Wednesday’s Vital Data: Apple, Applied Materials and IBM

U.S. stock futures are trading higher this morning as markets attempt to recover from this week’s nasty downturn. Tech stocks, which led to the downslide, are showing the most strength this morning.

Overnight gaps higher like this have had a higher failure rate during the market correction, so time will tell if bulls will maintain their foothold.

Against this backdrop, futures on the Dow Jones Industrial Average are up 0.57% and S&P 500 futures are higher by 0.72%. Nasdaq-100 futures have added 0.1.11%.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

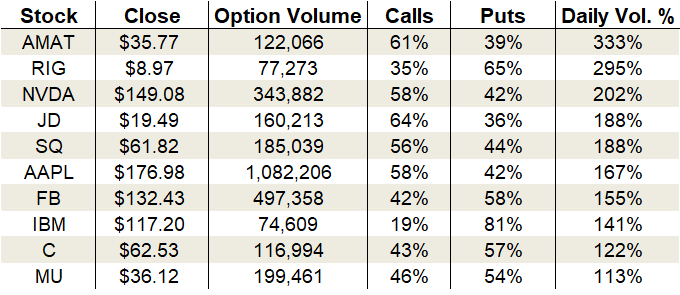

In the options pits, put volume spiked sharply yesterday, helping to drive overall volume well above average levels. Specifically, about 21 million calls and 23.4 million puts changed hands on the session.

Those puts made waves at the CBOE as well. The single-session equity put/call volume ratio jumped to 0.82 — a one-month high. The 10-day moving average climbed to a new record for 2018 at 0.82.

Options activity was really hopping in a few names Tuesday. The selling in Apple (NASDAQ:AAPL) reached a fever pitch as it fell even deeper below its 200-day moving average. The recovery attempt in IBM (NYSE:IBM) finally faltered. Finally, Applied Materials (NASDAQ:AMAT) is seeing institutions wade back into the waters as the stock attempts to bottom.

Let’s take a closer look:

Apple (AAPL)

Negative news continues to dominate the headlines for Apple. The latest humdinger comes from Foxconn Technology Group, which is the largest assembler of iPhones. An internal company memo outlined plans to cut almost $3 billion from expenses in 2019. The dramatic reduction likely comes as a result of underwhelming demand for Apple’s newest slate of iPhones.

AAPL stock fell deeply into negative territory Tuesday amid heavy volume.

On the options trading front, total trading soared past the 1 million mark. Activity swelled to 167% of the average daily volume, with 1,082,206 total contracts traded. Calls accounted for 58% of the day’s take.

The increased uncertainty drove implied volatility higher on the day, to 40%, placing it at the 88th percentile of its one-year range. Traders are pricing in daily moves of $4.46, or 2.5%.

Applied Materials (AMAT)

AMAT stock options were the most active compared to their average of any yesterday. The Santa Clara-based semiconductor supplier has struggled tremendously this year with its stock price falling as much as 50%. The response to its recent earnings release looks promising, however.

A pair of accumulation days have cropped up and AMAT is on the cusp of completing a rounded bottoming pattern by breaking above its 50-day moving average.

On the options trading front, traders came after calls with a vengeance. Activity ended the day at 333% of the average daily volume, with 122,066 total contracts traded. 61% of the trading came from call options.

AMAT’s implied volatility has been lively even after earnings. Amid increasing options demand it lifted yesterday to 49%, placing it at the 73rd percentile of its one-year range. Traders are now pricing in daily moves of $1.11, or 3.1%, so large moves should persist for a spell.

IBM (IBM)

IBM shares continued to struggle near their 52-week low. The stock was down 2.6% amid heavy volume as its recent bounce attempt finally failed.

The technicals for IBM stock continue to look terrible. It remains entrenched below falling moving averages across all time frames showing sellers hold full control.

On the options trading front, puts were all the rage yesterday. Activity ramped to 141% of the average daily volume, with 74,609 total contracts traded. Puts accounted for 81% of the total as the stock’s price slide renewed interest.

Implied volatility popped on the day to 30%, placing it at the 83rd percentile of its one-year range. Traders are pricing in daily moves of $2.24, or 1.9%.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. Want insightful education on how to trade? Check out his trading blog, Tales of a Technician.

More From InvestorPlace

The post Wednesday’s Vital Data: Apple, Applied Materials and IBM appeared first on InvestorPlace.