Weekly CEO Buys Highlight

- By Joy Hu

According to GuruFocus Insider Data, these were the largest CEO buys during the past week.

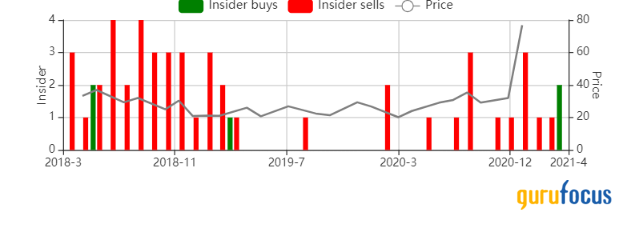

Editas Medicine

Editas Medicine Inc. (NASDAQ:EDIT) CEO James C. Mullen bought 25,000 shares on March 2 at a price of $46.27. The price of the stock has decreased by 10.03% since then.

Editas Medicine is a U.S.-based genome editing company. It is engaged in treating patients with genetically defined diseases by correcting disease-causing genes. The company focuses on developing a proprietary genome editing platform based on clustered, regularly interspaced short palindromic repeats (CRISPR)/ CRISPR-associated protein 9 (Cas9 technology).

The company has a market cap of $2.8 billion. Its shares traded at $41.63 as of March 5.

For the three months ended Dec. 31, 2020, the net loss was $62.5 million compared to $37.8 million for the same period in 2019.

Former CEO Cynthia Collins sold 1,262 shares on Feb. 9 at a price of $66.65. Since then, the price of the stock has decreased by 37.54%.

Director Jessica Hopfield bought 5,800 shares on March 3 at a price of $45.51. The price of the stock has decreased by 8.53% since then.

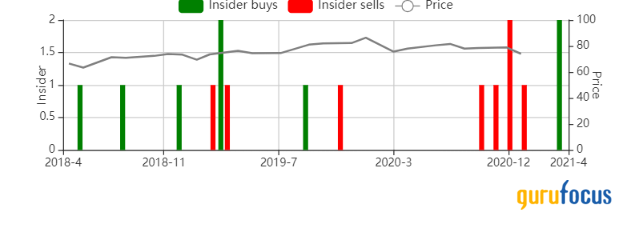

Dominion Energy

Dominion Energy Inc. (NYSE:D) President and CEO Robert M. Blue bought 14,402 shares on March 3 at a price of $69.44. Since then, the price of the stock has increased by 0.6%.

Based in Richmond, Virginia, Dominion Energy is an integrated energy company with approximately 30 gigawatts of electric generation capacity and more than 93,000 miles of electric transmission and distribution lines. In 2019, Dominion completed a liquefied natural gas export facility in Maryland and is now beginning a 5.2 GW wind farm 27 miles off the Virginia Beach coast. The wind farm would be the largest in the U.S.

The company has a market cap of $56.28 billion. Its shares traded at $69.86 as of March 5.

Net income for the fourth quarter of 2020 was $682 million compared with a net gain of $1.0 billion for the same period in 2019.

Director Mark J. Kington bought 2,000 shares on March 4 at a price of $69.29. The price of the stock has increased by 0.82% since then.

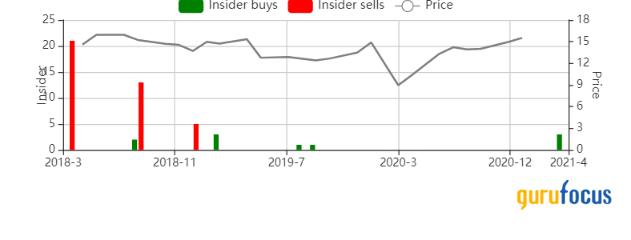

Evergy

Evergy Inc. (NYSE:EVRG) President and CEO David A. Campbell bought 10,000 shares on March 3 at a price of $52.92. Since then, the price of the stock has increased by 4.59%.

