Warren Buffett's 4 Airline Holdings

According to current portfolio statistics, Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) has four positions in the airline sector as of the first quarter: Delta Air Lines Inc. (NYSE:DAL), Southwest Airlines Co. (NYSE:LUV), United Continental Holdings Inc. (NASDAQ:UAL) and American Airlines Inc. (NASDAQ:AAL).

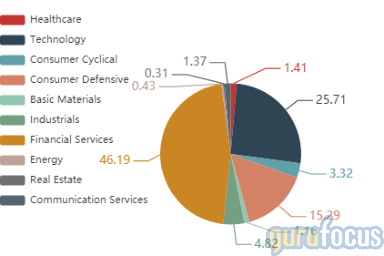

The conglomerate has not released its June quarter portfolio as the deadline is 45 days after quarter-end. As of the March quarter, the industrials sector occupies 4.82% of Berkshire's equity portfolio, with airlines occupying effectively the entire sector weight.

CNBC columnist Eric Rosenbaum said this week that the airline industry is "experiencing strong financial performance" and that Buffett, who has shunned airlines in the past, became a major investor in the sector over the last several years following "a wave of consolidation" that brought the carriers to monopoly-like businesses.

Buffett said during a February 2017 "Squawk Box" interview with Becky Quick that the airline industry got the poor 20th century out of the way and that he hopes airlines "will keep orders in reasonable relationship to potential demand." The conglomerate revealed positions in the top U.S. airlines starting with the September 2017 filing.

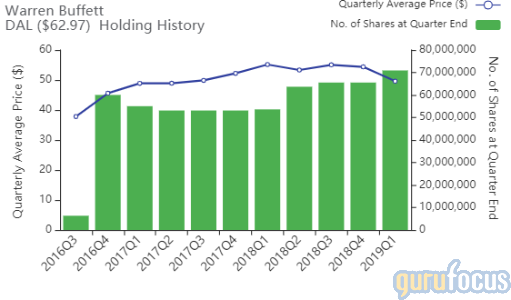

Delta

Berkshire owns 70,910,456 shares of Delta, giving the position 1.84% weight in the equity portfolio. Shares of the Atlanta-based airline opened at $62.77 on Thursday, up approximately 26.53% from its first-quarter average of $49.61.

Delta Chief Financial Officer Paul Jacobson said at last Tuesday's CNBC @Work Human Capital + Finance conference that the next area of competition among airlines is at the airport. Jacobson underscored Delta's use of survey data from all aspects of a customer's flight experience at each leg of the journey: check-in, security check, in-flight entertainment and dining.

GuruFocus ranks Delta's profitability 7 out of 10 on positive indicators like expanding profit margins, a solid Piotroski F-score of 6 and returns on assets that are outperforming 85.19% of global competitors.

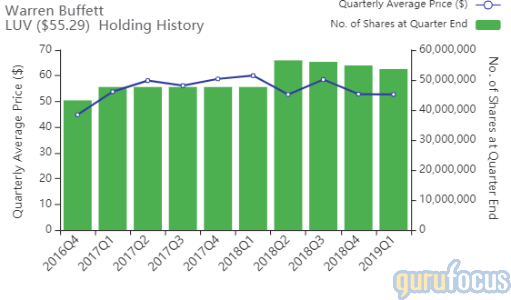

Southwest

Berkshire owns 53,649,213 shares of Southwest, giving the holding 1.40% weight in the equity portfolio. Shares of the Dallas-based airline opened at $53.33 on Thursday, up approximately 1.16% from the first-quarter average of $52.72.

Southwest said Thursday morning that despite headwinds stemming from Boeing Co.'s (BA) 737 Max troubles, the carrier reported second-quarter net income of $741 million, or $1.37 per diluted share, compared to net income of $733 million, or $1.27 per diluted share, in the prior-year quarter. Revenue per available seat mile increased 6.8% year over year, driven by strong growth in passenger revenue yield and load factor.

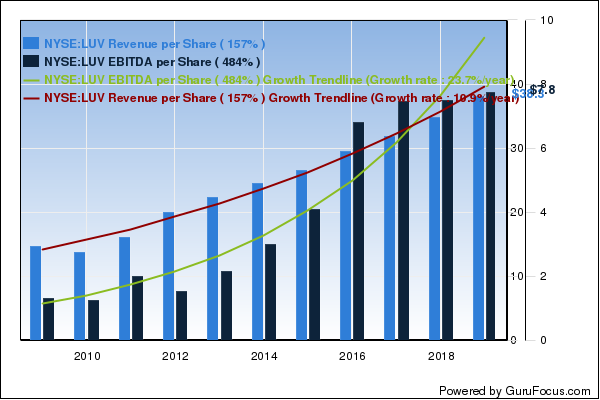

GuruFocus ranks Southwest's profitability 8 out of 10 on several positive signs, which include a five-star business predictability rank and operating margins that have increased 11.30% per year on average over the past five years and are outperforming 86% of global competitors.

