WeWork will be the 'most ridiculous IPO of 2019,' analyst says

WeWork is reportedly gearing up to go public under the ticker “WE” in September.

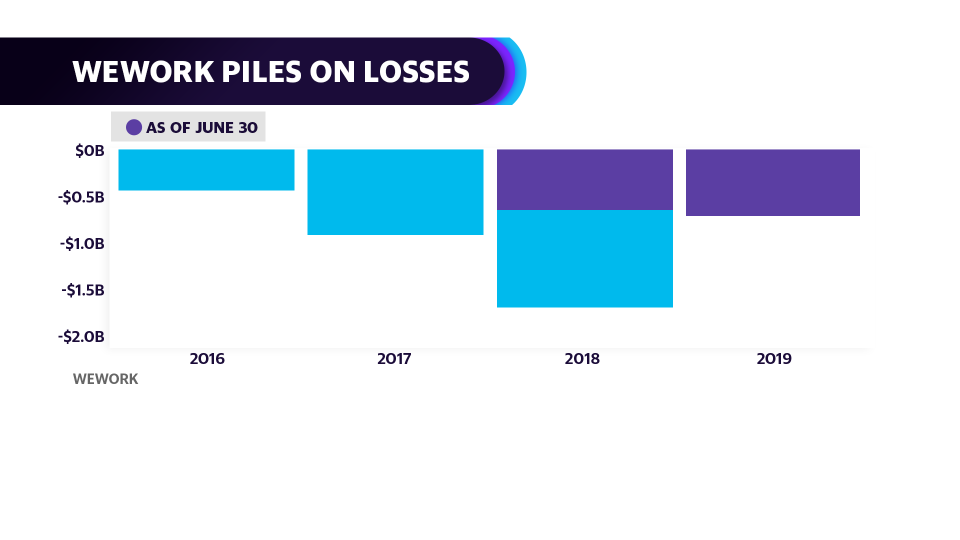

The co-working space startup revealed a $900 million loss in the first half of 2019 in its initial public offering filing earlier this month, up 25% from the year prior. The widening loss left some analysts bearish on the company, but Sam McBride of New Constructs Investment Analyst went as far as to call WeWork the “most ridiculous IPO of 2019” in his latest note.

WeWork is reportedly looking to raise $3.5 billion, which would make it the second-largest IPO of 2019 behind Uber (UBER). It also has a reported $47 billion valuation, which McBride contends it achieved by positioning itself as a tech company rather than a brick-and-mortar leasing business.

“This is a real estate leasing business that slapped a bunch of tech lingo on,” McBride told Yahoo Finance’s YFi AM on Friday.

The ‘same basic business model’ as IWG

WeWork was founded in 2010 in New York City to provide a co-working space for startups and freelancers, and it has expanded to 528 locations in 111 cities and 29 countries. It also has expanded into other businesses, including a co-working space called WeLive and a private school called WeGrow.

McBride says the idea behind the company’s main business is “nothing new.”

“IWG (IWG.L) is a European company, same basic business model, they take out long-term releases on properties, turn them around to lease them short-term to tenants, they have a $4 million market cap,” McBride told Yahoo Finance.

McBride attributes WeWork’s relatively high valuation to the fact that “they’ve taken on a bunch more risk.” IWG operates in 1,000 cities across the globe, while WeWork focuses on high-priced cities like New York, San Francisco, Los Angeles, Seattle, Washington D.C., Boston and London.

A‘lot of pressure’ in a recession

WeWork was founded after the Great Recession, so it has not had to weather an economic downturn — and McBride thinks WeWork only works during times of economic expansion.

WeWork is “trying to move more toward the high-end, toward the bigger enterprises since about 40% of their revenue is from their members that are bigger companies with over 500 employees,” McBride says.

While WeWork might argue that its corporate customers would consider its co-working spaces to be an inexpensive option during a downtown, McBride thinks that won’t be the case. As companies face economic headwinds, he noted, they typically lay off workers and reduce their office space.

READ MORE:

Cisco, Global Citizen announce multimillion-dollar partnership to help end poverty

How McDonald's is using technology to tell you what you want to eat

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.