WestRock (WRK) Gears Up for Q1 Earnings: What to Expect?

WestRock Company WRK is scheduled to report first-quarter fiscal 2023 results (ended Dec 31, 2022) on Feb 1, before the opening bell.

Q1 Estimates

The Zacks Consensus Estimate for fiscal first-quarter revenues is pegged at $5.098 billion, suggesting growth of 2.9% from the year-ago quarter's reported figure. The same for earnings per share is pegged at 60 cents, indicating a year-over-year decline of 7.7%. The Zacks Consensus Estimate for the company’s fiscal first-quarter earnings has moved down 6% in the past 30 days.

Q4 Performance

In the last reported quarter, WestRock delivered year-over-year improvements in both adjusted earnings per share and revenues. While revenues missed the Zacks Consensus Estimate, earnings beat the same. WRK’s earnings have surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an earnings surprise of 6%, on average.

WestRock Company Price and EPS Surprise

WestRock Company price-eps-surprise | WestRock Company Quote

Key Factors to Note

WestRock witnessed a slowdown in volumes in the corrugated packaging segment, as customers have been rebalancing their inventory and purchasing has been muted due to weak economic conditions. Also, four fewer shipping days compared to the fourth quarter of fiscal 2022 is expected to have impacted the company's performance in the quarter to be reported. WRK had also planned 150,000 tons of scheduled maintenance downtime across its system in the first quarter. This is expected to get reflected in the company’s top-line results in the first quarter of fiscal 2023.

WRK had provided consolidated adjusted EBITDA guidance of $625-$725 million for the fiscal first quarter, lower than the record fourth-quarter 2022 adjusted EBITDA actuals of $920 million. Adjusted earnings per share were projected at 45-74 cents for the first quarter of fiscal 2023, much lower than the adjusted earnings per share of $1.43 reported in the fourth quarter of fiscal 2022.

Wholesome costs were expected to have been favorable sequentially (natural gas and recycled fiber), higher freight, wage and chemicals costs are likely to have hurt its margins. Labor shortages and supply-chain issues have also been disrupting production and impacting WRK’s shipments to customers. Unfavorable non-cash pension expenses of approximately $40 million year over year due to higher interest rates and market volatility are also expected to have impacted its profits in the fiscal first quarter. Pricing actions and productivity initiatives undertaken by the company are expected to have negated some of these headwinds.

Segmental Projections

The Zacks Consensus Estimate for WRK’s Consumer Packaging segment’s quarterly revenues is pegged at $1,245 million, suggesting growth of 9% from the prior-year period's reported figure. The segment’s adjusted EBITDA is estimated to be $57 million.

For the Corrugated Packaging segment revenues, the Zacks Consensus Estimate is pinned at $2,253 million, calling for growth of 1% from the year-ago quarter's reported number. The segment’s adjusted EBITDA is projected at $48 million.

The revenue estimate for the Paper segment is pegged at $1,356 million and the same for the Distribution segment is pinned at $365 million.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for WestRock this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can see the complete list of today's Zacks #1 Rank stocks here.

Earnings ESP: The Earnings ESP for WestRock is -3.89%. You can uncover the best stocks before they're reported with our Earnings ESP Filter.

Zacks Rank: WRK currently carries a Zacks Rank of 3.

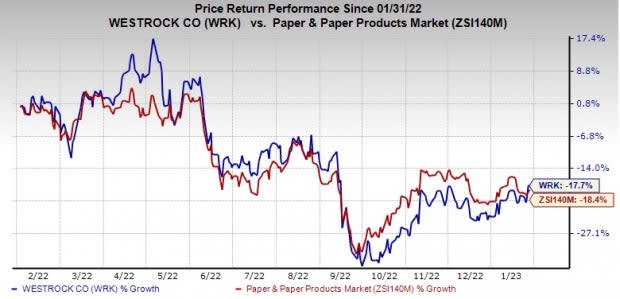

Share Price Performance

Image Source: Zacks Investment Research

WestRock’s shares have lost 17.7% over the past year compared with the industry’s 18.4% decline.

Stocks to Consider

Here are some Basic Materials stocks, which, according to, our model, have the right combination of elements to post an earnings beat in their upcoming releases.

Air Products and Chemicals APD, scheduled to release fourth-quarter 2022 earnings on Feb 2, has an Earnings ESP of +2.67% and currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Air Products’ fourth-quarter earnings has been revised 0.4% upward in the past 60 days. The consensus estimate for APD’s earnings for the fourth quarter is pegged at $2.73.

Teck Resources TECK, expected to release fourth-quarter earnings on Feb 23, has an Earnings ESP of +3.48%.

The Zacks Consensus Estimate for Teck’s fourth-quarter earnings is pegged at 94 cents. TECK currently carries a Zacks Rank of 2.

Albemarle ALB, scheduled to release fourth-quarter 2022 earnings on Feb 15, has an Earnings ESP of +7.16% and a Zacks Rank of 3.

The Zacks Consensus Estimate for ALB’s fourth-quarter earnings has moved north 3% in the past 60 days. The consensus mark is pegged at $7.89.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report