened to interest rates. A significant portion of what you earn in insurance comes from investment of the float.”

The return on what insurance companies earn on the float is critical for investors as it increases the profits that are kept after claims are paid out.

The current year has come with its share of disasters, but that’s just business as usual for insurers.

“The main loss drivers in 1H 2016 included earthquakes in Japan and Ecuador, storms in Europe and the US, and wildfires in Canada,” Gelb noted. “Hail storms, torrential rain, and flash floods caused direct losses of more than $20 billion in the US and Europe. A series of storms in Texas and neighboring states accounted for $9 billion insured losses, according to Munich Re. In August 2016, flooding in Southern Louisiana has caused significant residential and commercial damage although the insured damage is expected to be manageable.”

With losses manageable, expectations low, and hurricane season peaking, now could be an opportunity to make a quick buck trading the insurers.

“The average historical 352 basis points of outperformance versus the S&P 500 in September alone reflects relief as the risks subside from the historically most active part of hurricane season,” Gelb said.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Bullishness in the derivatives market has hit a 3-year high

Don’t be fooled by the calm in the markets

The stage is set for the next 10% plunge in stocks

David Rosenberg nails the stock market in a perfect sentence