Is Wells Fargo Stock a Good Value Right Now?

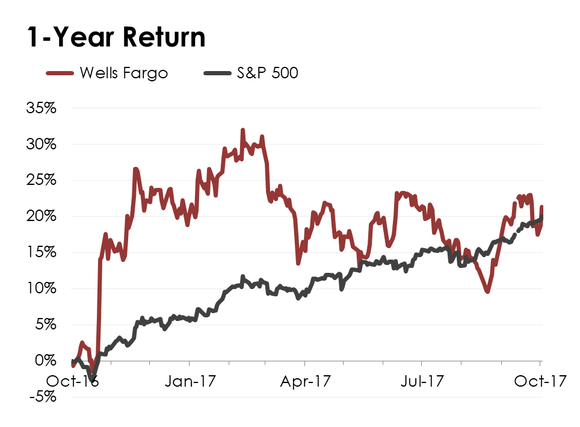

Over the past year, shares of Wells Fargo (NYSE: WFC) have climbed 19%. That may seem like a lot until you consider that the KBW Bank Index is up 38% over the same stretch.

Given this lagging performance, it's reasonable for investors to ask: Is Wells Fargo stock a good value right now?

Banners hanging outside a Wells Fargo branch. Image source: Getty Images.

Wells Fargo's price-to-book value ratio

The usual way to think about a bank stock's valuation is to use the price-to-book value ratio. This is calculated by dividing a bank's price per share by its book value per share. The quotient tells you how much investors think a bank is worth relative to how much the bank says its worth on its balance sheet.

Banks with price-to-book value ratios greater than 1.0 are said to trade for a premium to book value. The implication is that investors think the banks will create value beyond their current net worth.

Conversely, banks with price-to-book value ratios less than 1.0 are said to trade at a discount to book value, which implies that investors expect the value to erode -- as a consequence of loan losses, for instance.

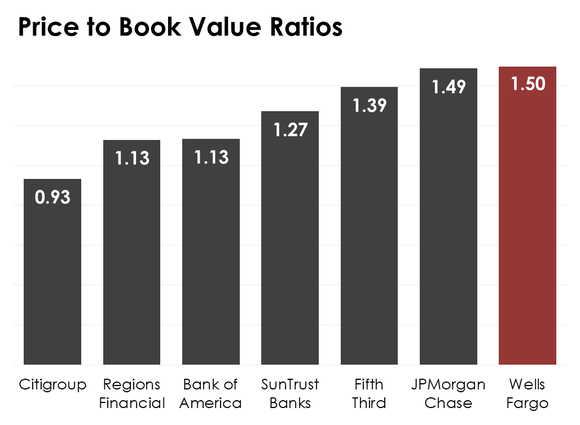

Data source: YCharts.com. Chart by author.

Wells Fargo's stock trades for 1.50 times its book value per share. That equates to a 50% premium.

This suggests that Wells Fargo is reasonably priced. The average bank stock on the KBW Bank Index is valued at 1.41 times its book value. That's less than Wells Fargo, but the California-based bank has proven over the years to be able to generate higher profitability than the industry average, which justifies a higher valuation.

One could thus be excused for concluding that Wells Fargo's stock seems reasonably priced, neither excessively low nor high.

Data source: YCharts.com. Chart by author.

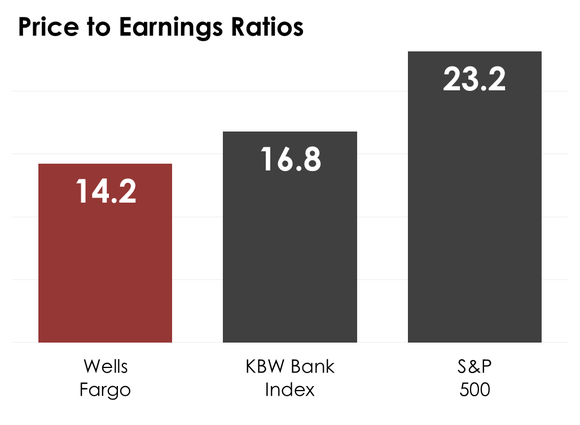

Wells Fargo's price-to-earnings ratio

A second way to measure the valuation of bank stocks is to use the price-to-earnings ratio, or P/E ratio. You calculate this by dividing a bank's share price by its earnings per share.

The result shows how much it costs an investor to buy $1 worth of a company's earnings. If the P/E ratio is 22, then it costs $22. If the ratio is 4, it costs $4.

There's no golden rule for what constitutes a good P/E ratio for a bank stock. That said, you can compare a bank's P/E ratio to other stocks, both within the bank industry and outside of it -- a key benefit of the P/E ratio over the price-to-book value ratio.

*The median was used for the KBW Bank Index and the S&P 500. Data source: YCharts.com, The Wall Street Journal. Chart by author.

In Wells Fargo's case, its stock trades for 14.2 times its earnings. That compares to a median PE ratio on the KBW Bank Index of 16.8 and a median ratio on the S&P 500 of 23.2.

By both measures, then, Wells Fargo's stock seems reasonably, if not modestly, priced.

An important caveat

Just because Wells Fargo's stock trades at a lower valuation than the typical bank stock in terms of its price-to-earnings ratio doesn't mean that its share price won't fall in the future, even by a large margin, because it can.

This seems particularly relevant right now, in light of the multiyear bull market in stocks since the financial crisis. But holding all else equal, if you're going to buy a bank stock in this environment, it doesn't hurt to buy one that's reasonably priced -- such as Wells Fargo.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

John Maxfield owns shares of Wells Fargo. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.