Walt Disney Flies Higher on Strong 3rd-Quarter Streaming Service Growth

Shares of The Walt Disney Co. (NYSE:DIS), a major player in the entertainment and media industry, soared over 5% in aftermarket trading on Tuesday as strong subscriber growth in streaming services outshined impacts from park and resort closures.

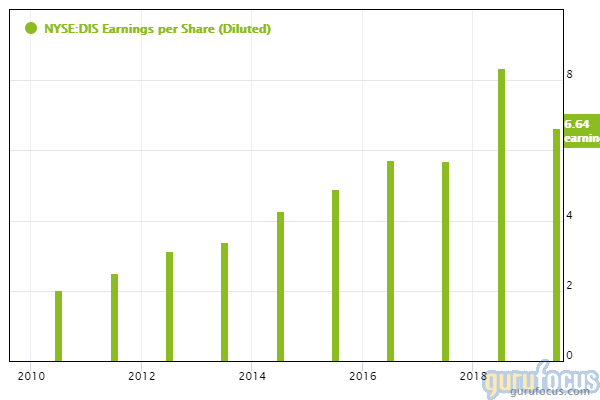

The Burbank, California-based company reported a net loss of $4.718 billion, or $2.61 in loss per share, compared with net income of $1.43 billion, or 79 cents in earnings per share, in the prior-year quarter. Despite this, Disney eked out an adjusted profit of 8 cents per share, outperforming the Refinitiv estimate of a loss of 64 cents per share.

Strong subscriber growth in streaming services mitigate adverse impacts due to park closures

Disney estimated that its net adverse impact for the quarter due to the coronavirus pandemic and regulatory measures to prevent the virus spreading amounted to approximately $2.9 billion, reflecting lost revenues in both the company's Parks, Experiences and Products and Studio Entertainment business segments. Revenues for the former segment sank 85% due to the closure of domestic parks, resorts, cruise lines and Disneyland Paris. Studio Entertainment revenues tumbled 55% on the back of theaters around the globe closing.

On the other hand, Direct-to-Consumer and International revenues increased 2% on the back of strong subscriber growth in the company's streaming services, including Disney+, Hulu and ESPN+. CEO Bob Chapek said during the earnings call that the company reached 100 million paid subscribers across its streaming services, including 60.5 million Disney+ paid subscribers. Chapek noted that Disney+ reached its goal of between 60 million and 90 million paid subscribers four years earlier than the target year of 2024.

Stock bounces from initial fall, rockets on surprise profit

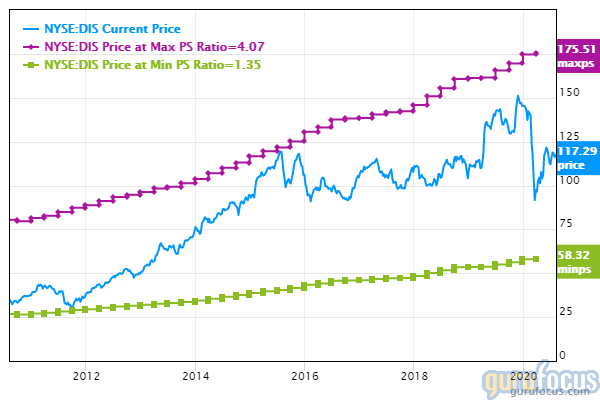

Shares of Walt Disney soared to an aftermarket high of $123.45, up over 5.2% from the closing price of $116.39 despite initially sinking to a low of $115.

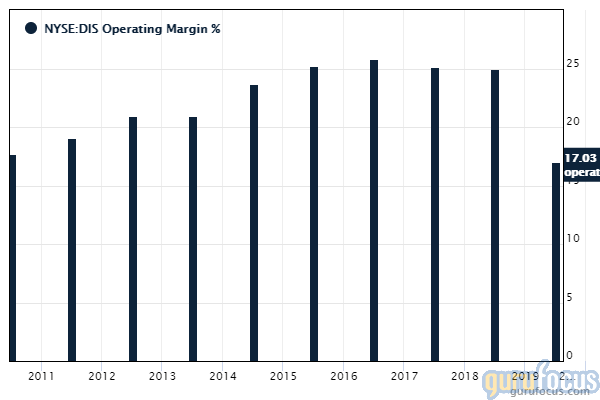

GuruFocus ranks Walt Disney's profitability 8 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and an operating margin that outperforms over 77% of global competitors.

Gurus with large holdings in Disney include Ken Fisher (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio) and Yacktman Asset Management (Trades, Portfolio).

Disclosure: No positions.

Read more here:

Tom Gayner's Top 5 Sells in the 2nd Quarter

Warren Buffett's Apple Soars on Strong 3rd-Quarter Sales Growth

Facebook Shares Rocket Despite Reporting Slowest Revenue Growth Since IPO

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.