Wendy's (WEN) Bets on Solid Breakfast Business Amid High Costs

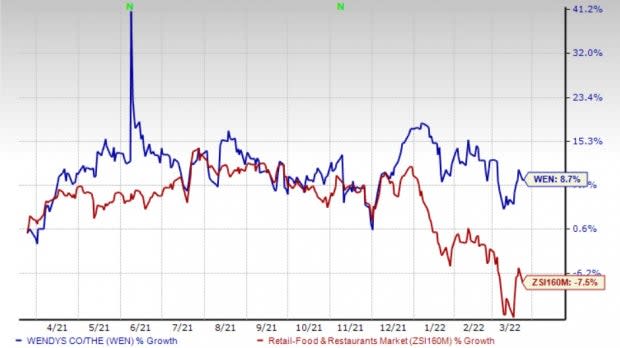

The Wendy's Company WEN is benefiting from robust demand for breakfast business, comps growth and international expansion. Consequently, the company’s shares have gained 8.7% in the past year, against the industry’s decline of 7.5%. However, high labor rates and commodity costs remain a concern. Let’s delve deeper.

Catalysts Driving Growth

Wendy’s continues to focus on Breakfast daypart Offerings to drive incremental sales. In the fourth quarter of 2021, robust breakfast performance continued, which accounted for 8.5% of sales, primarily stemming from morning meal traffic share gains within the QSR burger category. The company has been benefiting from its marketing efforts, high-quality offerings, repeat ordering and high customer satisfaction levels. In 2021, the company’s breakfast business increased by 25%. The company anticipates the breakfast business in the United States to accelerate in 2022 by roughly 10% to 20%. By the end of 2022, the company anticipates average weekly U.S. breakfast sales to be roughly $3,000 to $3,500 per restaurant.

The company is focusing on international expansion. Despite the pandemic, Wendy’s opened approximately 150 restaurants in 2020. In 2021, it opened more than 200 restaurants globally, withstanding a very challenging supply chain environment. In June 2021, the company opened its first restaurant in the U.K. Since the second quarter of 2021, it has opened several restaurants in the U.K. In 2021, the company also inaugurated its 1,000th international location. Given the solid development foundation, the company anticipates opening 8,500-9,000 global restaurants by 2025 end.

During fiscal second quarter 2021, the company announced a development commitment by REEF to open and operate 700 delivery kitchens (over the next five years) across the United States, Canada and the U.K.

The company continues to impress investors with robust global same-restaurant sales growth. During the fiscal third and fourth quarter, comps at Global restaurants increased 3.3% and 7.3%, respectively, year over year. The improvement was driven by continued strength across its U.S. and international businesses. During the quarter, comps in the United States witnessed growth of 6.1% year over year. The upside was backed by growth in breakfast and digital businesses. Same-restaurant sales at International restaurants (excluding Venezuela and Argentina) rose 18.1% year over year. For 2022, the company now anticipates global system-wide sales growth to be 6-8%.

Image Source: Zacks Investment Research

Concerns

High costs are likely to hurt the company’s performance. During the fiscal third quarter, the company-operated restaurant margin came in at 14.5% compared with 17.6% in the year-ago quarter. The downside was primarily due to higher labor rate, increase in commodity costs, a decline in traffic, and lower advertising spending in the prior-year quarter. General and administrative expenses in the quarter were $64.3 million, compared with $59.3 million in the prior-year quarter. This was primarily on account of higher incentive compensation, and stock compensation accrual and technology costs (related to the company's ERP implementation).

Wendy’s currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key picks

Some better-ranked stocks in the Zacks Retail-Wholesale sector include Genesco Inc. GCO, Arcos Dorados Holdings Inc. ARCO and Tapestry, Inc. TPR.

Genesco sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 2,739.6%, on average. Shares of the company have gained 62.1% in the past year.

The Zacks Consensus Estimate for Genesco’s 2022 sales and EPS suggests growth of 35.5% and 677.1%, respectively, from the year-ago period’s levels.

Arcos Dorados carries a Zacks Rank #2 (Buy). ARCO has a long-term earnings growth of 24.7%. Shares of the company have surged 54.5% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2022 sales and EPS suggests growth of 35% and 120.8%, respectively, from the year-ago period’s levels.

Tapestry carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 28.2%, on average. Shares of the company have declined 6.1% in the past year.

The Zacks Consensus Estimate for Tapestry’s 2022 sales and EPS suggests growth of 17.5% and 22.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Wendy's Company (WEN) : Free Stock Analysis Report

Genesco Inc. (GCO) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research