What's in the Cards for Alexandria (ARE) in Q2 Earnings?

Alexandria Real Estate Equities Inc. ARE is scheduled to report second-quarter 2020 results on Jul 27, after market close. The company’s results are expected to reflect year-over-year growth in its funds from operations (FFO) per share.

This Pasadena, CA-based urban office real estate investment trust (REIT), which primarily focuses on collaborative life science and technology campuses, delivered first-quarter 2020 FFO as adjusted of $1.82 per share, up 6.4% from the year-ago quarter’s $1.71. The reported figure was in line with the Zacks Consensus Estimate.It witnessed the highest quarterly rental rate growth over the past 10 years.

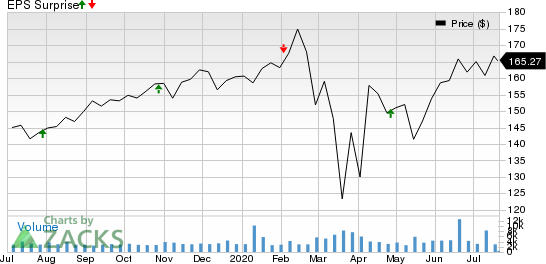

Over the trailing four quarters, the company met the Zacks Consensus Estimate on two occasions, surpassed in another and missed in the other, the average surprise being 0.01%. The graph below depicts this surprise history:

Alexandria Real Estate Equities, Inc. Price and EPS Surprise

Alexandria Real Estate Equities, Inc. price-eps-surprise | Alexandria Real Estate Equities, Inc. Quote

Let’s see how things have shaped up prior to this announcement.

Key Factors

Amid the increasing need for effective diagnostics, therapies and vaccines to combat the coronavirus pandemic, Alexandria’s properties and its tenants have become indispensable. While other REITs noted a shutdown of operations during the pandemic, the company continued its essential-natured business operations across its campuses during the second quarter.

Given the higher investments in pharmaceutical research and development, critical monetary support from the government and urgent hirings by its tenants, Alexandria’s lab-office assets are expected to have been in high demand during the second quarter.

Hence, it is likely to have enjoyed solid leasing activity, strong rental rate growth and occupancy for the quarter under review.

Moreover, the occupancy level in the company’s portfolio is anticipated to have been driven by elevated demand for its Class A properties in AAA locations. Ownership of such premium properties in strategic cluster locations is also expected to have driven rent growth during the second quarter.

Further, a significant part of the company’s revenues comes from investment-grade or publicly-traded large-cap tenants. Hence, even amid dislocations in the market, its rent collections during the second quarter are anticipated to have remained healthy.

These are likely to have aided revenue and net operating income growth for the company in the second quarter.

Prior to the second-quarter earnings release, the Zacks Consensus Estimate of FFO per share for the second quarter has been witnessing positive estimate revisions. Notably, second-quarter FFO per share estimate witnessed a 1.1% upward revision to $1.81 over the past 30 days, indicating bullish sentiments of analysts. Moreover, the revised estimate suggests year-over-year growth of 4.6%.

Here is what our quantitative model predicts:

Alexandria does not have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — for increasing the odds of a FFO beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Alexandria is 0.00%.

Zacks Rank: Alexandria currently carries a Zacks Rank of 2 (Buy).

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

First Industrial Realty Trust, Inc. FR, slated to release second-quarter earnings on Jul 22, has an Earnings ESP of +1.12% and a Zacks Rank of 2 at present.

Host Hotels & Resorts, Inc. HST, set to report quarterly numbers on Jul 30, currently has an Earnings ESP of +17% and a Zacks Rank of 3.

Iron Mountain Incorporated IRM, slated to release second-quarter earnings on Aug 6, has an Earnings ESP of +1.19% and a Zacks Rank of 3 at present.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gau0ge the performance of REITs.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

First Industrial Realty Trust, Inc. (FR) : Free Stock Analysis Report

Host Hotels Resorts, Inc. (HST) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research