Wednesday’s Vital Data: Alibaba, JD.com and Macy’s

U.S. stock futures are trading lower this morning. Wall Street is unable to shake the specter of Turkey’s economic woes for the second session. Corporate earnings and a flood of U.S. economic data also have investors worried heading into the open.

Speaking of economic data, July retail sales, the August Empire State Index, second-quarter productivity and labor costs, July industrial production and capacity utilization, the August home builders’ index and business inventories are all scheduled for release today.

Against this backdrop, futures on the Dow Jones Industrial Average are down 0.60% with S&P 500 futures off 0.55%. Nasdaq-100 futures, meanwhile, have plunged 0.74%.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

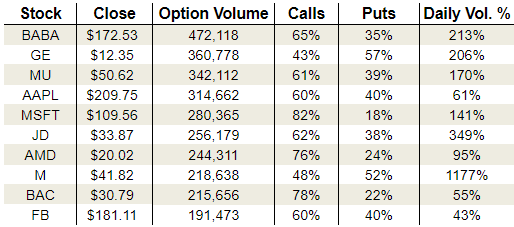

In the options pits, volume remained anemic on Tuesday. Overall, about 16.3 million calls and 13.1 million puts changed hands on the session. Over on the CBOE, the single-session equity put/call volume ratio rose to 0.66. The 10-day moving average held at 0.63.

Options traders turned their attention toward Chinese stocks yesterday. Alibaba (NYSE:BABA) was a popular call option target amid a flurry of financial headlines. JD.com (NASDAQ:JD) was also a heavy call favorite amid Chinese retails sector concerns. Finally, Macy’s (NYSE:M) was flooded with activity ahead of this morning’s earnings report.

Let’s take a closer look:

Alibaba (BABA)

Alibaba is slated to release its quarterly earnings report next week, and hedge funds are loading up on BABA stock ahead of the event. In 13F filings with the SEC, both Jana Partners and Bridgewater Associates reported sizable new positions in Alibaba yesterday.

Additionally, Alibaba announced a new partnership with leading American supermarket chain Kroger’s (NYSE:KR) to start selling groceries in China. The move is not only a boon to Alibaba’s offerings, but it also solidifies Kroger’s growing bullish position.

As you can see, options traders had more than enough reason to dive into BABA stock yesterday. Volume surged to 472,000 contracts, more than doubling BABA’s daily average. Calls were the most popular, claiming 65% of the day’s take.

That said, the weekly Aug 24 series put/call open interest ratio comes in at a moderate 0.73. In other words, traders remain divided on the stocks’ direction following earnings, likely due to U.S. trade concerns. Aug. 24 implied volatility is pricing in a 6.8% move for BABA stock following earnings.

JD.com (JD)

Like BABA, JD stock has taken a beating in the current U.S./China trade war. Selling pressure got worse this week after China reported that retail sales rose 8.8% in July. Analysts were expecting sales to rise 9%, leading some to believe that the U.S. tariffs were having a broader impact than expected.

Still, there appear to be bargain hunters in the Chinese retail sector. Yesterday, JD options traders loaded up on calls, with these typically bullish bets claiming 62% of the more than 256,000 contracts traded on JD stock.

That optimism is also present in the September series. Specifically, the September put/call OI ratio for JD stock comes in at 0.60. As a result, calls are close to being twice as popular as puts in this back month series, indicating that JD options traders may be looking for a rebound.

Macy’s (M)

Bright and early this morning, Macy’s reported second-quarter earnings of 59-cents-per-share on revenue of $5.57 billion. Analysts were expecting earnings of 50-cents-per-share on revenue of $5.55 billion. Same-store sales were flat, compared to expectations for a decline of 0.7%. Finally, Macy’s lifted its 2018 full-year outlook to earnings of $3.95 to $4.15-per-share from $3.75 to $3.95.

Despite those solid figures, M stock was last down more than 2% heading into the open.

Options traders were worried M stock might drop on the news. Volume yesterday skyrocketed to 218,000 contracts, or more than 11 times M’s daily average. Puts claimed 52% of that heavy activity.

Currently, peak August put OI rests at the deep out-of-the-money $36 strike, totaling more than 20,000 contracts. Closer to the money, the $40 strike maintains OI of about 7,800 contracts. Both options expire this Friday. M stock is threatening to break below $40 heading into the open.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Wednesday’s Vital Data: Alibaba, JD.com and Macy’s appeared first on InvestorPlace.