Evergy is a regulated electric utility serving eastern Kansas and western Missouri. Major operating subsidiaries include Evergy Metro, Evergy Kansas Central, Evergy Missouri West and Evergy Transmission Company. The utility has a combined rate base of approximately $15 billion, about half in Kansas and half split between Missouri and federal jurisdiction.

The company has a market cap of $12.56 billion. Its shares traded at $55.35 with a price-earnings ratio of 20.35 as of March 5.

Earnings for the fourth quarter of 2020 were $51 million compared with earnings of $64 million for the fourth quarter of 2019.

Executive Vice President and Chief Financial Officer Kirkland B. Andrews bought 10,000 shares on March 3 at a price of $53.48. The price of the stock has increased by 3.5% since then.

Former Executive Vice President and Principal Financial Officer Anthony D. Somma sold 32,423 shares on March 2 at a price of $53.51. Since then, the price of the stock has increased by 3.44%.

Primo Water

Primo Water Corp. (NYSE:PRMW) CEO Thomas Harrington bought 35,000 shares on March 1 at a price of $14.53. The price of the stock has increased by 5.09% since then.

Primo Water, formerly Cott, is a pure-play water provider that is the product of the March 2020 acquisition of the legacy Primo business by Cott. The firm's water solutions ecosystem is anchored by an assortment of water dispensers and its water direct business. Most sales are generated in North America, with the remainder primarily in Europe and Israel.

The company has a market cap of $2.45 billion. Its shares traded at $15.27 as of March 5.

Net loss was $20 million for the fourth quarter of 2020 compared to net income of $2 million in the prior-year quarter.

Director Gregory R. Monahan bought 15,280 shares on March 1 at a price of $14.48. Since then, the price of the stock has increased by 5.46%.

Director Eric Rosenfeld bought 212,720 shares on March 1 at a price of $14.48. The price of the stock has increased by 5.46% since then.

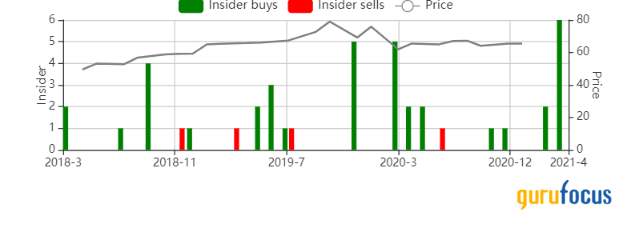

Agree Realty

Agree Realty Corp. (NYSE:ADC) President and CEO Joey Agree bought 7,870 shares on March 2 at a price of $63.61. Since then, the price of the stock has increased by 1.35%.

Agree Realty operates as a fully integrated real estate investment trust primarily focused on the ownership, acquisition, development and management of retail properties net leased to industry-leading tenants. Some of its properties in the portfolio include 24 Hour Fitness, 7-Eleven, Wawa and PetSmart.

The company has a market cap of $4.09 billion. Its shares traded at $64.47 with a price-earnings ratio of 37.05 as of March 5.

Net income for the three months ended Dec. 31, 2020 were $23.6 million compared to $22.6 million for the comparable period in 2019.

Chief Financial Officer, Executive Vice President and Secretary Simon Leopold bought 2,000 shares on March 2 at a price of $63.75. The price of the stock has increased by 1.13% since then.

Director John Rakolta Jr. bought 19,525 shares on Feb. 23 at a price of $63.63; 10,000 shares on March 2 at a price of $63.50; and 10,000 shares on March 3 at a price of $62.73. Since then, the price of the stock has increased by 2.77%.

Chief Operating Officer Craig Erlich bought 2,000 shares on March 3 at a price of $63.74. The price of the stock has increased by 1.15% since then.

Executive Chairman of the Board Richard Agree bought 10,000 shares on March 2 at a price of $63.77. Since then, the price of the stock has increased by 1.1%.

For the complete list of stocks bought by their company CEOs, go to: CEO Buys.

Disclosure: I do not own stock in any of the companies mentioned in the article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.