One of Warren Buffett's wishes for corporate America is already coming true

Warren Buffett and some of his peers in American business are promoting what they call “Commonsense Corporate Governance Principles.”

The group aims to make changes in board-level governance, shareholder rights, succession planning, compensation, investors’ roles, and public disclosures. Regarding public disclosures, one hot-button issue is the role of earnings guidance.

“We don’t manage to try to get any given number from quarter to quarter,” Buffett said at Berkshire Hathaway’s annual shareholder meeting. “We never make a forecast on earnings. We don’t give out earnings guidance. We think it’s silly.”

Buffett would like to see fewer companies provide short-term guidance. The good news is that this may already be happening.

How earnings guidance can cause problems

It’s earnings season, which means big companies revealing the results of their most recently completed quarter. Some will also provide guidance about future earnings.

The benefit of these quarterly updates is increased transparency for investors. However, these announcements often lead to big swings in stock prices as investors and traders inevitably tweak their own expectations and valuations models for these companies based on the news.

“Our financial markets have become too obsessed with quarterly earnings forecasts,” said Buffett and his co-signers. “Companies should not feel obligated to provide earnings guidance — and should do so only if they believe that providing such guidance is beneficial to shareholders.”

Unfortunately, some of those shareholders are executives and managers, who are often compensated with company stock or derivative securities tied to that stock. This is the source of some serious conflicts. It’s for this reason that Warren Buffett is an outspoken critic of quarterly disclosures and management guidance.

“Guidance can lead to a lot of malpractice,” Buffett said to CNBC. “I’ve seen guidance produce some bad results … There are ways to move earnings toward the end of a quarter, and sometimes even after the end of a quarter.”

There’s already a trend towards giving less short-term guidance

While many companies offer earnings guidance, many do not. Even of the companies that do offer guidance, most only offer annual guidance.

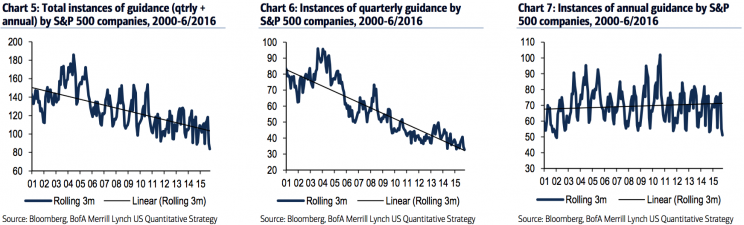

And according to data compiled by Bank of America Merrill Lynch’s Savita Subramanian, Buffett’s hopes for less short-term guidance may already becoming true.

“[C]orporates have gradually been doing away with quarterly guidance (but maintaining annual guidance) in what may be a shift away from short-termism,” Subramanian said in a note to clients earlier this month. “[W]e note that both annual and quarterly guidance have dropped over the past two months, potentially suggesting growing uncertainty over the macro backdrop/the cycle. In fact, total instances of guidance on a rolling three month basis fell to their lowest level since 2000 last month.”

That chart in the middle suggests Buffett’s hope for less short-term thinking may already be coming true.

“These recommendations are not meant to be absolute,” they said. “We know that there is significant variation among our public companies and that their approach to corporate governance will inevitably (and appropriately) reflect those differences. But we do hope our effort will be the beginning of a continuing dialogue that will benefit millions of Americans by promoting trust in our nation’s public companies.”

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Warren Buffett shines a spotlight on the ‘most egregious’ example of financial deception

Warren Buffett: The foundation of every market bubble is a ‘sound premise’

The most popular way of measuring stock market value is being misused

The most important question in the stock market right now

How history’s most successful investors think about wild market swings