Warren Buffett Continues to Bet Big on Bank of America

Warren Buffett (Trades, Portfolio) has revealed a 6.12% addition to his holding of Bank of America (NYSE:BAC) since the end of the first quarter, according to GuruFocus' Real-Time Picks, a Premium feature.

Buffett follows a value investing strategy that is an adaptation of Benjamin Graham's approach. His investment strategy of discipline, patience and value has consistently outperformed the market, and his moves are followed by thousands of investors worldwide as a result. He seeks to acquire great companies trading at a discount to their intrinsic value, and to hold them for a long time. He will only invest in businesses that he understands, and always insists on a margin of safety.

Buffett's Bank of America history

The Oracle of Omaha first got involved with Bank of America in 2011 as the company was still recovering from the 2008 financial crisis. He made an offer to purchase 50,000 preferred shares, senior to common equity and junior to a bond, at a value of $100,000 each, according to CNN.

The preferred shares would offer Buffett a solid 6% dividend that would be paid out quarterly. On top of the dividends, Buffett received warrants to purchase 700 million common shares over the following 10 years at a price of $7.14 per share. With shares trading at $8.15 the day of the deal, Buffett was already looking at roughly one billion dollars in profit if he were to activate his warrants at that moment.

Come 2017, Bank of America passed their annual stress test with the Federal Reserve and was granted the ability to raise their annual dividend to $0.48 per share, surpassing the $0.44 needed for Buffett to maintain his 6% yield. With shares trading around $24.58 at the time of the dividend rise, Buffett cashed in the warrants early and made approximately $12 billion dollars, according to reports from CNBC.

Buffett has continued to add to the holding since the acquisition of the common shares, while only selling shares one time in the fourth quarter of 2019. The recent purchases have equated to a total addition of 56.65 million shares since the end of the first quarter. Between July 20 and July 22 alone, 33.90 million shares were purchased.

The shares purchased since the end of the first quarter were bought at an average price of $23.99 and represented a 6.12% increase in the holding. Overall, the additions represent a 0.77% impact on the portfolio.

Bank of America

Bank of America is one of the largest financial institutions in the United States, with more than $2.3 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking and global markets.

Bank of America's consumer-facing lines of business include its network of branches and deposit-gathering operations, home mortgage lending, vehicle lending, credit and debit cards and small-business services. The company's Merrill Lynch operations provide brokerage and wealth management services, as does U.S. Trust private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending and capital markets operations.

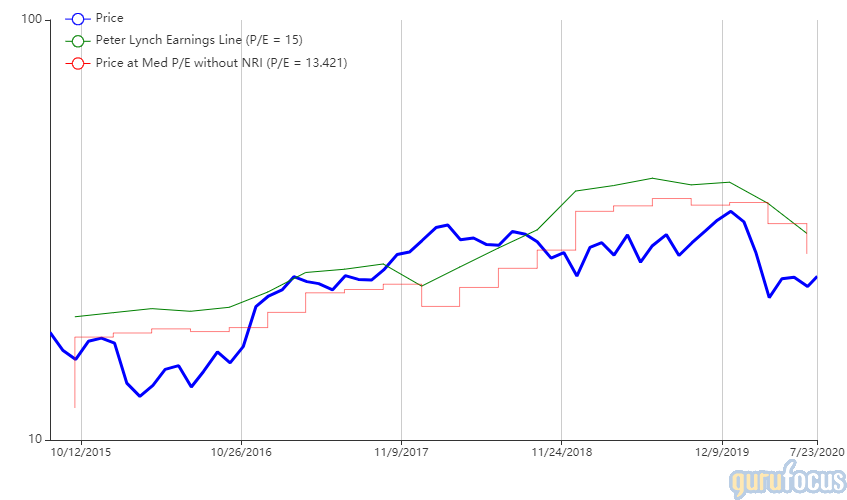

On July 23, the stock was trading at $24.31 per share with a market cap of $210.62 billion. Since 2018,the shares have been trading below intrinsic value, according to the Peter Lynch Chart.

GuruFocus gives the company a financial strength rating of 3 out of 10, a profitability rank of 4 out of 10 and a valuation rank of 5 out of 10. The company has significantly cut back on debt since 2011 and their cash-to-debt ratio of 1.06 places them just below the industry median. In recent years cash flows and income have been on the rise.

Buffett is currently the top shareholder with 11.33% of shares outstanding. Other top guru shareholders include Vanguard Group Inc. (Trades, Portfolio), BlackRock Inc. (Trades, Portfolio), State Street Corp. (Trades, Portfolio), FMR LLC (Trades, Portfolio) and Wellington Management Group LLP (Trades, Portfolio).

Portfolio overview

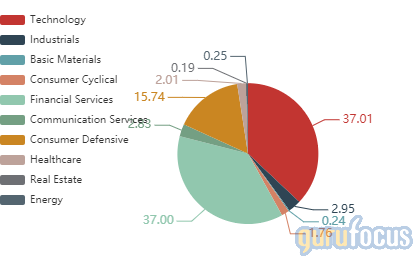

At the end of the first quarter, the equity portfolio of Buffett's Berkshire Hathaway (BRK.A)(BRK.B) contained 50 stocks and was valued at $175.53 billion dollars. By weight, the portfolio is most heavily invested in the technology (37.01%), financial services (37.00%) and consumer defensive (15.74%) sectors.

Disclaimer: Author owns no stocks mentioned.

Read more here:

David Abrams Cuts Camping World Holdings

Jerome Dodson Reveals Major Portfolio Revision in 2nd Quarter

Boeing Gets Military Save Amidst Struggles

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.