Watsco (WSO) Q1 Earnings Beat, Revenues Miss, Shares Rise

Watsco, Inc. WSO reported mixed first-quarter 2023 results, wherein earnings topped the Zacks Consensus Estimate but sales missed the same. Notably, Watsco delivered record sales and navigated the regulatory transition to higher Seasonal Energy Efficiency Rating or SEER products across its markets.

Shares of Watsco gained 8.3% during the trading session on Apr 20.

Inside the Numbers

Watsco reported quarterly earnings of $2.83 per share, which topped the consensus estimate of $2.35 by 20.4% but decreased 2.4% year over year on lower operating profit.

Total sales of $1.55 billion, on the other hand, missed the consensus mark of $1.56 billion by 0.6% but increased 2% from the year-ago period. The upside reflects sustainable market share gains, solid heat pumps sales, solid commercial business, product diversity and technology leadership. Also, continued investment in technologies, designed to revolutionize customer experience, added to the positives.

Sales of HVAC equipment (heating, ventilating and air conditioning, comprising 68% of sales) were up 2% year over year. Sales of other HVAC products (28% of sales) decreased 2% from the prior-year quarter. Sales from commercial refrigeration products (4% of sales) rose 12% year over year.

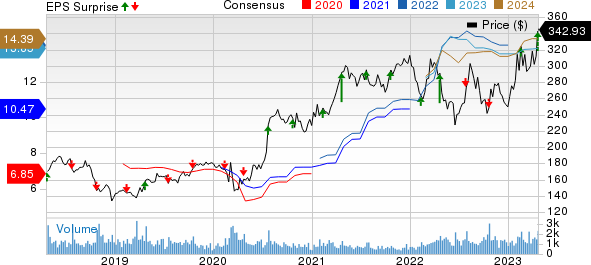

Watsco, Inc. Price, Consensus and EPS Surprise

Watsco, Inc. price-consensus-eps-surprise-chart | Watsco, Inc. Quote

Operating Highlights

Gross margin contracted 70 basis points (bps) in the first quarter to 28.9%. SG&A expenses improved 10 bps year over year in the quarter.

The operating margin declined 60 bps in the first quarter to 10.6%.

Financial Operations

As of Mar 31, 2023, cash and cash equivalents were $141 million compared with $147.5 million at 2022-end. The company used $47.4 million of cash in operating activities in the quarter compared with $101.6 million a year ago.

Zacks Rank

WSO currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A Few Recent Construction Releases

KB Home KBH reported better-than-expected first-quarter fiscal 2023 (ended Feb 28, 2023) results, defying the challenging housing market conditions. Its earnings and revenues beat the Zacks Consensus Estimate.

KBH’s quarterly revenues were at the high end of its guided range, and both operating and gross margins performed better than expected. KBH’s book value per share grew to $44.80, up 27% from a year ago.

RPM International Inc. RPM reported third-quarter fiscal 2023 (ended Feb 28, 2023) results, wherein its earnings and sales beat the Zacks Consensus Estimate. Meanwhile, although sales increased, earnings declined year over year.

During the quarter, RPM’s net sales benefited from reshoring and infrastructure spending.

Acuity Brands, Inc. AYI reported mixed results for second-quarter fiscal 2023 (ended Feb 28, 2023), wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. Earnings beat the consensus mark for the 11th consecutive quarter. Revenues missed the same for two quarters in a row, following six straight quarters of beat.

On a year-over-year basis, AYI’s earnings and revenues rose as both the lighting and spaces businesses’ sales grew, while the adjusted operating profit expanded and adjusted earnings per share increased.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

RPM International Inc. (RPM) : Free Stock Analysis Report

Acuity Brands Inc (AYI) : Free Stock Analysis Report