We're A Little Worried About Codebase Ventures's (CNSX:CODE) Cash Burn Rate

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Codebase Ventures (CNSX:CODE) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Codebase Ventures

Does Codebase Ventures Have A Long Cash Runway?

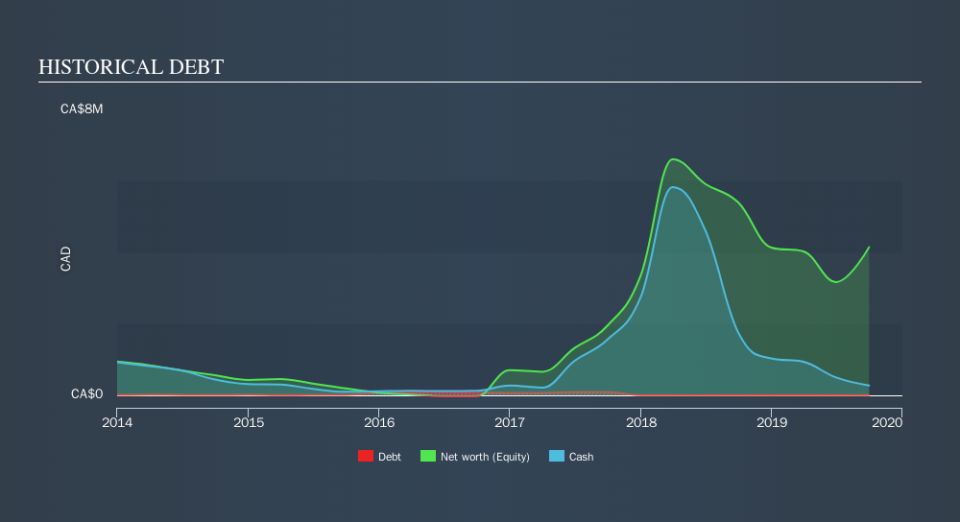

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In September 2019, Codebase Ventures had CA$273k in cash, and was debt-free. Looking at the last year, the company burnt through CA$3.0m. So it seems to us it had a cash runway of less than two months from September 2019. It's extremely surprising to us that the company has allowed its cash runway to get that short! Depicted below, you can see how its cash holdings have changed over time.

How Is Codebase Ventures's Cash Burn Changing Over Time?

Because Codebase Ventures isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. As it happens, the company's cash burn reduced by 13% over the last year, which suggests that management may be mindful of the risks of their depleting cash reserves. Codebase Ventures makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Codebase Ventures Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Codebase Ventures to raise more cash in the future. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of CA$7.9m, Codebase Ventures's CA$3.0m in cash burn equates to about 38% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

How Risky Is Codebase Ventures's Cash Burn Situation?

There are no prizes for guessing that we think Codebase Ventures's cash burn is a bit of a worry. Take, for example, its cash runway, which suggests the company may have difficulty funding itself, in the future. While not as bad as its cash runway, its cash burn reduction is also a concern, and considering everything mentioned above, we're struggling to find much to be optimistic about. Once we consider the metrics mentioned in this article together, we're left with very little confidence in the company's ability to manage its cash burn, and we think it will probably need more money. We think it's very important to consider the cash burn for loss making companies, but other considerations such as the amount the CEO is paid can also enhance your understanding of the business. You can click here to see what Codebase Ventures's CEO gets paid each year.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.