Waste Connections (WCN) Stock Gains 5% on Q3 Earnings Beat

Waste Connections, Inc. WCN reported solid third-quarter 2022 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate.

Raised 2022 revenue outlook motivated investors as the stock has risen 5% since the earnings release on Nov 2. Full-year revenues are estimated at $7.190 billion (previous view: $7.125 billion). The Zacks Consensus Estimate is below the raised guidance of $7.17 billion.

Adjusted earnings (excluding 18 cents from non-recurring items) of $1.10 per share beat the Zacks Consensus Estimate by 8.9% and increased 23.6% year over year. Revenues of $1.88 billion topped the consensus mark by 0.3% and rose 17.7% year over year.

Acquisitions contributed $51.4 million to revenues in the reported quarter.

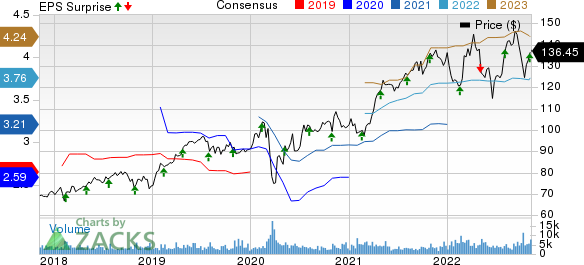

Waste Connections, Inc. Price, Consensus and EPS Surprise

Waste Connections, Inc. price-consensus-eps-surprise-chart | Waste Connections, Inc. Quote

Revenues by Segment

The Solid Waste Collection segment’s revenues increased 20.2% year over year to $1.34 billion.

The Solid Waste Disposal and Transfer segment’s revenues increased 11.4% from the year-ago quarter’s level to $616.9 million.

The Solid Waste Recycling segment’s revenues plunged 13.5% year over year to $48.25.

The Intermodal and Other segment’s revenues increased 24.6% to $47.6 million.

The E&P Waste Treatment, Recovery and Disposal segment’s revenues soared 48.1% from the year-ago quarter’s level to $57 million.

Operating Results

Adjusted EBITDA in the reported quarter was $588.1 million, up 16.3% from the year-ago quarter’s level. Adjusted EBITDA margin came in at 31.3% compared with 31.7% in the year-ago quarter.

Operating income totaled $326.8 million, up 14.6% from the prior-year quarter’s level.

Dividend Hike

WCN announced that its board of directors declared a dividend hike of 10.9% to 25.5 cents per share. The updated dividend will be paid out on Dec 1 to its shareholders of record as of Nov 16.

Balance Sheet and Cash Flow

Waste Connections exited third-quarter 2022 with cash and cash equivalents of $147.4 million compared with $217.8 million at the end of the prior quarter. Long-term debt was $6.2 billion compared with $5.63 billion at the end of the March quarter.

WCN generated $421.5 million of cash from operating activities in the reported quarter. Adjusted free cash flow was $240 million. Capital expenditures totaled $208.1 million.

WCN paid out dividends worth $53.5 million in the reported quarter. Currently, Waste Connections carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2022 View

Net income is estimated to be $836.7 million (prior view: $837.5 million). Adjusted EBITDA is estimated at $2.210 billion (past view: $2.190 billion).

Capital expenditures are estimated to be approximately $850 million, in line with the previous estimate.

Net cash provided by operating activities is estimated to be $1.963 billion (prior view: $1.974 billion). Adjusted free cash flow is estimated to be $1.160 billion, in line with the previous estimate.

Recent Releases

Omnicom Group Inc. OMC reported impressive third-quarter 2022 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate.

Earnings of $1.77 per share beat the consensus mark by 7.9% and increased 7.3% year over year, driven by a solid margin performance. Total revenues of $3.4 billion surpassed the consensus estimate by 3% and increased slightly year over year.

Equifax Inc. EFX reported stellar third-quarter 2022 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate.

Adjusted earnings (excluding 39 cents from non-recurring items) of $1.73 per share beat the Zacks Consensus Estimate by 5.5% but decreased 6.5% on a year-over-year basis. However, revenues of $1.24 billion beat the consensus estimate by 2.3% and improved 1.8% year over year on a reported basis and 4% on a local-currency basis.

The Interpublic Group of Companies, Inc. IPG reported better-than-expected third-quarter 2022 results.

Adjusted earnings (excluding a penny from non-recurring items) of 63 cents per share beat the Zacks Consensus Estimate by 6.8%. The bottom line has been flat over the past year. Net revenues of $2.3 billion beat the consensus estimate by 0.3% but declined 9.7% on a year-over-year basis. Total revenues of $2.64 billion increased 3.8% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. The (IPG) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research