Should Weakness in Vanda Pharmaceuticals Inc.'s (NASDAQ:VNDA) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

It is hard to get excited after looking at Vanda Pharmaceuticals' (NASDAQ:VNDA) recent performance, when its stock has declined 13% over the past month. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. In this article, we decided to focus on Vanda Pharmaceuticals' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Vanda Pharmaceuticals

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Vanda Pharmaceuticals is:

6.7% = US$32m ÷ US$481m (Based on the trailing twelve months to June 2021).

The 'return' is the yearly profit. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.07.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Vanda Pharmaceuticals' Earnings Growth And 6.7% ROE

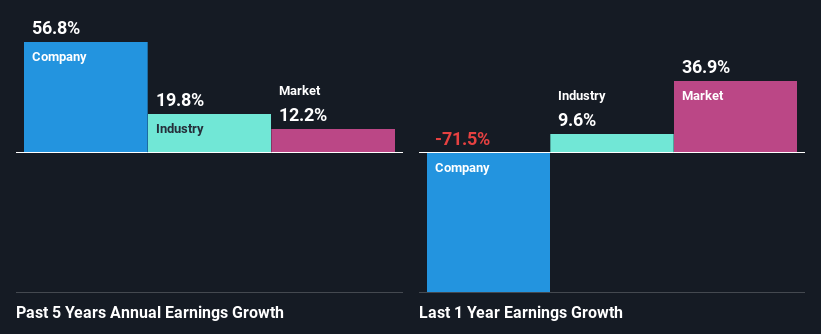

On the face of it, Vanda Pharmaceuticals' ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 18% either. Despite this, surprisingly, Vanda Pharmaceuticals saw an exceptional 57% net income growth over the past five years. We reckon that there could be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared Vanda Pharmaceuticals' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 20% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. What is VNDA worth today? The intrinsic value infographic in our free research report helps visualize whether VNDA is currently mispriced by the market.

Is Vanda Pharmaceuticals Efficiently Re-investing Its Profits?

Conclusion

On the whole, we do feel that Vanda Pharmaceuticals has some positive attributes. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.