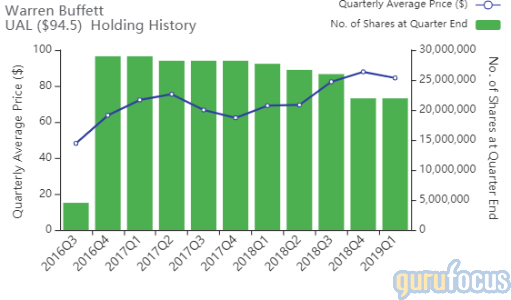

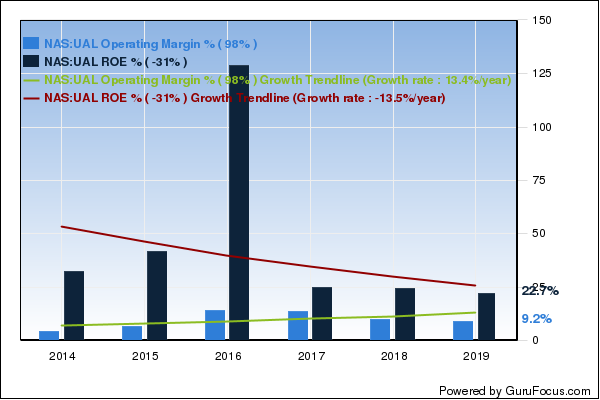

United

Berkshire owns 21,938,642 shares of United, giving the stake 0.88% weight in the equity portfolio. Shares of the Chicago-based airline opened at $94.19, up approximately 7.22% from the first-quarter average of $87.85.

GuruFocus ranks United's profitability 8 out of 10 on several positive indicators, which include expanding profit margins, a strong Piotroski F-score of 7 and a return on equity that outperforms 90.57% of global competitors.

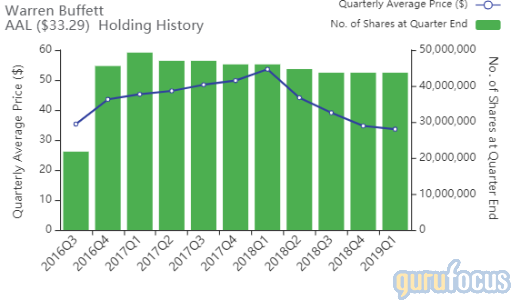

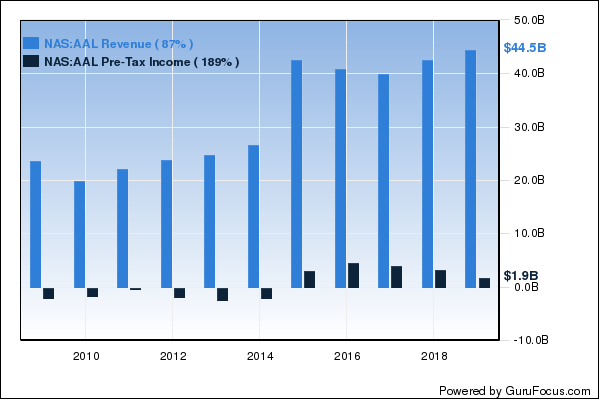

American

Berkshire owns 43.7 million shares of American, giving the position 0.70% weight in the equity portfolio. Shares of the Fort Worth, Texas-based airline traded at an intraday low of $32.56 Thursday morning, down 16.68% from its first-quarter average of $39.08.

American said Thursday morning that although second-quarter revenues reached a record $12 billion, driven by continued strength in passenger demand and load factor, it estimated that pretax income for the quarter declined $175 million due to cancellations stemming from the Boeing 737 Max grounding. American further said pretax income for the year is expected to decline $400 million from the prior year as the carrier extended the Max cancellations to Nov. 2.

GuruFocus ranks American's profitability 7 out of 10: Even though the company's profit margins are underperforming 62.07% of global competitors, it has a strong Piotroski F-score of 7 and a three-year revenue growth rate that outperforms 81.67% of global airline competitors.

Disclosure: No positions.

Read more here:

Facebook Rises Despite $5 Billion FTC Privacy Charge

5 Stocks to Consider as the UK Gains New Prime Minister

Buffett's Favorite Drink Coca-Cola Soars on Increased Revenue Guidance

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.