Wednesday’s Vital Data: Cisco Systems, Inc. (CSCO), Home Depot Inc (HD) and J C Penney Company Inc (JCP)

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

U.S. stock futures are trending broadly higher this morning, as Wall Street waits for the release of minutes from the July Federal Open Market Committee meeting. Geopolitical concerns appear to have settled down, and traders are once again turning to economic data for direction, and sentiment is setting a bullish mood.

Heading into open, Dow Jones Industrial Average futures have added 0.22%, Nasdaq-100 futures have risen 0.22% and S&P 500 futures have gained 0.2%.

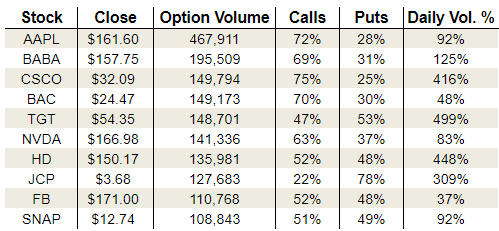

On the options front, volume remained below average, with about 13.1 million calls and 12.4 million puts crossing the tape. On the CBOE, single-session equity put/call volume ratio bounced to 0.68, while the 10-day moving average ticked higher to 0.75 once again.

Taking a closer look at Tuesday’s options activity, Cisco Systems, Inc. (NASDAQ:CSCO) has a hot hand with call options traders this week ahead of tonight’s quarterly report. Meanwhile, Home Depot Inc (NYSE:HD) drew mixed activity following yesterday’s quarterly report, and J C Penney Company Inc (NYSE:JCP) is still attracting heavy put options volume after last week’s abysmal report.

Cisco Systems, Inc. (CSCO)

Networking bellwether Cisco Systems steps onto the earnings stage after the close of trading this afternoon, and Wall Street is looking a profit of 61 cents per share on revenue of $12.06 billion. In the same quarter last year, Cisco earned 63 cents per share on revenue of $12.64 billion. The year-over-year declines are a result of Cisco’s restructuring toward cloud services to compete with several upstart companies in the networking space.

That said, there is plenty of optimism that Cisco is on the right path. EarningsWhispers.com puts the whisper number of 63 cents per share, above the consensus, and CSCO options traders are piling into calls. Volume yesterday rose to nearly 150,000 contracts, with calls gobbling up 75% of the day’s take.

What’s more, the August put/call open interest ratio has fallen to a reading of 0.67, as calls were added at a faster pace than puts in the past week. A closer look reveals that implieds aren’t pricing in much of a post-earnings move for CSCO stock — only about 3.8%, putting the upper bound at $33.22 and the lower bound at $30.78.

Home Depot Inc (HD)

By and large, Home Depot posted solid second-quarter earnings yesterday. The home improvement retailer said it earned $2.25 per share in the quarter, on revenue of $28.11 billion. Wall Street was expecting $2.21 per share on sales of $27.84 billion. In fact, Home Depot’s results on both the top and bottom line were record breaking.

However, fears of a slowdown in the housing market undermined the results, as well as concerns that Amazon.com, Inc. (NASDAQ:AMZN) is eating into Home Depot’s market share. As a result, HD stock dropped 2.65% on the news.

The mix of strong results and poor price action left options traders in the lurch. Volume bounced to 136,000 contracts, while calls only eked out 52% of the day’s take.

Furthermore, the lingering concerns following this report could eat into the largely bullish sentiment in the September options series. Currently, the September put/call OI ratio stands at a lowly 0.33, with calls tripling puts among back-month options. Peak call OI rests at the $155 strike, which is now trading out of the money, and we could see these traders roll their positions out and down for better returns.

J C Penney Company Inc (JCP)

J C Penney was hammered last week after the company posted a 9-cent second-quarter loss, more than doubling Wall Street’s expectations for a loss of 4 cents. Earnings were impacted by inventory liquidations after J C Penney closed 127 stores in the quarter. The struggling retailer did confirm its full-year guidance, but traders clearly have no faith in the projections, as JCP stock plunged more than 16% on the news, hitting a new 52-week low in the process.

Additionally, JCP options traders are continuing to place bearish bets in the wake of the report. Volume rose to more than 127,000 contracts, and has stayed at above-average levels since the earnings report. Puts dominate the landscape, claiming 78% of yesterday’s total volume. Furthermore, the September put/call open interest ratio rests at a lofty reading of 2.11, with puts more than doubling calls in the series.

This high level of put OI is highly unusual for a stock trading in the low single digits. Typically, dollar stocks see higher than average call volume because there is more potential upside to be had, as a stock can only fall so low. For JCP, this bearish options sentiment backdrop does not bode well for the stock.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Wednesday’s Vital Data: Cisco Systems, Inc. (CSCO), Home Depot Inc (HD) and J C Penney Company Inc (JCP) appeared first on InvestorPlace.