Warren Buffett still cites See's Candies as an acquisition he loves, 48 years after buying it

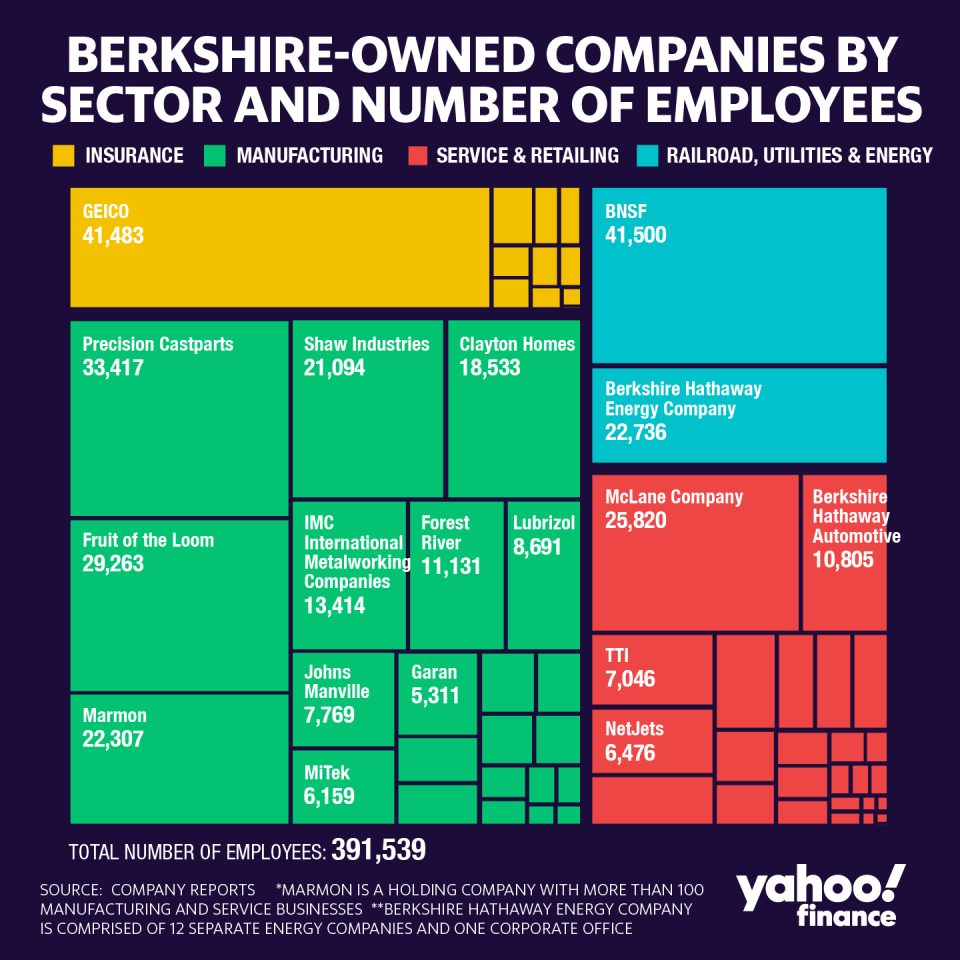

During Berkshire Hathaway’s 2020 (virtual) annual shareholder meeting on Saturday evening, CEO Warren Buffett fielded a question about which of Berkshire’s subsidiaries (the company had 391,539 total employees at the end of 2019) have been hardest-hit by coronavirus.

Buffett said that there has not been a large employment hit to Berkshire-owned companies so far. “It’s not like we’re in the hotel business.”

He also reassured investors when he added, “I’ll put it this way: five years from now, I think Berkshire will be employing considerably more people.” Greg Abel, vice chairman of Berkshire’s non-insurance operations, also said later in the meeting that Berkshire’s businesses are "in very sound shape" despite the pandemic, and are "preparing to emerge now."

But Abel did come up with an example of a Berkshire-owned business temporarily shuttered by coronavirus: See’s Candies, which Berkshire acquired in 1972 for $25 million.

Buffett elaborated on See’s. “We were in the midst of our Easter season, and Easter is a big sales period for See's,” Buffett said. “We weren't halfway through [the Easter candy season] in terms of the volume that can be delivered, because it comes toward the end. And essentially we were shut down, and we remain shut down. The malls, we have 220 or so retail stores, and we’ve got a lot of [non-See’s stores] that sell our candy, and are shut down. So See's business stopped. And it's a very seasonal business to start with, so we have a lot of seasonal workers too, particularly who come in for the Christmas season. But we have a lot of Easter candy [left over]... and we won’t sell it. We produced a good bit of it, and we couldn’t ship it, and we couldn’t put it in stores.” (See’s says many of its stores are still offering no-contact pickup.)

You probably noticed: Buffett has learned a lot about the candy business. And he loves talking about See’s. “We've owned that since 1972, and we love it, and we continue to love it,” he said at this year’s meeting, with a box of See’s famous peanut brittle sitting on the desk next to him.

Buffett mentions See’s most years, in either his shareholder letters or at the annual meeting, so its small size (about $450 million in revenue) belies the company’s personal significance to him. As Buffett told Fortune in 2012, “We have made a lot more money out of See’s than shows from the earnings of See’s, just by the fact that it’s educated me, and I’m sure it’s educated Charlie, too.”

When Buffett and Charlie Munger decided to buy the company in 1972, See’s had $30 million in annual sales and profit of $4.2 million. By 2014, See’s had annual sales of $400 million, and profits of more than $82 million. (See’s does not publicly share its annual revenue.)

The key to See’s is that it requires low capital investment each year, it’s a reliable seasonal business with devoted customers, and it grows every year at a slow but consistent pace.

"The ideal business is one that takes no capital, and yet, grows," Buffett said at the 2016 annual meeting. See’s is his favorite example of that. At last year’s annual meeting, Buffett framed the acquisition in crystal-clear terms: “We put $25 million into it and it's given us over $2 billion of pretax income.”

See’s is still best-known on the West Coast, with dual headquarters in Los Angeles and San Francisco, and most of its stores are in the state of California. In 2012, the company attempted to map out an East Coast expansion with Berkshire’s blessing, but the demise of brick-and-mortar retail put a stop to that plan.

—

Daniel Roberts is an editor-at-large at Yahoo Finance. Follow him on Twitter @readDanwrite.

Read more about Buffett and Berkshire:

Warren Buffett: 'Never, ever bet against America'

Kraft Heinz has two glaring issues right now for investors

Buffett on buying bitcoin: ‘That is not investing’

Why Buffett and Munger love companies like See’s Candies

Meet the South Dakota railroad worker who won $50,000 in Buffett’s 2019 March Madness pool

Meet the West Virginia steelworker who won $100,000 in Buffett’s 2017 March Madness pool