What's in the Cards for Ares Capital (ARCC) in Q1 Earnings?

Ares Capital Corporation ARCC is scheduled to announce first-quarter 2020 results on May 5, before market open. While its revenues are likely to have improved in the quarter on a year-over-year basis, earnings are expected to have witnessed a decline.

In the last reported quarter, the company’s earnings were in line with the Zacks Consensus Estimate. Results reflected improvement in total investment income and decent portfolio activity. However, higher expenses hurt results to some extent.

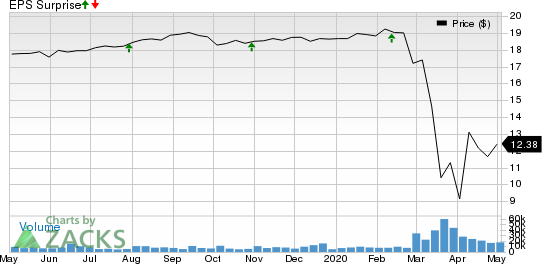

Ares Capital has an impressive earnings surprise history. The company’s earnings have surpassed the Zacks Consensus Estimate in three and met in one of the trailing four quarters, the average beat being 6.9%.

Ares Capital Corporation Price and EPS Surprise

Ares Capital Corporation price-eps-surprise | Ares Capital Corporation Quote

However, the Zacks Consensus Estimate for its earnings of 43 cents for the to-be-reported quarter has been unchanged over the past seven days. The figure indicates a decline of 8.5% from the year-ago quarter’s reported number.

The consensus estimate for sales of $381.8 million for the first quarter suggests 2.4% growth on a year-over-year basis.

Key Estimates for Q1

The Zacks Consensus Estimate for interest income from investments (constituting a significant portion of the company’s total investment income) is pegged at $305 million, indicating a 3% rise from the prior quarter’s reported figure.

The consensus estimate for capital structuring service fees is pegged at $37.52 million, suggesting a 1.3% sequential decline. Moreover, the Zacks Consensus Estimate for dividend income of $41.08 million indicates a decline of 6.6% on a sequential basis.

The consensus estimate for other income is pegged at $8.88 million, suggesting an 11% improvement from the prior quarter’s reported figure.

Ares Capital has been witnessing higher expenses over the past several quarters. As it continues to invest in venture growth stage companies, operating expenses are expected to have remained elevated in the first quarter as well.

Earnings Whispers

According to our quantitative model, chances of Ares Capital beating the Zacks Consensus Estimate this time are low. This is because it does not have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Ares Capital has an Earnings ESP of -7.51%.

Zacks Rank: The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other finance stocks, Fidelity National Information Services, Inc. FIS and Main Street Capital Corporation MAIN are slated to release quarterly results on May 7, while Essent Group Ltd. ESNT will report the same on May 8.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Main Street Capital Corporation (MAIN) : Free Stock Analysis Report

Essent Group Ltd. (ESNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research