Were Hedge Funds Right About Flocking Into The Ensign Group, Inc. (ENSG) ?

Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 due to various reasons. Nevertheless, the data show elite investors' consensus picks have done well on average over the long-term. The top 15 S&P 500 stocks among hedge funds at the end of September 2018 returned an average of 1% through March 15th whereas the S&P 500 Index ETF lost 2.2% during the same period. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at The Ensign Group, Inc. (NASDAQ:ENSG) from the perspective of those elite funds.

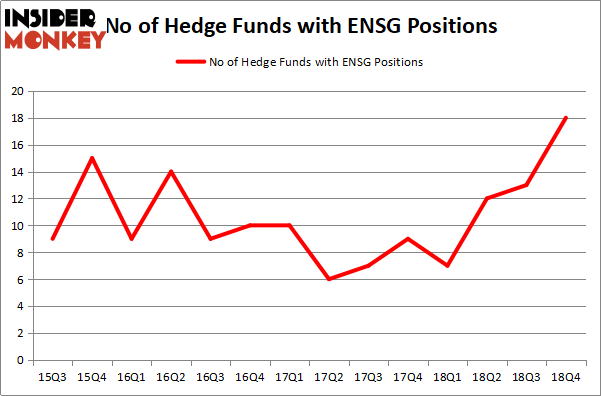

The Ensign Group, Inc. (NASDAQ:ENSG) was in 18 hedge funds' portfolios at the end of the fourth quarter of 2018. ENSG has experienced an increase in enthusiasm from smart money lately. There were 13 hedge funds in our database with ENSG holdings at the end of the previous quarter. Our calculations also showed that ENSG isn't among the 30 most popular stocks among hedge funds.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let's take a peek at the recent hedge fund action surrounding The Ensign Group, Inc. (NASDAQ:ENSG).

How have hedgies been trading The Ensign Group, Inc. (NASDAQ:ENSG)?

At Q4's end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ENSG over the last 14 quarters. With hedge funds' positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in The Ensign Group, Inc. (NASDAQ:ENSG) was held by Winton Capital Management, which reported holding $19.1 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $8.1 million position. Other investors bullish on the company included AQR Capital Management, Millennium Management, and Royce & Associates.

As industrywide interest jumped, some big names have jumped into The Ensign Group, Inc. (NASDAQ:ENSG) headfirst. Renaissance Technologies, managed by Jim Simons, initiated the largest position in The Ensign Group, Inc. (NASDAQ:ENSG). Renaissance Technologies had $4.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace's Marshall Wace LLP also initiated a $2.5 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman's GLG Partners, Joel Greenblatt's Gotham Asset Management, and Benjamin A. Smith's Laurion Capital Management.

Let's also examine hedge fund activity in other stocks - not necessarily in the same industry as The Ensign Group, Inc. (NASDAQ:ENSG) but similarly valued. We will take a look at Chart Industries, Inc. (NASDAQ:GTLS), AppFolio Inc (NASDAQ:APPF), Heron Therapeutics Inc (NASDAQ:HRTX), and Glaukos Corporation (NYSE:GKOS). This group of stocks' market caps resemble ENSG's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position GTLS,15,264312,-3 APPF,14,171232,-5 HRTX,25,716009,-6 GKOS,11,49669,-3 Average,16.25,300306,-4.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $300 million. That figure was $63 million in ENSG's case. Heron Therapeutics Inc (NASDAQ:HRTX) is the most popular stock in this table. On the other hand Glaukos Corporation (NYSE:GKOS) is the least popular one with only 11 bullish hedge fund positions. The Ensign Group, Inc. (NASDAQ:ENSG) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on ENSG as the stock returned 25.7% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index