Weekly CEO Buys Highlight

According to GuruFocus Insider Data, these are the largest CEO buys during the past week.

Encompass Health

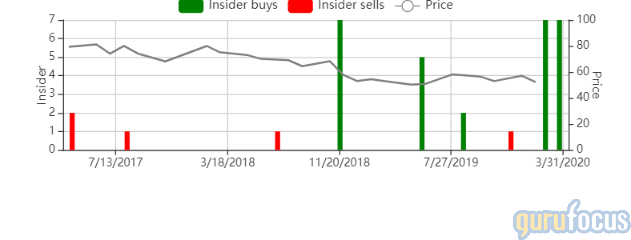

Encompass Health Corp. (NYSE:EHC) CEO and President of Home Health April Kaye Bullock Anthony bought 165,000 shares during the past week at the average price of $60.04.

Encompass Health provides post-acute healthcare services in the United States through a network of inpatient rehabilitation hospitals, home health agencies and hospice agencies. It operates in two segments: inpatient rehabilitation and home health and hospice. The inpatient rehabilitation segment contributes the majority of the firm's revenue and provides specialized rehabilitative treatment through a network of inpatient hospitals. These hospitals are concentrated in the eastern half of the United States and Texas. The home health and hospital segment provides skilled home health services through agencies concentrated in the southeastern United States and Texas.

The company has a market cap of $6.29 billion. Its shares traded at $63.91 with a price-earnings ratio of 17.71 as of March 13. Net income was $67.6 million for the fourth quarter of 2019 compared to $28.1 million for the prior-year quarter.

Anthony bought 40,000 shares on March 11 at a price of $64.24 and 125,000 shares on March 12 at a price of $58.69. The price of the stock has increased by 8.89% since then.

Director Leo I. Higdon Jr. bought 1,000 shares on March 11 at a price of $64.07. Since then, the price of the stock has decreased by 0.25%.

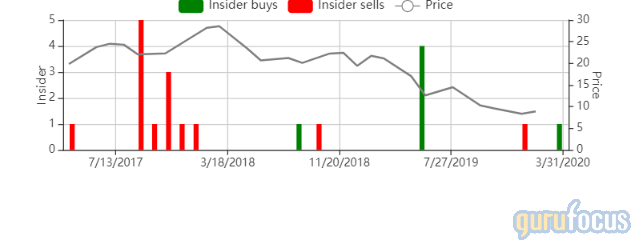

Bunge

Bunge Ltd. (NYSE:BG) CEO Gregory A. Heckman bought 120,000 shares on March 11 at a price of $39.85. The price of the stock has decreased by 3.24% since then.

Founded in 1818, Bunge is a global agribusiness and food company with operations along the farm-to-consumer food chain. The company is a leading oilseed processor and seller of packaged vegetable oils and other food and ingredients products. Bunge also grows and processes Brazilian sugarcane to produce sugar and ethanol.

The company has a market cap of $5.47 billion. Its shares traded at $38.56 as of March 13. Net loss for the fourth quarter of 2019 was $51 million compared to a loss of $65 million for the prior-year period.

Heckman also bought 37,180 shares on Feb. 21 at a price of $53.76. Since then, the price of the stock has decreased by 28.27%.

Executive Vice President and Chief Financial Officer John W. Neppl bought 10,000 shares on Feb. 20 at a price of $53.85; 2,500 shares on Feb. 28 at a price of $46.63; and 5,000 shares on March 13 at a price of $36.55. The price of the stock has increased by 5.5% since then.

Director Henry Ward Winship IV bought 11,000 shares on March 12 at a price of $37.26. Since then, the price of the stock has increased by 3.49%.

Director Sheila Colleen Bair bought 500 shares on March 12 at a price of $37.28. The price of the stock has increased by 3.43% since then.

Controller and Principal Acting Officer Jerry Matthews Simmons Jr. bought 500 shares on March 12 at a price of $36.43. Since then, the price of the stock has increased by 5.85%.

Director Erik J. Fyrwald bought 12,500 shares on March 11 at a price of $39.82. The price of the stock has decreased by 3.16% since then.

President of Global Risk Management Brian Zachman bought 12,500 shares on March 10 at a price of $42.87. Since then, the price of the stock has decreased by 10.05%.

Qurate Retail

Qurate Retail Inc. (NASDAQ:QRTEA) President and CEO Michael A. George bought 550,000 shares on March 6 at a price of $5.44. The price of the stock has decreased by 17.46% since then.

Through its subsidiaries, Qurate Retail engages in the video and online commerce industries in North America, Europe, and Asia. The company markets and sells various consumer products primarily through live video programs, Websites and mobile applications. It also operates as an online retailer offering women's, children's and men's apparel, as well as other products, under the name Zulily.

The company has a market cap of $1.86 billion. Its shares traded at $4.49 as of March 13. Net income for the fourth quarter of 2019 was $141 million compared to $273 million for the prior-year quarter.

American Assets Trust

American Assets Trust Inc. (NYSE:AAT) Chairman, CEO, President and 10% Owner Ernest S. Rady bought 74,223 shares during the past week at the average price of $37.51.

American Assets Trust is a self-administered real estate investment trust based in the United States. The company invests in, operates and develops retail, office, residential and mixed-use properties. Its properties are primarily located in South California, Northern California, Oregon, Washington and Hawaii.

The company has a market cap of $2.02 billion. Its shares traded at $33.67 with a price-earnings ratio of 39.85 as of March 13. Net income was $12.8 million for the three months ended Dec. 31, 2019 compared to $6.7 million for the three months ended Dec. 31, 2018.

Rady bought 33,313 shares on Feb. 28 at a price of $42.77; 29,130 shares on March 6 at a price of $42.06; 25,093 shares on March 11 at a price of $37.13; and 20,000 shares on March 12 at a price of $31.35. Since then, the price of the stock has increased by 7.4%.

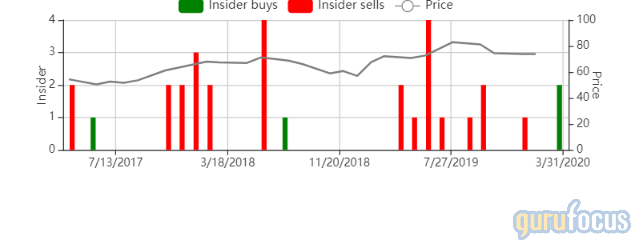

Hexcel

Hexcel Corp. (NYSE:HXL) Chairman, CEO and President Nick L. Stanage bought 40,000 shares during the past week at the average price of $50.56.

Hexcel develops and manufactures composites used in aerospace, defense and other industrial markets. The company operates under two segments: Composite Materials and Engineered Products. It offers a wide range of adhesives, carbon fibers and other structured materials to use in commercial and military aircraft, wind turbines, vehicles and other industrial applications.

The company has a market cap of $4.23 billion. Its shares traded at $50.72 with a price-earnings ratio of 14.21 as of March 13. Net income was $73.2 million for the quarter ended Dec. 31, 2019 compared to $66.1 million for the prior-year quarter.

Stanage bought 20,000 shares on March 9 at a price of $55.96 and 20,000 shares on March 12 at a price of $45.15. The price of the stock has increased by 12.34% since then.

For the complete list of stocks bought by their company CEOs, go to: CEO Buys.

Disclosure: I do not own stock in any of the companies mentioned in the article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.