Weekly CEO Buys Highlight

According to GuruFocus Insider Data, these are the largest CEO buys during the past week.

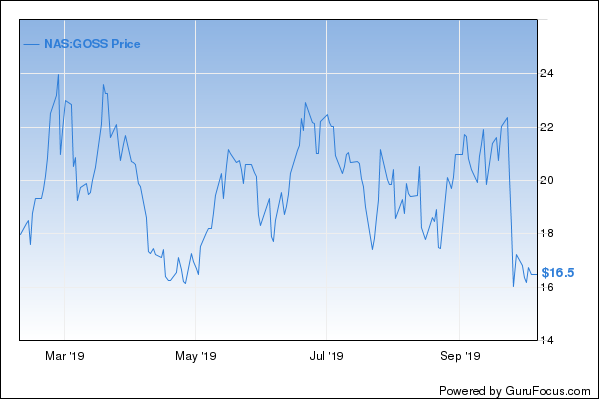

Gossamer Bio CEO bought 10,000 shares

Gossamer Bio Inc. (NASDAQ:GOSS) President and CEO Sheila Gujrathi bought 10,000 shares on Sept. 27 at a price of $16.80. The price of the stock has decreased by 2.02% since.

Gossamer Bio is a clinical-stage biopharmaceutical company focused on discovering, acquiring, developing and commercializing therapeutics in the disease areas of immunology, inflammation and oncology. The company has a market cap of $1.05 billion. Its shares traded at $16.46 as of Oct. 4.

Net loss for the second quarter of 2019 was $44.5 million.

Chief Financial Officer Bryan Giraudo bought 1,121 shares on Sept. 26 at a price of $16.78. The price of the stock has decreased by 1.91% since.

Executive Vice President and General Counsel Christian Waage bought 1,000 shares on Sept. 27 at a price of $16.65. The price of the stock has decreased by 1.14% since.

Director Faheem Hasnain bought 10,000 shares on Sept. 27 at a price of $16.80. The price of the stock has decreased by 2.02% since.

Ten-percent Owner Omega Fund V GP LP sold 112,776 shares on Sept. 11 at a price of $21.22; 82,213 shares on Sept. 18 at a price of $21.75; and 183,607 shares on Sept. 20 at a price of $21.96. The price of the stock has decreased by 25.05% since.

Heron Therapeutics CEO bought 4,571 shares

Heron Therapeutics Inc. (NASDAQ:HRTX) CEO Barry D. Quart bought 4,571 shares on Oct. 3 at a price of $17.50. The price of the stock has decreased by 0.46% since.

Heron Therapeutics is a biotechnology company developing products to address unmet medical needs. It is developing novel, patient-focused solutions that apply its science and technologies to already-approved pharmacological agents. The company has a market cap of $1.34 billion. Its shares traded at $17.42 as of Oct. 4.

Heron's net loss for the three months ended June 30, 2019 was $50.2 million compared to $38.7 million for the same period in 2018.

Executive Vice President and Chief Commercial Officer John Poyhonen bought 5,143 shares on Oct. 3 at a price of $17.50. The price of the stock has decreased by 0.46% since.

Athenex CEO bought 3,000 shares

Athenex Inc. (NASDAQ:ATNX) CEO, Chairman of the Board, and 10% Owner Johnson Yiu Nam Lau bought 3,000 shares on Sept. 27 at a price of $12.85. The price of the stock has decreased by 5.21% since then.

The biopharmaceutical company is dedicated to the discovery, development and commercialization of novel therapies for the treatment of cancer. Its mission is to improve the lives of cancer patients by creating more effective, safer and tolerable treatments. The company has organized its business model into three segments: Oncology Innovation Platform, Commercial Platform and Global Supply Chain Platform, with operations in both the U.S. and China. The company has a market cap of $940.67 million. Its shares traded at $12.18 as of Oct. 4.

Net loss for the three months ending June 30 was $32 million compared to a net loss of $36.9 million in the same period last year.

Lau also bought 5,000 shares on Sept. 16 at a price of $13.57 and 5,000 shares on Sept. 23 at a price of $13.86. Since then, the price of the stock has decreased by 12.12%.

Chief Financial Officer Randoll Sze bought 1,000 shares on Sept. 30 at a price of $12.62. The price of the stock has decreased by 3.49% since then.

Perceptive Life Sciences Master Fund, which is a 10% owner of the stock, bought 70,000 shares on Sept. 13 for an average price of $14.23 and 30,000 shares on Sept. 16 for $13.58. Since then, the stock has decreased by 10.31%.

For the complete list of stocks bought by their company CEOs, go to: CEO Buys.

Disclosure: I do not own stock in any of the companies mentioned in the article.

Read more here:

52-Week Company Lows

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.