Were Hedge Funds Right About Flocking Into Arch Capital Group Ltd. (ACGL) ?

The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing more than 730 13F filings submitted by hedge funds and prominent investors. These filings show these funds' portfolio positions as of June 28th, 2019. What do these smart investors think about Arch Capital Group Ltd. (NASDAQ:ACGL)?

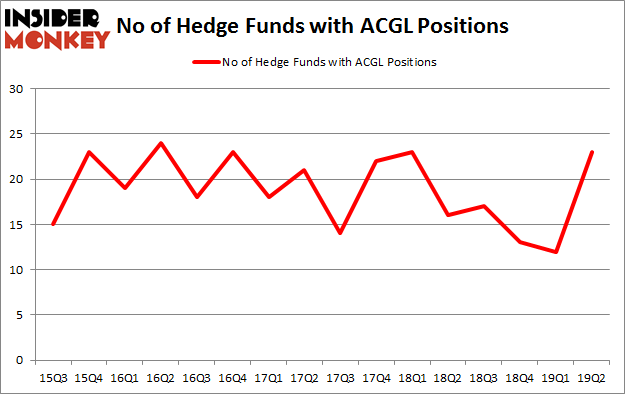

Arch Capital Group Ltd. (NASDAQ:ACGL) shareholders have witnessed an increase in support from the world's most elite money managers in recent months. ACGL was in 23 hedge funds' portfolios at the end of the second quarter of 2019. There were 12 hedge funds in our database with ACGL holdings at the end of the previous quarter. Our calculations also showed that ACGL isn't among the 30 most popular stocks among hedge funds.

In the financial world there are a multitude of indicators shareholders employ to size up their holdings. A couple of the most under-the-radar indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best fund managers can outpace the market by a superb margin (see the details here).

[caption id="attachment_30621" align="aligncenter" width="487"]

Cliff Asness of AQR Capital Management[/caption]

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn't rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We're going to take a glance at the latest hedge fund action encompassing Arch Capital Group Ltd. (NASDAQ:ACGL).

Hedge fund activity in Arch Capital Group Ltd. (NASDAQ:ACGL)

At Q2's end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 92% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in ACGL a year ago. So, let's find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, FPR Partners was the largest shareholder of Arch Capital Group Ltd. (NASDAQ:ACGL), with a stake worth $610.2 million reported as of the end of March. Trailing FPR Partners was Polar Capital, which amassed a stake valued at $268.9 million. Renaissance Technologies, D E Shaw, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key hedge funds have been driving this bullishness. Gillson Capital, managed by Daniel Johnson, assembled the most valuable position in Arch Capital Group Ltd. (NASDAQ:ACGL). Gillson Capital had $9.7 million invested in the company at the end of the quarter. Daniel Lascano's Lomas Capital Management also initiated a $8.2 million position during the quarter. The following funds were also among the new ACGL investors: Steve Cohen's Point72 Asset Management, Sander Gerber's Hudson Bay Capital Management, and Michael Kharitonov and Jon David McAuliffe's Voleon Capital.

Let's go over hedge fund activity in other stocks similar to Arch Capital Group Ltd. (NASDAQ:ACGL). We will take a look at EXACT Sciences Corporation (NASDAQ:EXAS), Waters Corporation (NYSE:WAT), Regions Financial Corporation (NYSE:RF), and BioMarin Pharmaceutical Inc. (NASDAQ:BMRN). All of these stocks' market caps are closest to ACGL's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position EXAS,32,837125,-1 WAT,26,603252,-4 RF,32,700009,-9 BMRN,45,2076416,4 Average,33.75,1054201,-2.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.75 hedge funds with bullish positions and the average amount invested in these stocks was $1054 million. That figure was $1291 million in ACGL's case. BioMarin Pharmaceutical Inc. (NASDAQ:BMRN) is the most popular stock in this table. On the other hand Waters Corporation (NYSE:WAT) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Arch Capital Group Ltd. (NASDAQ:ACGL) is even less popular than WAT. Hedge funds clearly dropped the ball on ACGL as the stock delivered strong returns, though hedge funds' consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks (view the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on ACGL as the stock returned 13.2% during the third quarter and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

Florida Millionaire Predicts 'Cash Panic' In 2019