Walmart (WMT) Ceases Tobacco Product Sales in Some US Stores

Walmart Inc. WMT has been taking bold steps to strengthen its presence in the healthcare space. The omnichannel retailer will stop offering tobacco products in select U.S. stores, including more than 5,000 stores across regions like California, New Mexico and Florida, per media reports. However, Walmart will not completely exit the tobacco sales category.

Sources also revealed that instead of cigarettes, the supermarket giant will place other items like grab-and-go food or candies close to the front of the stores and has come up with more self-checkout registers. The abovementioned move of stopping tobacco product sales in select American stores apparently comes after years of discussions within the retailer’s leadership team.

Reports suggest that in recent years, Walmart has been taking steps to move away from some tobacco products. WMT paused the sale of e-cigarettes in 2019 due to regulatory tensions surrounding vaping.

We also note that the company’s Sam’s Club segment has been seeing soft tobacco sales for a while. In the fourth quarter of fiscal 2022, Sam’s Club, which comprises membership warehouse clubs, witnessed a net sales increase of 16.5% to $19.2 billion. Sam’s Club comp sales, excluding fuel, grew 10.4%. Comp sales saw broad-based strength across categories, mainly led by food. However, tobacco hurt comp sales.

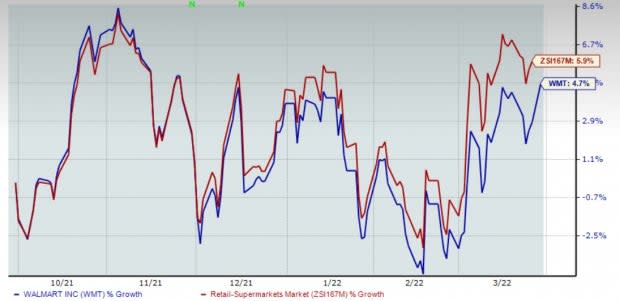

Image Source: Zacks Investment Research

Walmart’s Focus on Growth Areas

The world’s largest retailer has been undertaking steps to enhance business areas seeing more demand. The company’s e-commerce business and omnichannel penetration have been increasing all the more amid pandemic-led social distancing. From the fiscal 2021 beginning to the fiscal 2022 end, the company’s digital sales as a percentage of sales increased from 6% to 13%. Walmart has been taking several e-commerce initiatives, including buyouts, alliances, and improved delivery and payment systems. The company is innovating the supply chain, adding capacity and building businesses, such as Walmart GoLocal, Walmart Connect, Walmart Luminate, Walmart+, Spark Delivery, Marketplace and Walmart Fulfillment Services.

For deliveries, Walmart has taken robust strides to strengthen its delivery arm as evident from its expansion of the InHome delivery service, investments in DroneUp, a pilot with HomeValet, the introduction of Carrier Pickup by FedEx, the launch of the Walmart+ membership program, drone delivery pilots in the United States with Flytrex and Zipline and a pilot with Cruise to test grocery delivery through self-driven all-electric cars. Before this, Walmart unveiled Express Delivery, joined forces with Point Pickup, Roadie and Postmates, alongside acquiring Parcel to enhance its delivery service. Furthermore, the company’s store and curbside pickup options add to customers’ convenience. As of the fourth quarter of fiscal 2022, Walmart U.S. had 4,600 pickup locations and 3,500 same-day delivery stores.

U.S. e-commerce sales rose 1% in the fourth quarter and soared 70% on a two-year stack basis. At Sam’s Club, e-commerce sales jumped 21% due to a robust direct-to-home show and a solid curbside performance. In the International segment, e-commerce sales advanced 21% on a constant currency basis.

Conclusion

Walmart leaves no stone unturned to improve its store and online businesses. It remains committed to strengthening areas with solid growth potential. The aforementioned move of ceasing tobacco sales in select locations is likely to boost WMT’s healthcare presence and help it focus on areas with more potential in those regions.

Shares of this Zacks Rank #3 (Hold) company have rallied 4.7% in the past six months compared with the industry’s rise of 5.9%.

Retail Stocks to Bet on

The Kroger Co. KR currently sports a Zacks Rank #1 (Strong Buy). Kroger has a trailing four-quarter earnings surprise of 3.8%, on average. KR has an expected earnings per share (EPS) growth rate of 9.9% for three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Kroger’s current financial-year sales suggests growth of 2.4% from the year-ago period’s reported figure.

Target Corporation TGT, a general merchandise retailer, holds a Zacks Rank #2 (Buy) at present. Target has a trailing four-quarter earnings surprise of 21.3%, on average. TGT has an expected EPS growth rate of 16.5% for three to five years.

The Zacks Consensus Estimate for Target’s current financial-year sales suggests growth of 3.5% from the year-ago period’s reported figure.

Dillard's, Inc. DDS, a retail department stores operator, currently has a Zacks Rank #2. Dillard's has a trailing four-quarter earnings surprise of 294.5%, on average.

The Zacks Consensus Estimate for Dillard's current financial-year sales suggests growth of 4.7% from the year-ago period’s tally. DDS has an expected EPS growth rate of 14.6% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research