Warner Bros Discovery: A New Media Powerhouse

The long-term historical path of the Time Warner media businesses has been a fascinating business story that may be taught in MBA classes someday. From the original merger of Time Inc. and Warner Communications in 1990 to the infamous AOL/Time Warner Merger in 2000 to the AT&T Inc. (NYSE:T) acquisition in 2018, the company seems to change it corporate structure every 10 years or so. Now in 2022, we have what many hope to be the final reshuffling of these core businesses for quite some time when the Warner Media businesses merged with Discovery Communications to form Warner Bros. Discovery (NASDAQ:WBD).

This new media powerhouse hosts the legacy Warner assets, such as cable channels TBS, TNT, HBO and CNN, as well Warner Bros. movie and television studios and legacy Discovery assets such as Discovery Channel, Food Network, HGTV and TLC. As with most media companies today, streaming services are of course a focus for the company. Primary streaming channels include HBO Max and Discovery+.

CNN+

One of the companys first stumbles came in April when it announced it was going shut down its streaming version of CNN called CNN+. The service was rolled out March 29 after spending $300 million to attract big-name journalists. The streaming service never found a big audience with an average of only 10,000 daily users in the first few weeks after launch. The company had planned to spend approximately $1 billion on the service in the first four years to grow the audience and make it profitable. The overabundance of streaming options currently available and the reluctance of consumers to pay for a multitude of these services seems to be having an affect on the streaming industry. If a consumer is paying for seven or more streaming services, why not just pay for cable or satellite TV for the same price where you get 100s of "streams?"

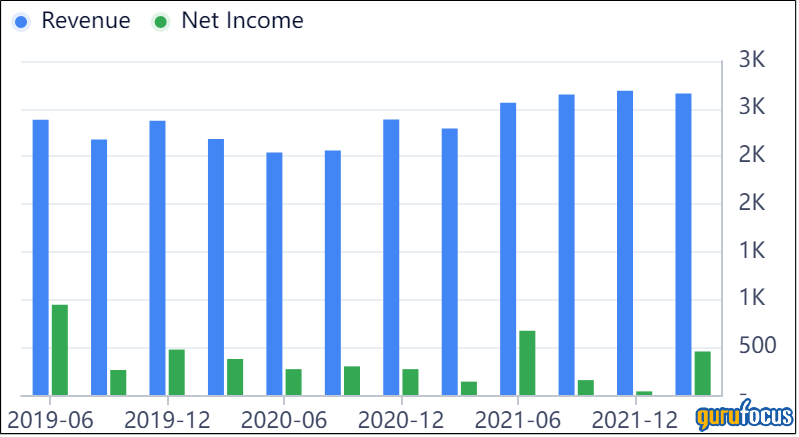

Financials

The first-quarter results for the company, which were released April 26, only include the former Discovery business and not WarnerMedia as the merger occurred on April 8. Nonetheless, results were strong with revenue growing 15% on a constant currency basis and adjusted Ebitda increasing 23%. When looking at WarnerMedia results from AT&Ts first-quarter results, revenue also increased 15%, but operating income was down significantly due to heavy investments in the HBO Max streaming service. On a combined basis, the new company would have generated $45 billion in revenue in 2021.

One of the principal reasons for the spinoff from AT&T was to reduce debt, so the new Warner Bros. Discovery is highly leveraged. Long-term debt on a pro-forma basis is $56 billion, but the company expects $14 billion in Ebitda in 2023. Due to strong free cash flow generation, management stated the leverage ratio will be approximately 3 times within a 24-month time period after closing.

Valuation

Analysts are still trying to figure out the earnings potential of the company going forward. This year's earnings per share estimates of 60 cents are somewhat meaningless due to the April 8 closing date and expected synergies are not anticipated to kick in until next year. 2023 estimates are more reasonable in the $1.61 to $1.91 range, creating a very low forward price-earnings ratio. The forward enterprise value/Ebitda valuation are approximately 7 to 8 times based on $14 billion in Ebitda in 2023. This a discount to most streaming peers.

Guru trades

Gurus who have purchased or added to their Warner Bros. Discovery positions include Jeremy Grantham (Trades, Portfolio) and John Hussman (Trades, Portfolio). Gurus who have reduced their positions include Ken Fisher (Trades, Portfolio) and Mark Hillman (Trades, Portfolio). Note that these transactions pertain to the former Discovery entity as the merger transaction closed after the March 31 filing date.

Conclusion

Warner Bros. Discovery laid out four strategic priorities for the new company, which include creating world-class content, widespread global distribution, a balanced asset monetization model from different revenue streams and strong and lasting free cash flow generation. This means that although the company hopes to be a streaming leader with HBO Max, it will still maintain strong positions in traditional advertising revenue and content distribution.

The stock appears to be undervalued based on the companys and analysts' outlooks. The current leverage ratio of approximately 4.5 times is something to watch, but strong free cash flow generation should alleviate those concerns over the long term.

This article first appeared on GuruFocus.