What's in the Cards for Aimco (AIV) This Earnings Season?

Apartment Investment & Management Co. AIV — commonly known as Aimco — is slated to report third-quarter 2019 results on Oct 31, after the market closes. Its funds from operations (FFO) per share and revenues are expected to witness year-over-year declines.

In the last reported quarter, the Denver, CO-based residential real estate investment trust (REIT) delivered a negative surprise in terms of FFO per share. The company’s second-quarter 2019 performance was affected by revenues lost after the disposition of the Asset Management business.

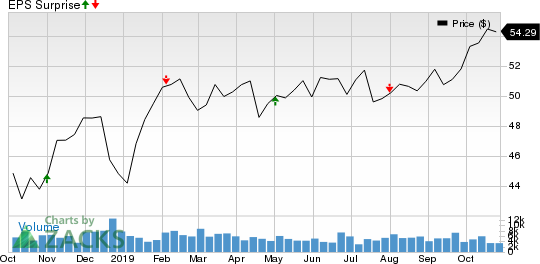

Aimco has a mixed earnings surprise history. Over the trailing four quarters, the company surpassed the Zacks Consensus Estimate on one occasion, reported in-line results once and missed on the other two. Its average positive surprise for the four quarters was 0.02%. This is depicted in the chart below:

Apartment Investment and Management Company Price and EPS Surprise

Apartment Investment and Management Company price-eps-surprise | Apartment Investment and Management Company Quote

Notably, the U.S. apartment market has put up an impressive performance in the past few months, banking on the stellar rental-unit demand. While occupancy is hovering at a near-record level, rents continue to register steady rise.

Per the latest report from real estate technology and analytics firm, RealPage, occupancy reached 96.3% as of third-quarter 2019, with impressive leasing activity. The figure is not only up from the prior-year period’s 95.9% but is also close to the all-time high of 96.4% attained in late 2000. The warmer months witness an uptick in apartment leasing activity. However, this year, the performance was robust as demand was particularly strong.

With an uptick in occupancy, rent growth also seems to be steady. For new leases, rents were up 1.2% during the third quarter, driving the annual rent growth pace to 3% and monthly rents averaging $1,416.

Amid these, Aimco is anticipated to benefit from its portfolio situated in key U.S. markets. Diversified, in terms of geography and price point, the company’s well-located assets are likely to experience healthy demand due to favorable demographics, household formation and job-market growth.

Moreover, the company has been making efforts to enhance portfolio and generate higher revenues. It aims at creating value by repositioning communities within its portfolio. Aimco has also been selling low-return properties and reinvesting the proceeds in measures like redevelopment and development, capital enhancements, and property acquisitions. The company is expected to continue reaping benefits from these efforts in the third quarter as well.

Nevertheless, the struggle to lure renters is likely to have continued in the third quarter as supply volumes were high in a number of the company’s markets. Particularly, new supply is competing with some of its higher rent properties. High supply curtails landlords’ ability to command more rent and result in lesser absorption. Such an environment is predicted to have resulted in aggressive rental concessions and moderate pricing power of landlords, thereby affecting the company’s top-line growth. Aimco’s results for the to-be-reported quarter are expected to reflect the dilutive impact of asset dispositions.

In fact, the Zacks Consensus Estimate for third-quarter revenues is pegged at $227.2 million, indicating a decline of 6.3% from the year-ago quarter’s reported figure.

Moreover, the company’s activities during the quarter were inadequate to gain analysts’ confidence. Consequently, the Zacks Consensus Estimate has been unchanged over the past 30 days at 63 cents. This indicates a 3.1% year-over-year decline. For the September-ended quarter, management projects pro-forma FFO per share of 60-64 cents.

Here is What Our Quantitative Model Predicts

Our proven model predicts a beat in terms of FFO per share for Aimco this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of a beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Aimco carries a Zacks Rank #3 and has an Earnings ESP of +0.60%.

Other Stocks That Warrant a Look

Here are a few other stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Stag Industrial, Inc STAG, scheduled to release earnings on Oct 30, has an Earnings ESP of +3.30% and currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Digital Realty Trust, Inc DLR, slated to report third-quarter results on Oct 29, currently has an Earnings ESP of +2.61% and a Zacks Rank of 3.

Simon Property Group, Inc SPG, set to release quarterly numbers on Oct 30, presently has an Earnings ESP of +0.28% and a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Apartment Investment and Management Company (AIV) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Stag Industrial, Inc. (STAG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research