Wallace Weitz's Major Consumer Cyclical Holdings

According to current portfolio statistics, the top four consumer cyclical holdings of Wallace Weitz (Trades, Portfolio)'s Weitz Partners as of the third quarter include CarMax Inc. (NYSE:KMX), Booking Holdings Inc. (NASDAQ:BKNG), Amazon.com Inc. (NASDAQ:AMZN) and Qurate Retail Inc. (NASDAQ:QRTEA).

As of quarter-end, the consumer cyclical sector represents 9.11% of the $2.43 billion equity portfolio. Despite this, two of Weitz Partners' three new holdings were from the consumer cyclical sector: Expedia Group Inc. (NASDAQ:EXPE) and LKQ Corp. (NASDAQ:LKQ).

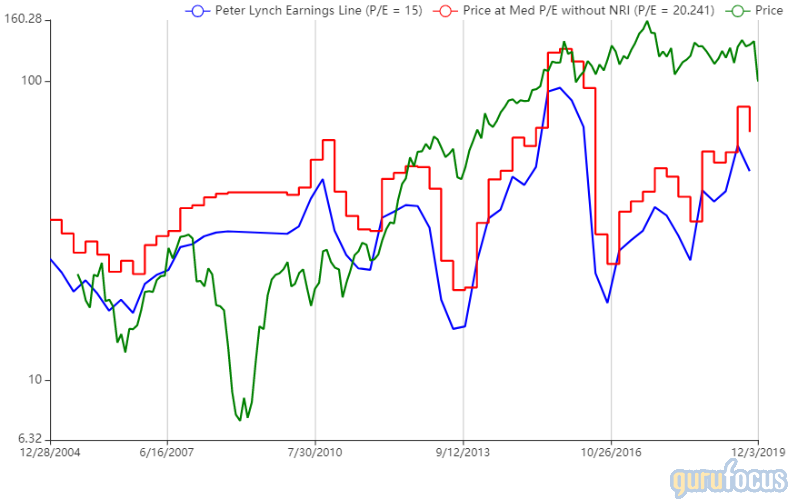

Expedia shares rise on leadership changes

On Wednesday, Expedia CEO Mark Okerstrom and Chief Financial Officer Alan Pickerill announced they will both step down from their roles, effective immediately. Chairman Barry Diller and Vice Chairman Peter Kern will oversee the Seattle-based company's leadership team, while Chief Strategy Officer Eric Hart will serve as acting CFO. Shares of Expedia traded at an intraday high of $109.32, up 9.99% from Tuesday's close of $99.39, following the announcement.

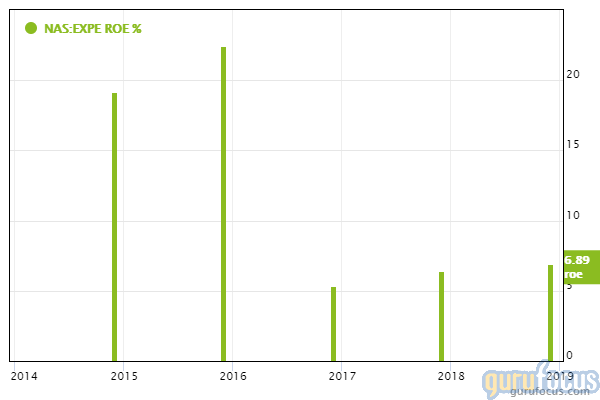

Expedia runs a wide range of travel booking platforms, including Expedia.com, Hotels.com, Travelocity and Orbitz.com. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 8, a return on equity that outperforms 72.61% of global competitors and a Joel Greenblatt (Trades, Portfolio) return on capital that outperforms 80.11% of global travel and leisure companies.

Weitz purchased 54,000 shares of Expedia during the quarter, with shares averaging $132.14. The position represents 0.30% of the equity portfolio.

Other gurus that purchased shares of Expedia during the quarter included Chris Davis (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio) and 2019 Value Conference speaker Mario Gabelli (Trades, Portfolio).

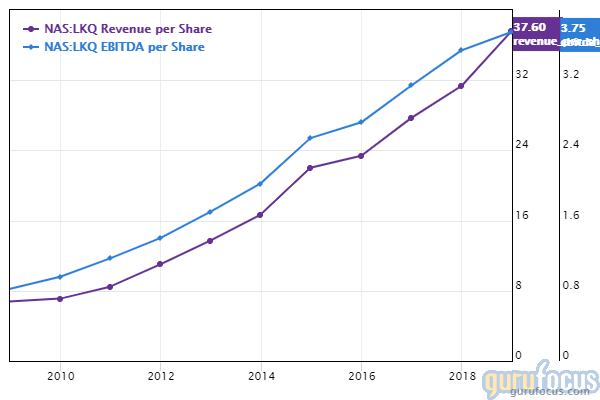

LKQ

Weitz purchased 750,900 shares of LKQ, giving the holding 0.97% equity portfolio weight. Shares averaged $27.34 during the quarter.

The Chicago-based company distributes vehicle replacement parts, components and systems used in car maintenance and repair. GuruFocus ranks LKQ's profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and a three-year revenue growth rate that outperforms 86.08% of global competitors. Additionally, operating margins are outperforming 71.44% of global auto parts companies despite contracting approximately 5.1% per year on average over the past five years.

