Wells Fargo's (WFC) Q3 Earnings Beat on Growth in Revenues

Wells Fargo’s WFC third-quarter 2021 earnings of $1.17 per share surpassed the Zacks Consensus Estimate of 1.03. Also, the bottom line improved 67% year over year.

Results included the impact of a $1.7-billion decline in allowance for credit losses backed by an improving economic environment and lower net charge-offs, offset by a $250-million impact of an operating loss related to the September 2021 Office of the Comptroller of the Currency (OCC) enforcement action.

Improved investment advisory and other asset-based fees, aided by higher market valuations as well as lower costs, supported the bank. Yet, reduced net interest income owing to low yields on earning assets and lower loans affected the results.

For the third quarter, net income applicable to common stock came in at around $4.8 billion, up 65% from the prior-year period.

Total quarterly revenues were $18.8 billion, outpacing the Zacks Consensus Estimate of $18.4 billion. However, the top line was 2% lower than the year-ago quarter.

Net Interest Income Down on Lower Loans, Costs Fall

Wells Fargo’s net interest income for the third quarter came in at $8.9 billion, down 5% year over year due to low yields on earning assets and lower loan balances, partially offset by reduced mortgage-backed securities premium amortization. Also, net interest margin (on a taxable-equivalent basis) shrunk 10 basis points to 2.13%.

Non-interest income at Wells Fargo came in at $9.9 billion, marginally down year over year. Higher card, deposit-related and investment banking fees, investment advisory, and other asset-based fees were partially offset by lower mortgage banking revenues, fall in gains on the sale of securities along with reduced Markets revenues in Corporate and Investment Banking.

As of Sep 30, 2021, average loans were $854 billion, marginally down sequentially. Average deposits came in at $1.45 trillion, up 1% from the prior quarter.

Non-interest expense was $13.3 billion for the third quarter, down 13% year over year. Lower operating losses, restructuring charges, occupancy expenses, salaries expense, and consultant and contractor spend were partly muted by higher incentive and revenue-related compensations.

The company’s efficiency ratio of 71% was below 79% recorded in the year-ago quarter. A fall in efficiency ratio indicates a rise in profitability.

Credit Quality Improves

Wells Fargo’s credit quality metrics were robust during the September-end quarter. The provision for credit losses was a benefit of $1.4 billion as of Sep 30, 2021 against an expense of $769 million in the prior-year quarter. Non-performing assets decreased to $7.2 billion for the third quarter from $8.2 billion reported in the year-earlier period.

Net charge-offs were $257 million or 0.12% of average loans for the reported quarter, down 65% from $731 million (0.29%) a year ago. Provision for credit losses was a net benefit of around $1.4 billion against a provision of $769 million reported in the year-ago quarter.

Healthy Capital Position

Wells Fargo maintained a sturdy capital position. Its Tier 1 common equity under Basel III (fully phased-in) increased to $141.6 billion from $134.9 billion witnessed in the prior-year quarter. The Tier 1 common equity to total risk-weighted assets ratio was estimated at 11.6 % under Basel III (fully phased-in) as of Sep 30, 2021, up from 11.4% in the corresponding period of 2020.

Return on assets was 1.04%, up from the prior-year quarter’s 0.66%. Return on equity was 11.1%, comparing favorably with the year-ago quarter’s 7.2%.

Capital Deployment Activities

Wells Fargo repurchased 114.2 million shares or $5.3 billion in the third quarter and increased the common stock dividend to 20 cents per share from 10 cents in the prior quarter.

Our Viewpoint

Legal hassles for Wells Fargo escalated in early September when OCC assessed a $250-million civil money penalty on the company on grounds of “unsafe or unsound practices” related to the home-lending loss mitigation program. In addition to the hefty fine, the banking giant has been slapped with an enforcement action, limiting it from acquiring certain third-party residential mortgage servicing. This might affect mortgage revenues for the company in the upcoming period.

Nonetheless, improving credit quality and strong capital deployment activities are encouraging.

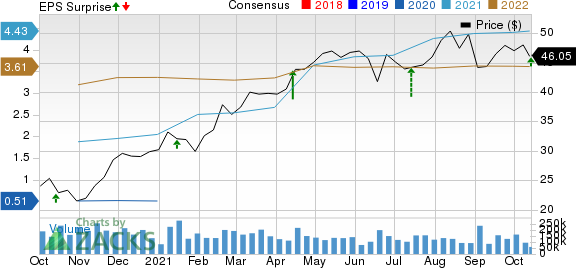

Wells Fargo & Company Price, Consensus and EPS Surprise

Wells Fargo & Company price-consensus-eps-surprise-chart | Wells Fargo & Company Quote

Currently, Wells Fargo carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Date of Other Companies

KeyCorp KEY and BankUnited, Inc. BKU are scheduled to release quarterly numbers on Oct 21, while Fifth Third Bancorp FITB will report on Oct 19.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

Fifth Third Bancorp (FITB) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

BankUnited, Inc. (BKU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research