West Pharmaceutical (WST) Q2 Earnings & Revenues Top Estimates

West Pharmaceutical Services, Inc. WST reported second-quarter 2021 adjusted earnings per share (EPS) of $2.46, which beat the Zacks Consensus Estimate of $1.74 by 41.4%. The bottom line soared 96.8% year over year.

GAAP EPS in the quarter was $2.47, up 104% from the prior-year quarter.

Revenue Details

The company reported revenues of $723.6 million, which surged 37.3% from the prior-year quarter. The top line outpaced the Zacks Consensus Estimate by 8.7%.

It reported organic sales growth of 30.6%.

Segment Details

Proprietary Products

Net sales at the segment amounted to $587.3 million, reflecting year-over-year improvement of 47%. Organic sales growth came in at 39.3%. High-value products (components and devices) represented more than 70% of segment sales and delivered double-digit organic sales growth. Customer demand for FluroTec, Westar, Daikyo, NovaPure and Envision components led to the upside.

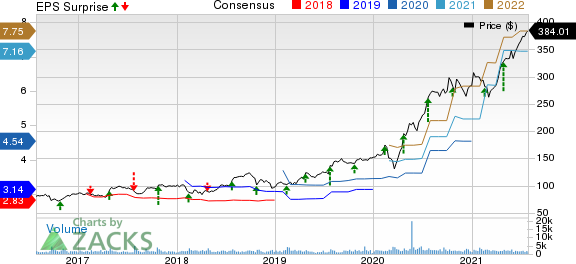

West Pharmaceutical Services, Inc. Price, Consensus and EPS Surprise

West Pharmaceutical Services, Inc. price-consensus-eps-surprise-chart | West Pharmaceutical Services, Inc. Quote

Contract-Manufactured Products

In the reported quarter, net sales improved 6.7% year over year to $136.4 million. The segment delivered organic sales growth of 3.2%. Sales of healthcare-associated injection and diagnostic devices contributed to the improvement.

Margins

Gross profit in the reported quarter was $315.1 million, up 61.5% year over year. As a percentage of revenues, gross margin in the quarter was 43.5%, up 650 basis points (bps).

Research and development expenses were $13.8 million, up 27.8% from the year-ago quarter. Selling, general and administrative expenses amounted to $92.7 million, up 19.3% on a year-over-year basis.

Operating income totaled $211.3 million, up 103.9% year over year. As a percentage of revenues, operating margin in the quarter was 29.2%, up 950 bps.

Financial Position

The company exited the second quarter with cash, cash equivalents and investments of $576.2 million, compared with $483.7 million in the previous quarter.

Cumulative operating cash flow in the second quarter totaled $233.1 million, compared with $205.2 million in the prior-year quarter.

Outlook

On the back of the solid second-quarter 2021 performance, the company raised its full-year 2021 guidance.

Net sales for full-year 2021 are projected between $2.76 billion and $2.79 billion (up from the prior range of $2.63-$2.65 billion). The Zacks Consensus Estimate for the same is currently pegged at $2.66 billion.

Organic sales growth is estimated to be 24-25% (up from the prior range of 19-20%).

Adjusted earnings per share for 2021 is anticipated in the band of $8.05 to $8.20 (up from the previous range of $6.95-$7.10 per share). The Zacks Consensus Estimate for the same is currently pegged at $7.16 per share. This range includes an expected benefit of around 27 cents (compared to prior anticipated benefit of 23 cents) based on present foreign currency exchange rates.

Wrapping Up

West Pharmaceutical exited second-quarter 2021 on a strong note, wherein both earnings and revenues beat the Zacks Consensus Estimate. The company witnessed strong performance across its segments. Expansion in both gross and operating margins in the reported quarter is encouraging. Given the strength exhibited in the first half of 2021, a raised outlook for the year buoys optimism.

Per management, sustained momentum in organic sales growth in both its base business along with higher demand for its products related to COVID-19 vaccines drove the second-quarter performance.

However, increase in selling, general and administrative expenses remained a concern.

Zacks Rank

West Pharmaceutical currently carries a Zacks Rank #2 (Buy).

Other Key Picks

Some other top-ranked stocks, which are expected to report earnings soon, are AMN Healthcare Services Inc. AMN, Catalent, Inc. CTLT and Change Healthcare Inc. CHNG, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for AMN Healthcare’s second-quarter 2021 adjusted EPS is currently pegged at $1.47. The consensus mark for second-quarter revenues stands at $829.4 million.

The Zacks Consensus Estimate for Catalent’s fourth-quarter fiscal 2021 adjusted EPS is currently pegged at $1.04. The consensus mark for fiscal fourth-quarter revenues stands at $1.13 billion.

The Zacks Consensus Estimate for Change Healthcare’s first-quarter fiscal 2022 adjusted EPS is currently pegged at 46 cents. The consensus mark for its revenues stands at $851.9 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Catalent, Inc. (CTLT) : Free Stock Analysis Report

Change Healthcare Inc. (CHNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research