CarMax

Weitz owns 812,550 shares of CarMax as of third quarter-end, down 11.61% from the second quarter. Shares, which averaged $85.83 during the September quarter, occupy 2.94% of the equity portfolio.

The Richmond, Virginia-based company sells, finances and services used and new cars through a chain of over 185 retail stores. GuruFocus ranks CarMax's profitability 7 out of 10: operating margins have increased approximately 0.20% per year on average over the past five years despite underperforming 51.78% of global competitors. Additionally, CarMax has a 3.5-star business predictability rank and a return on equity that outperforms 92.46% of global vehicles and parts companies.

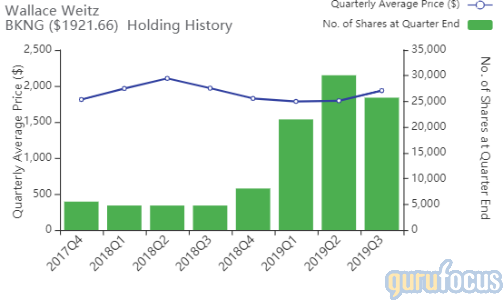

Booking

Weitz owns 25,730 shares of Booking, giving the position 2.08% weight in the equity portfolio. Shares averaged $1,936.45 during the quarter.

The Norwalk, Connecticut-based company offers reservation services through platforms like Priceline.com, Booking.com and OpenTable. GuruFocus ranks Booking's profitability 10 out of 10 on several positive investing signs, which include a solid Piotroski F-score of 7, expanding profit margins and a 3.5-star business predictability rank.

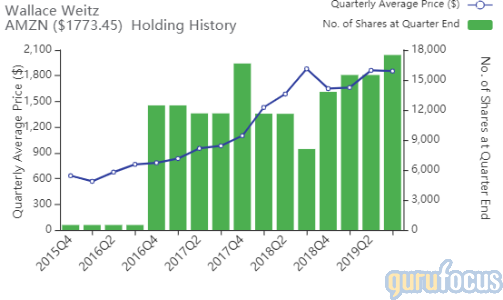

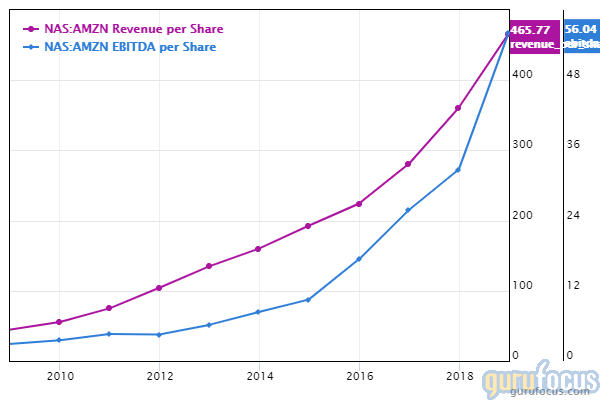

Amazon

Weitz owns 17,500 shares of Amazon, giving the position 1.25% weight in the equity portfolio. Shares averaged $1,854.66 during the quarter.

GuruFocus ranks the Seattle-based retail giant's profitability 9 out of 10 on several positive investing signs, which include a four-star business predictability rank and a return on equity that outperforms 89.42% of global competitors.

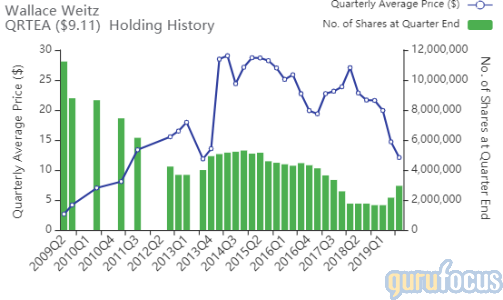

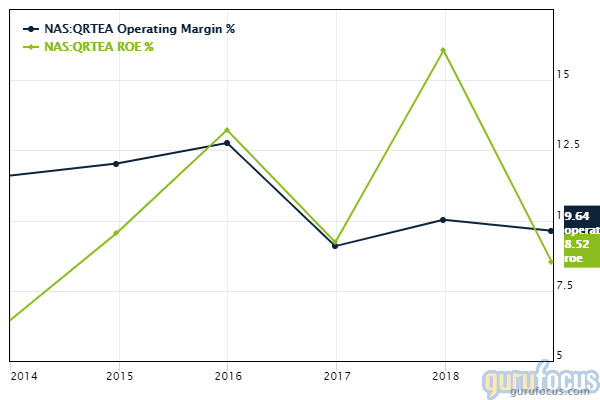

Qurate Retail

Weitz owns 2,943,848 shares of Qurate Retail, giving the position 1.25% weight in the equity portfolio. Shares averaged $12.08 during the quarter.

GuruFocus ranks the Englewood, Colorado-based company's profitability 8 out of 10 primarily due to a three-star business predictability rank and operating margins that are outperforming 81.16% of global competitors. Despite this, Qurate's return on equity is underperforming 78.94% of global Internet retail companies.

Disclosure: No positions.

Read more here:

5 Asian Stocks Gurus Agree On

5 Manufacturing Companies Gurus Broadly Own

Ron Muhlenkamp's Firm Starts 3 Positions in 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.